Taxes and fees drive California’s high diesel prices

Link to article: https://stillwaterassociates.com/taxes-and-fees-drive-californias-high-diesel-prices/

May 10, 2021

by Leigh Noda

Back in February, we published an article about the factors contributing to the price of gasoline in California. We concluded that, contrary to what some may claim, GHG-reduction programs and taxes on petroleum fuels have a cost, and these costs are passed through to consumers. That first article focused on gasoline, but diesel customers also feel the pinch. Today we discuss California taxes and fees on diesel.

Like gasoline in California, diesel fuel has unique requirements in California, including:

- California-specific diesel specifications that overlay the ASTM D975 The additional requirement is 10% maximum aromatics or an approved formulation that has emissions equivalent to a 10% aromatics diesel fuel.

- California’s Alternate Diesel Fuels (ADF) regulation that requires a three-stage process for introducing alternative fuels such as biodiesel and renewable diesel into the diesel pool.

These requirements differentiate the diesel fuel supplied in California.

What is the price premium for retail diesel in California versus the U.S. average?

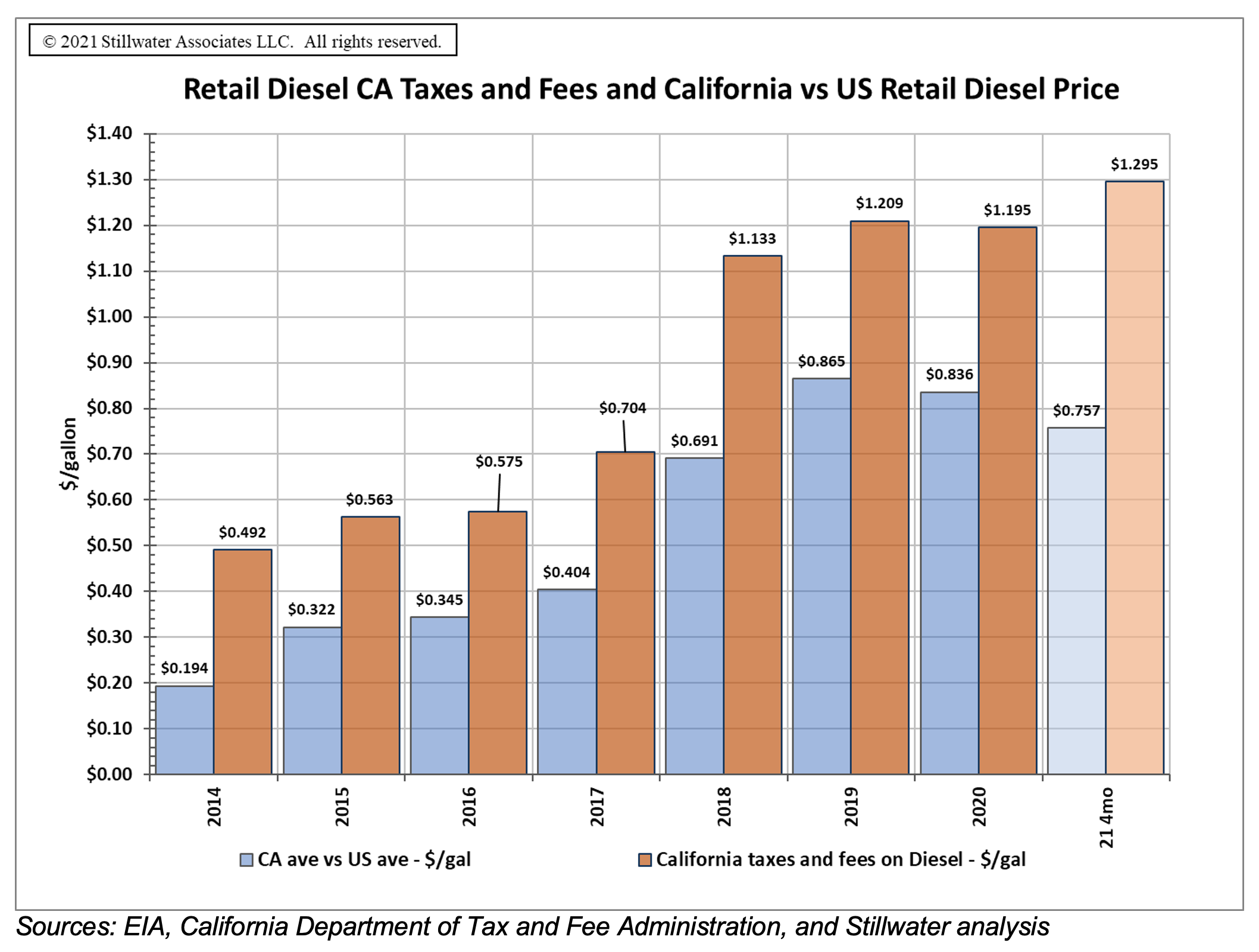

The figure below illustrates the average retail prices of diesel fuel for the U.S. and for California. The columns show the retail diesel price premium in California versus the rest of the country. As can be seen, the premium paid in California for a gallon of diesel compared to the rest of the country has risen rapidly since 2014. In 2014, the spread between California and the U.S. was less than 20 cents per gallon (cpg); by 2019, however, that spread had risen to about 87 cpg. That sizeable spread has held relatively steady through the pandemic – in 2020, it was 84 cpg, and for 2021 year-to-date the spread has been 76 cpg.

The years 2011, 2015, and 2018 are highlighted as those years marked significant changes to California taxes and greenhouse gas (GHG) fees on diesel. The year 2011 (bright green column) marked the year the Low Carbon Fuel Standard (LCFS) was implemented. The year 2015 (light green column) marked when the fuels under the cap provision began under the state’s Cap & Trade program. The year 2018 (light blue) marked the first full year after the fuel excise taxes were increased by Senate Bill 1 (SB1) in November 2017.

What taxes and fees contribute to the California retail diesel fuel price?

The federal excise tax of 24.40 cpg for on-road diesel fuel is the same across all states and has been at this level since 1997, but state and local taxes and fees levied against on-road diesel fuel vary from state to state. According to the American Petroleum Institute (API), taxes and fees, including the federal excise tax, average 62.25 cpg across the U.S., with a high (excluding California) of 99.60 cpg in Pennsylvania to a low of 38.22 cpg in Alaska. California is shown at 107.46 cpg, the highest indicated by API. Our analysis, however, shows that API’s pricing index does not include the “hidden taxes and fees” imposed by the California’s GHG regulations.

In California, the taxes and fees applied to on-road diesel are:

