California Taxes & Fees on the Rise

Link to article: https://stillwaterassociates.com/california-taxes-fees-on-the-rise/

March 6, 2024

By: Christine Martin

Stillwater has been tracking and writing about the taxes and fees that contribute to California fuel prices for nearly a decade. Several news articles this week highlighted the likelihood that California fuel prices will only continue to skyrocket over the next few years, so we thought it would be a good time to provide our readers with Stillwater’s latest analysis of the taxes and fees in California that affect both gasoline and diesel prices, including how they have changed over the last ten years.

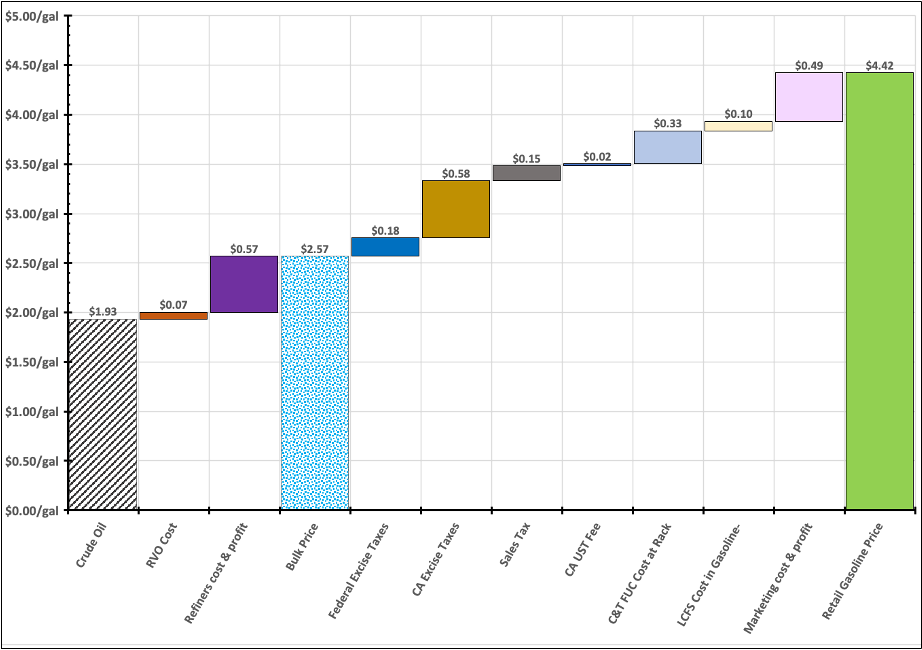

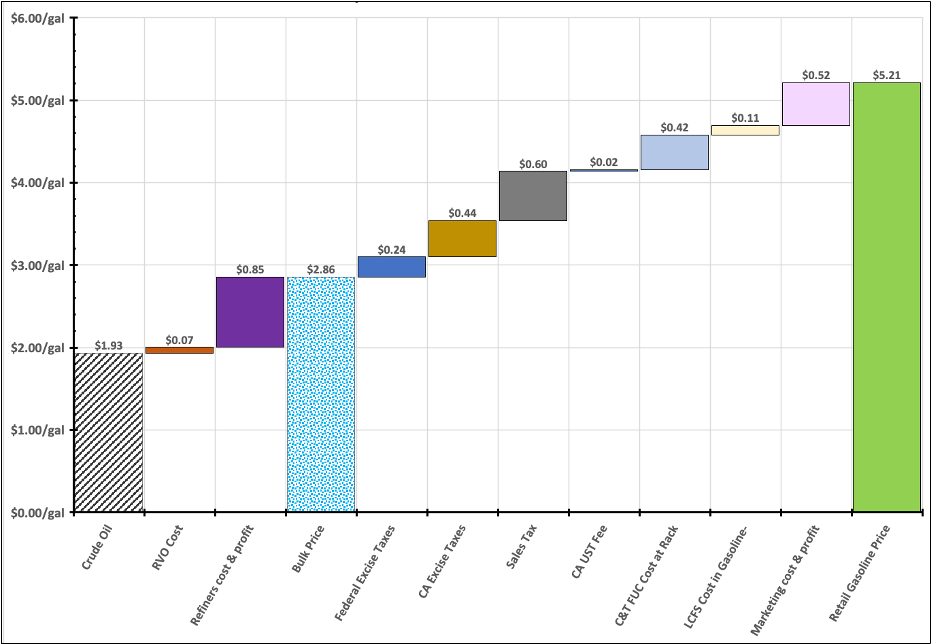

We begin with current prices. The two figures below show the components making up gasoline and diesel prices in California for the month of February 2024. (Check out this article we published in 2021 for detailed descriptions of all the components of fuel price shown in the figures below.) As can be seen in the figures that follow, the cost of crude oil is the largest contributing component to the price of both gasoline and diesel, but the cost of crude oil makes up less than half of the total cost of a gallon of fuel.

