West Coast Gasoline is Off the Bottom

Link to article: https://stillwaterassociates.com/west-coast-gasoline-is-off-the-bottom/

July 6, 2020

By Dave Hackett

We have all had a wild ride the last three months, and you can see that in transportation fuel statistics. This article builds on two earlier pieces in this series (one from April 15th and a second from May 7th), tracking the wild ride that fuels have taken along with everything else since the COVID-19 pandemic hit the U.S.

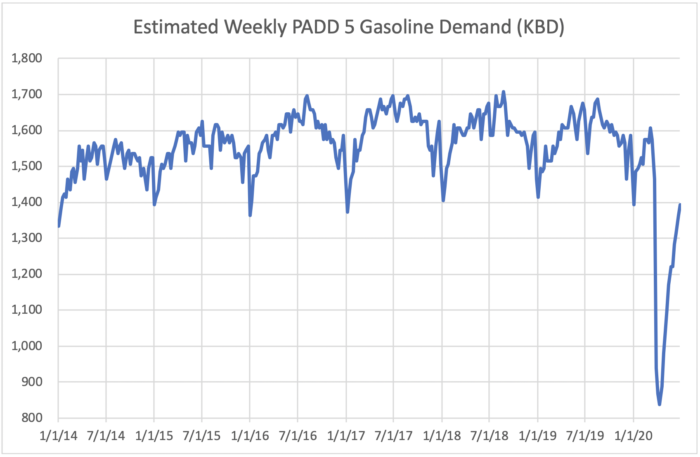

In mid-April we pointed out that nobody was driving, and you could see that in the gasoline demand numbers. Indeed, gasoline demand for the West Coast (Petroleum for Defense District 5, PADD 5) bottomed out at 838 thousand barrels per day (KBD), or about 52% of the same week in 2019. By June 26th, however, gasoline demand improved to 1394 KBD, which is about 84% of the same week last year. This cratering and rebound can be seen in the figure below, the result of U.S. Energy Information Administration (EIA) data and Stillwater analysis.

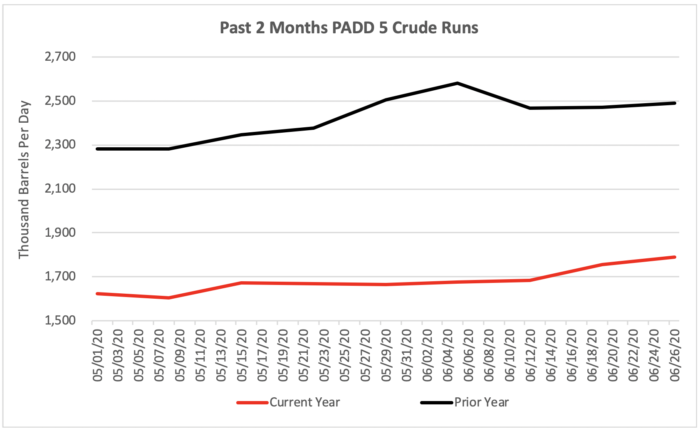

Meanwhile, the utilization rate for refineries – the amount of crude oil run (processed) divided by the refineries’ capacity to process crude oil – remains low. This week last year, PADD 5 refineries ran at about 92% of capacity. Refiners cut runs in late March, and utilization bottomed out at about 59% in early May. Crude runs were only at 65% this last week, with many refineries still cut back and the large Marathon Martinez refinery in California still shut down. The chart below shows how much lower runs were this year compared to last year.

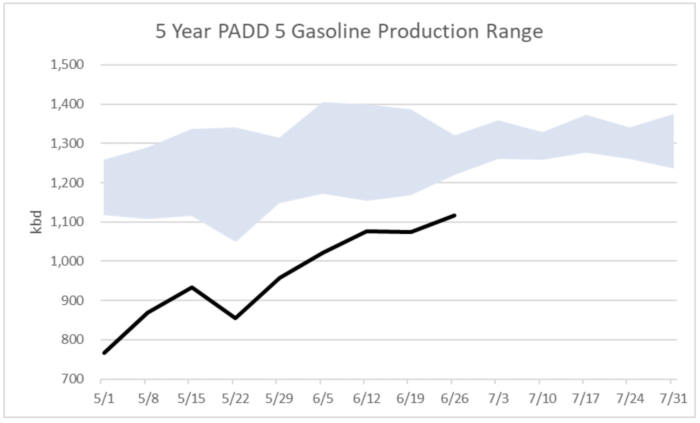

As can be seen, gasoline production is still well below normal.

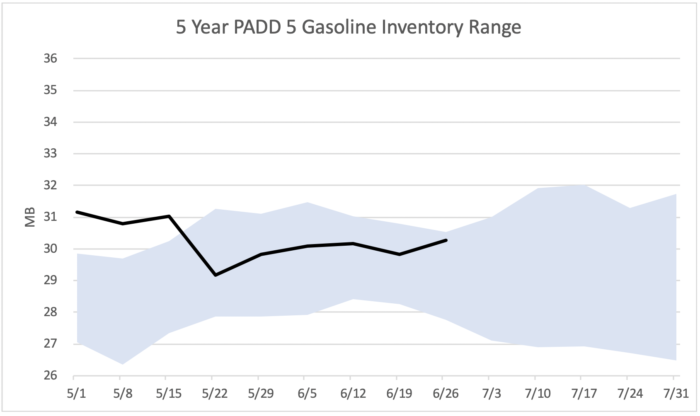

Refiners are holding down production, but gasoline inventories are on the high side of normal.

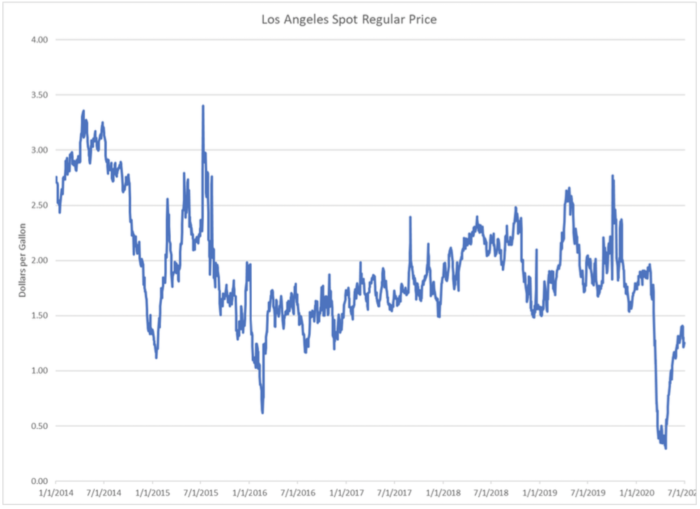

So, what about gasoline prices? The West Coast spot price bottomed out on April 20th at 29.3 cents per gallon (cpg), the lowest price EIA has recorded in the 17 years of tracking the “Los Angeles Reformulated RBOB Regular Gasoline Spot Price.” The spot price quickly rebounded but is still below normal levels given weak demand and weak crude oil prices.

Retail Prices bottomed out in early May and are likely to move with the gasoline spot market.

Demand is still in the driver’s seat in this market. If the pandemic results in further demand destruction, refiners and retailers will have to scramble for customers.

Are you looking for a more in-depth analysis? Do you have additional questions? Drop us a line!

Categories: Economics, News, Wisdom from the Downstream Wizard