Retail gasoline and diesel prices are sky-high. Why?

Link to article: https://stillwaterassociates.com/retail-gasoline-and-diesel-prices-are-sky-high-why/

April 1, 2021

By Steve Holton

In the first quarter of 2021, prices at the pump have been rising steadily, leading many people to complain once again about the price of gasoline. Have you ever wondered how the price of gasoline or diesel is derived? A multitude of factors impact the price we pay at the pump including, of course, product supply and demand but also crude oil prices, refining, distribution and retail costs, and taxes and fees. Today, we discuss some key factors at play in the recent pump price increases.

The Cost of Crude

The primary driver of gasoline and diesel prices is the cost of crude oil. As crude prices fluctuate up or down, the price of retail gasoline and diesel typically move in concert. When crude prices are rising, product suppliers will typically pass a portion of the increase along not fully covering the cost of the increase until they plateau. Conversely, when crude prices are falling, suppliers attempt to hold prices higher to recoup costs they did not cover on the way up. This is called the “rockets and feathers” effect. Prices rise quickly like a rocket but fall slowly like a feather.

Finished Inventory Levels

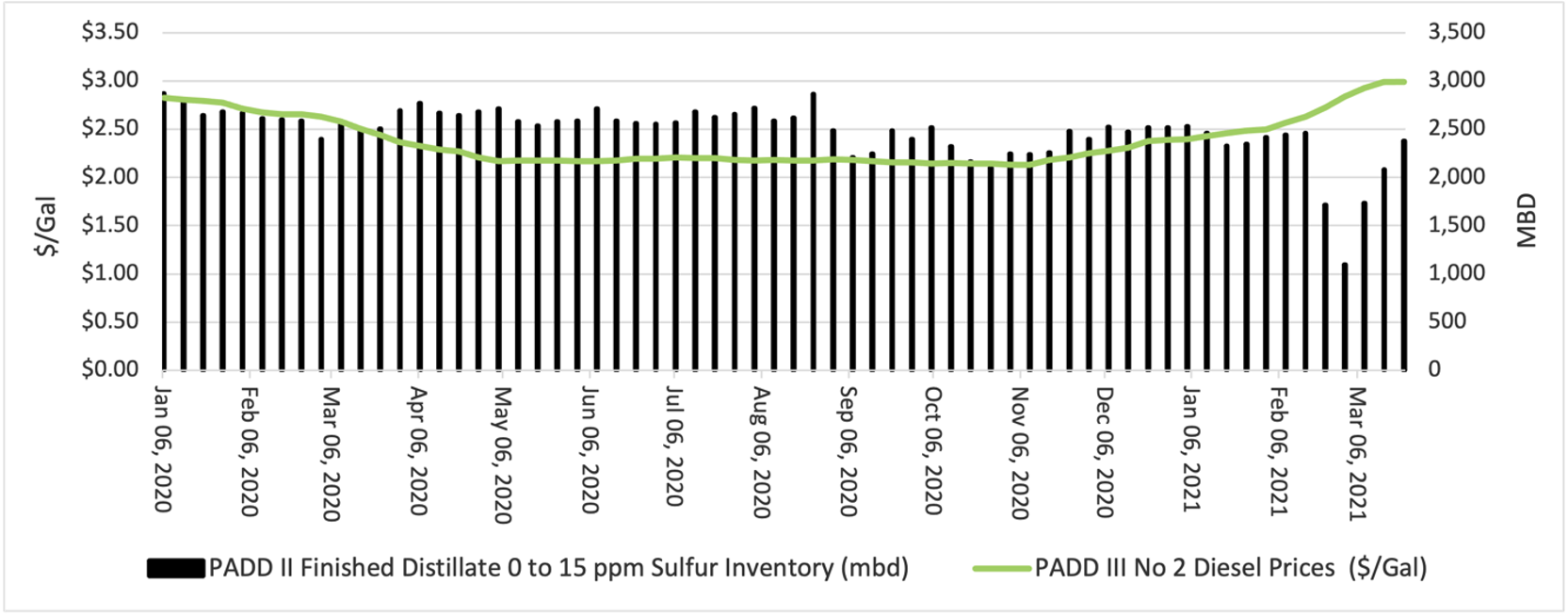

The second-largest driver of pump prices is the balance between supply and demand of finished gasoline and diesel in the market. If inventories are lower than forecasted, traders push prices higher. The figures below show the effect in PADD III (the U.S. Gulf Coast region) on retail pricing based on inventories of finished gasoline. Note that in February 2021, inventories were impacted by winter storm Uni in Texas which resulted in a spike in prices.