Components of California Gasoline Price (February 2024)

Components of California Diesel Price (February 2024)

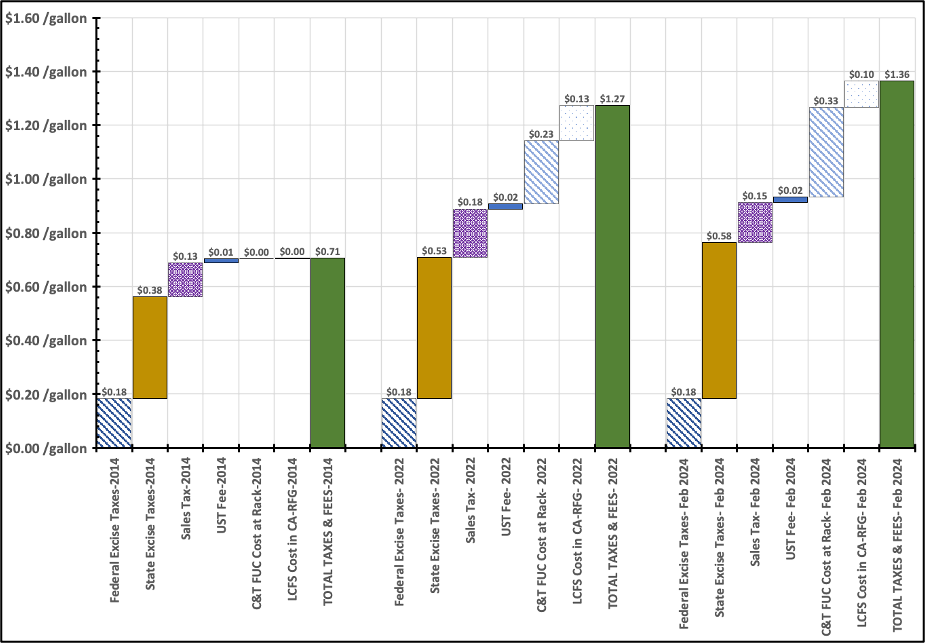

Now let’s compare current taxes and fees with historic prices. The figure below hones in on the taxes and fees that affect retail gasoline prices, comparing 2014, 2022, and February 2024 – the timeframe when California gasoline taxes and fees increased sharply. As can be seen, California-specific taxes and fees increased by 106% from 53 cents per gallon (cpg) in 2014 to 109 cpg in 2022, and again by 8% to 118 cpg in 2024. The two largest components of the increase are the Fuels under the Cap (FUC) and state excise tax which increased by 10 cpg and 5 cpg from 2022 to 2024, respectively. For its part, the Low Carbon Fuel Standard (LCFS) cost decreased by 3 cpg from 2022 to 2024 due to flagging credit prices in that program.

Taxes and Fees in California Gasoline Price (2014, 2022, and Feb 2024)

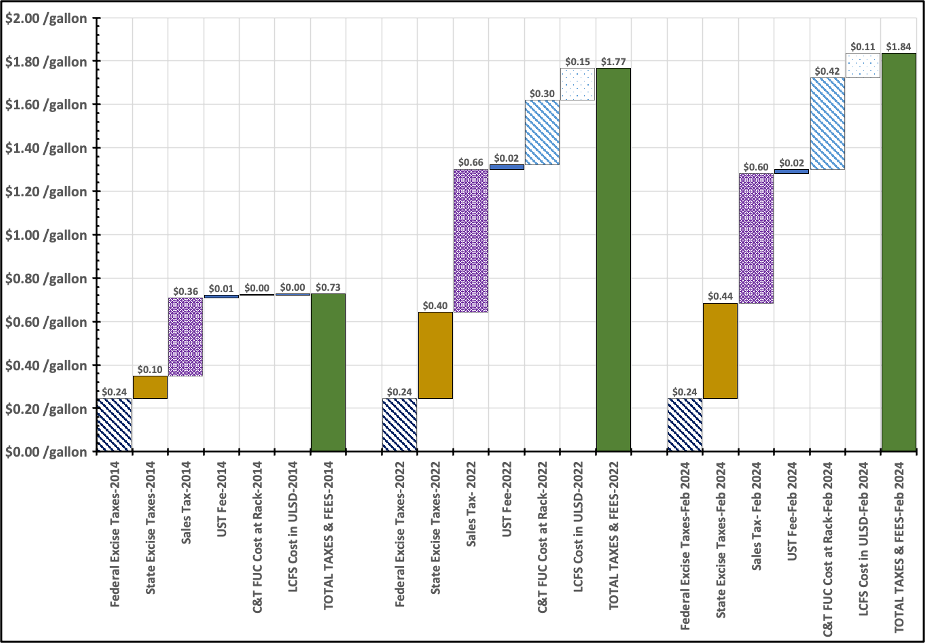

The figure below illustrates the same taxes and fees components, but for diesel. As can be seen, California-specific taxes and fees increased by 212% from 49 cpg in 2014 to 153 cpg in 2022, and again by 5% to 160 cpg in 2024. The two largest components of this increase are the FUC and state excise tax which increased by 12 cpg and 4 cpg from 2022 to 2024, respectively. Similar to the cost impact on gasoline, the LCFS cost for diesel decreased by 4 cpg from 2022 to 2024.

Taxes and Fees in California Diesel Price (2014, 2022, and Feb 2024)

These taxes and fees aren’t likely to go anywhere. In fact, a well-informed market observer should only expect them to rise. State excise taxes are adjusted annually with the Consumer Price Index (CPI), California Carbon Allowance (CCA) prices which drive the FUC costs are expected to continue to rise, and CARB’s proposed amendments to the LCFS are expected to drive LCFS credit prices (and thus the cost of the LCFS) higher. All these taxes and fees set the stage for the cost of fuel in California to remain higher than the rest of the U.S. on average.

Have questions about California’s fuels taxes and fees and the programs behind them? Contact us to learn more!