Sacramento policymakers drive California’s high gasoline prices

Link to article: https://stillwaterassociates.com/sacramento-policymakers-drive-californias-high-gasoline-prices/

February 1, 2021

By Leigh Noda

California has a history of having the highest gasoline prices in the country. Why? For one, the West Coast fuels market is isolated from other supply/demand centers. As such, the West Coast is susceptible to unexpected outages of West Coast refineries as it is unable to backfill an unexpected loss in supply by quickly supplying additional product from outside of the region. Examples of these periods of significant outages include BP Cherry Point in 2012, Chevron Richmond in 2012, and Exxon Mobil Torrance in 2015. The supply, demand, and pricing trends in this unique market are covered in-depth on an ongoing basis over on Stillwater’s West Coast Watch.

In addition to the West Coast’s “isolation” and supply challenges, there are three major reasons for California’s higher gasoline prices:

- Before 2010, the additional costs were mainly associated with unique California gasoline specifications. First, the state restricted olefins, sulfur, and vapor pressure in the 1970s, driving up refining costs. In 1994, the state transitioned to California Reformulated Gasoline (CA-RFG) specifications in 1994. Those specifications have since evolved as MTBE was banned and replaced with a 10% ethanol blend requirement. Sulfur levels have also been decreased to exceptionally low levels.

- Beginning in 2010, increases in taxes levied on gasoline and the costs of the two California Climate Change programs (the Low Carbon Fuel Standard and Cap & Trade) that apply to gasoline.

- Increases to the California motor fuel tax (excise tax) were enacted in 2017.

The price at the pump is especially important as the cost of gasoline can be a significant portion of consumers’ monthly budgets. We know that gasoline prices make the news when they rise, so understanding why gasoline prices rise is important. Let’s talk about what causes gasoline prices to rise.

What is the price premium for California gasoline compared to the rest of the U.S.?

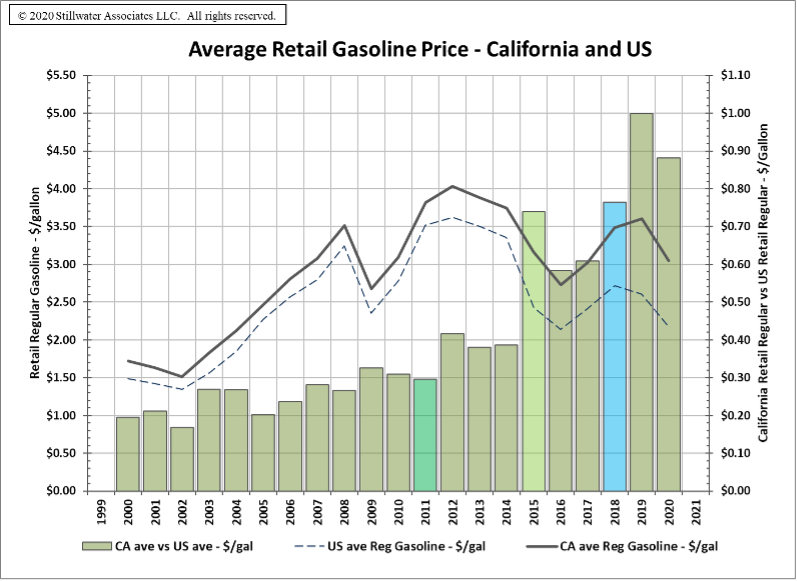

The figure below illustrates the average retail prices of regular gasoline for the U.S. and for California. The columns show the gasoline price premium in California versus the rest of the country. As can be seen, the premium paid by Californians for a gallon of gasoline compared to the rest of the country has risen rapidly since 2015 and was about $1.00 per gallon in 2019 and nearly $0.90 per gallon in 2020 (a slight decline due to the effects of the pandemic on the fuels market).

The years 2011, 2015, and 2018 are highlighted as those years marked significant changes to California taxes and greenhouse gas (GHG) fees on gasoline. The year 2011 (bright green column) marked the first year the Low Carbon Fuel Standard (LCFS) was applied. The year 2015 (light green column) marked when the fuels under the cap provision began under the state’s Cap & Trade program. The year 2018 (light blue) marked the first full year after the fuel excise taxes were increased by Senate Bill 1 (SB1) in November 2017.

What taxes and fees contribute to the California retail gasoline price?

The federal excise tax of 18.40 cents per gallon (cpg) on gasoline is the same across all states and has been at this level since 1997, but state and local taxes and fees levied on gasoline vary from state to state. According to the American Petroleum Institute (API), taxes and fees, including the federal excise tax, average 62.25 cpg across the U.S. but excluding California, with a high of 77.10 cpg in Pennsylvania to a low of 32.19 cpg in Alaska. California is shown at 81.45 cpg, the highest indicated by API. Our analysis, however, shows that API’s pricing index does not include all the taxes and fees.

In California, the current gasoline taxes and fees applied to gasoline are:

- Federal Excise Tax – This includes an 18.3 cpg component for the Highway Trust fund and an 0.1 cpg component for the federal Leaking Underground Storage Tank Trust Fund.