PADD III Gasoline Pricing and Finished Inventory

Sources: EIA data, Stillwater Analysis

PADD III Low Sulfur Diesel Pricing and Finished Inventory

Sources: EIA data, Stillwater Analysis

Transportation & Handling

There are additional costs associated with finished products; most are related to transportation, logistics and handling. These costs are generally stable and are not subject to swings associated with refined products and crude oil. Some of these costs are:

- Pipeline or marine charges associated with moving a barrel of finished product to its destination. Waterborne shipments will also incur docking and harbor fees.

- Colonial Pipeline shipments may include line space costs which can be a positive or negative value based on market conditions. This is a daily posted value based on actual trades in the market.

- Terminal fees are the costs charged by the owner of the distribution facility where the finished product is received, stored, loaded, and ethanol along with additives are injected for delivery to the retail outlet.

- Additives are required by EPA standards and must meet a minimum specification. These additives can be branded or unbranded.

- Truck delivery fees from the terminal to the station.

- Renewable Identification Numbers (RINs) are credits to the blender of record granted under the federal Renewable Fuel Standard. RINs represent the percentage of biofuels used in the finished gallon of gasoline or biodiesel and are based on the traded value of a RIN. RINs acquired from blending ethanol with gasoline or blending biodiesel with diesel offset the cost of the RIN obligation attributed to the petroleum-derived gasoline and diesel.

- Costs associated with operating the retail fueling station.

- Federal and state taxes added to a gallon of gasoline or diesel and reflected in the pump price. State taxes will vary by state.

Regulatory Requirements

Regulatory requirements such as the Reformulated Fuels Standard or California’s Low Carbon Fuel Standard can also impact the price of gasoline or diesel. Gasoline also requires a lower Reid Vapor Pressure (RVP) in summer months versus the winter. Refiners begin blending down RVP in March of each year, and the season lasts until mid-September. Gasoline prices tend to rise during this period, particularly at the time immediately prior to the spring transition as inventories of winter-grade gasoline need to be cleared out to make room for the more costly summer-grade product. Other impacts to prices include weather events such as hurricanes, floods, or the Texas freeze in February 2021, geopolitical events, or events that may jeopardize the flow of products such as the container ship that blocked the Suez Canal in late March resulting in a 5% price increase in crude oil and refined products on the 24th of March.

Pandemic impacts on supply and pricing

2020 saw a dramatic reduction in the consumption of products produced from crude oil due to the pandemic. The sudden reduction in demand resulted in an oversupply of crude oil globally causing a collapse in crude prices with crude closing at a negative price in April 2020. Since the onset of the pandemic, producers have looked for ways to minimize their exposure to the global oversupply by reducing, or in some instances completely shutting in crude production. The Organization of the Petroleum Exporting Countries (OPEC) initially cut production by 9.7 million barrels per day (mb/d) and decreased over time to 7.7 mb/d at the start of 2021. In addition to the OPEC cuts, non-OPEC countries (Russia) also reduced daily production and in 1Q 2021 Saudi Arabia voluntarily reduced production by an additional 1 mb/d to remove the remaining glut of supply from the global markets. The result of these reductions in supply has been a steady increase in the cost of crude oil in late 2020 into 2021. As we pointed out at the start of this article, the cost of crude oil is the primary driver of changes in prices at the pump. As such, these post-pandemic reductions in supply to remove the pandemic-related glut have impacted the price of gasoline.