- California State Excise Tax – This tax revenue is deposited into the State Transportation Fund. In 2017, the state legislature passed Senate Bill 1, the Road Repair and Accountability Act of 2017, which raised the excise taxes on motor fuels effective November 2017 and provided to inflation adjust the tax rate. The current excise tax rate is 50.5 cpg.

- Sales Tax – Sales taxes are applied to the price of gasoline similar to but at a lower rate than general sales taxes. The sales tax rate in any given location includes county, transit, and local sales taxes in addition to the state sales tax.

- Underground Storage Tank Fee (UST) – UST is used to provide revenue for the state’s Underground Storage Tank Cleanup Fund. The primary purpose of the fund is to provide financial assistance to the owners and operators of underground storage tanks to remediate conditions caused by leaks, reimbursement for third-party damage and liability, and assistance in meeting federal financial responsibility requirements. The current CA UST tax rate is 2.0 cpg.

- Fuels Under the Cap (FUC) – This is part of California’s Cap & Trade (C&T) program that requires fuel suppliers to purchase Allowances (basically a license to emit a ton of greenhouse gas (GHG)) to offset the GHG from the combustion of the fuel. This fee will vary with the price of C&T Allowances. This provision was applied to gasoline in 2015. At recent C&T allowance prices, this corresponds to 14.3 cpg.

- Low Carbon Fuel Standard (LCFS) – This program that began in 2011, requires suppliers of high carbon intensity (CI) fuels, like the petroleum portion of gasoline, to purchase credits from suppliers of low-CI fuels such as ethanol, biodiesel, renewable diesel, renewable natural gas, and electricity. Through 2015, the cost of the LCFS was low, but as the price of credits has increased and the LCFS standards have tightened, the costs have become more significant. This fee will vary with the price of LCFS Credits and will increase as the annual LCFS standard is scheduled to become more stringent through 2030. At recent LCFS credit prices, this amounts to 22.6 cpg.

The last two items, FUC and LCFS, are not considered in the tax and fee category by API or the U.S. Energy Information Administration (EIA) as these items do not strictly use a cent-per-gallon rate, a percentage of price, or may not be collected by the state. The two GHG “fees” are an indirect charge to the fuel on the fuel characteristic and a GHG emission price. However, since the application of both GHG programs mimic a fee or tax and are passed through to the retail consumer, they are included in our definition of taxes and fees.

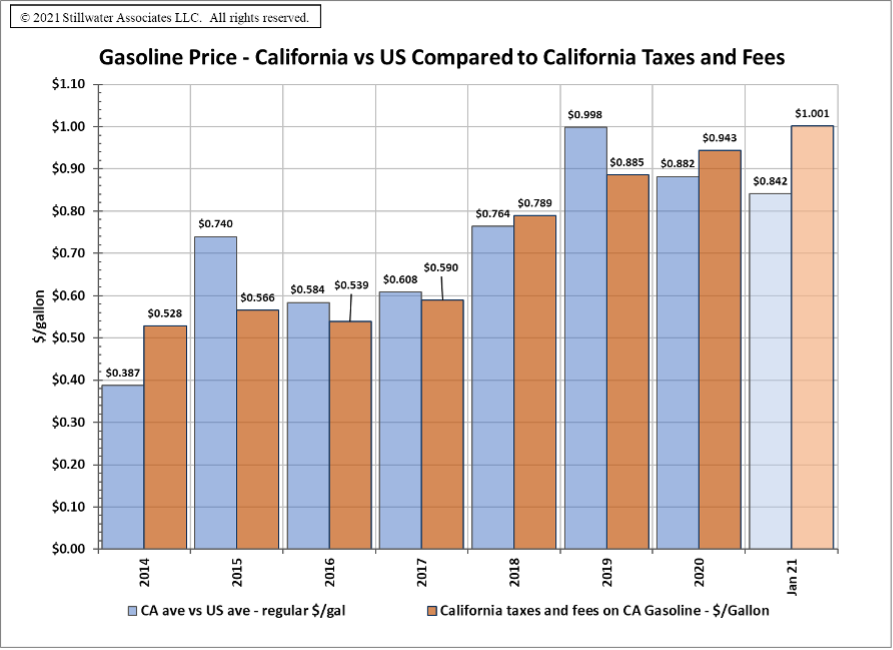

The following figure compares the total retail gasoline taxes and fees from 2014 through 2020 in California. As can be seen, the trend of the price premium generally follows the amount of taxes and fees that are applied to gasoline.

Sources: EIA, California Department of Tax and Fee Administration and Stillwater analysis

How much are the components of Taxes and Fees?

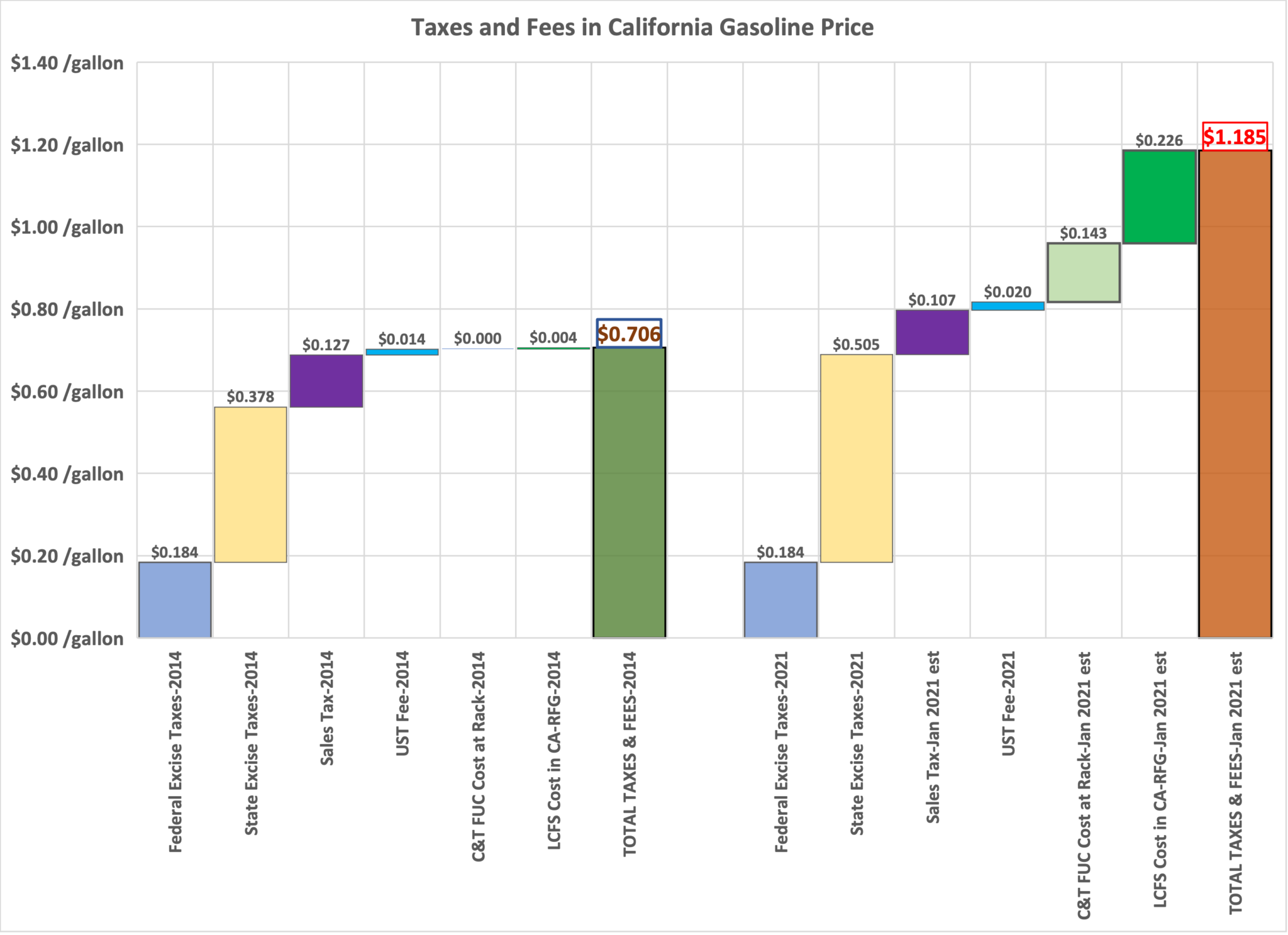

The following figure illustrates each of the components included above for 2014 and 2021 which covers the period when the California gasoline taxes and fees increased sharply. As can be seen, the total taxes and fees imposed by California tracks with the difference between the retail price of gasoline in California and the U.S. average. The difference in the price of gasoline increased by 118% from 38.7 cpg in 2014 to 84.2 cpg in 2021, while the California-specific taxes and fees increased by 90% from 52.8 cpg in 2014 to 100.1 cpg in 2021. The three largest components of the increase are the LCFS at 22.6 cpg, FUC at 14.3 cpg and the state excise tax at 12.7 cpg. Sales taxes have decreased in parallel with the price of gasoline which has declined due to lower crude oil prices.

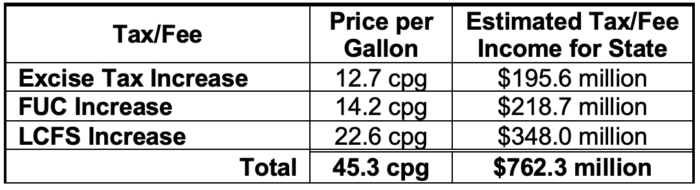

As can be seen, price increases due to taxes and fees are not insignificant. Using the 15.4 billion gallons of gasoline reported by the California Department of Tax and Fee Administration (CDTFA) for 2019, the cost of these three increases would amount to $762 million paid by California gasoline consumers at a normal gasoline consumption rate. The following table shows the value of each component.

Added Costs to California Consumers

The total listed in the table above is for gasoline only; it does not include the taxes and fees that have increased on diesel fuels in California.

Conclusion: Contrary to what some may claim, GHG-reduction programs and taxes on petroleum fuels have a cost, and these costs are passed through to consumers.

Want a deeper or more specific analysis? Contact us!