- Federal Excise Tax – This includes a 24.3 cpg component for the Highway Trust fund and a 0.1 cpg component for the federal Leaking Underground Storage Tank Trust Fund.

- California State Excise Tax – This tax revenue is deposited into the State Transportation Fund. As mentioned above, near the close of 2017, the state legislature passed SB1, the Road Repair and Accountability Act of 2017, which raised the excise taxes on motor fuels effective November 2017 and provided to inflation-adjust the excise tax rate. The current excise tax rate is 38.5 cpg.

- Sales Tax – Sales taxes are applied to the price of on-road diesel at a higher rate than general sales taxes. The sales tax rate in any given location includes county, transit, and local sales taxes in addition to the state sales tax. The base rate is 13.0% before the additional local and district tax rates.

- Underground Storage Tank Fee (UST) – UST is used to provide revenue for the state’s Underground Storage Tank Cleanup Fund. The primary purpose of the fund is to provide financial assistance to the owners and operators of underground storage tanks to remediate conditions caused by leaks, reimbursement for third-party damage and liability, and assistance in meeting federal financial responsibility requirements. California’s current UST tax rate is 2.0 cpg.

- Fuels Under the Cap (FUC) – This is part of California’s Cap & Trade (C&T) program that requires fuel suppliers to purchase Allowances (basically a license to emit a ton of GHG) to offset the GHG from the combustion of the fuel. This fee will vary with the price of C&T Allowances and will vary depending on the content of renewable fuel. This provision was applied to diesel fuel in 2015. At recent C&T allowance prices, this corresponds to 19.3 cpg of petroleum-based diesel.

- Low Carbon Fuel Standard (LCFS) – This program began in 2011 and requires suppliers of high carbon intensity (CI) fuels, like petroleum diesel, to purchase credits from suppliers of low-CI fuels such as ethanol, biodiesel, renewable diesel, renewable natural gas, and electricity. Through 2015, the cost of the LCFS was low, but as the price of credits has increased and the LCFS standards have tightened, the costs have become more significant. This fee will vary with the price of LCFS credits and will increase as the annual LCFS standard becomes more stringent through 2030. At recent LCFS credit prices, this amounts to 21.6 cpg of petroleum-based diesel.

The last two items, FUC and LCFS, are not considered in the tax and fee category by API or the U.S. Energy Information Administration (EIA) as these items do not strictly use a cent-per-gallon rate, a percentage of price, or may not be collected by the state. The two GHG “fees” are an indirect charge on the fuel characteristic and a GHG emission price. However, since the application of both GHG programs mimic a fee or tax and are passed through to the retail consumer, they are included in our definition of taxes and fees.

The following figure compares the total retail diesel fuel taxes and fees from 2014 through the first four months of 2021 in California. As can be seen, the trend of the price premium generally follows the amount of taxes and fees that are applied to diesel fuel.

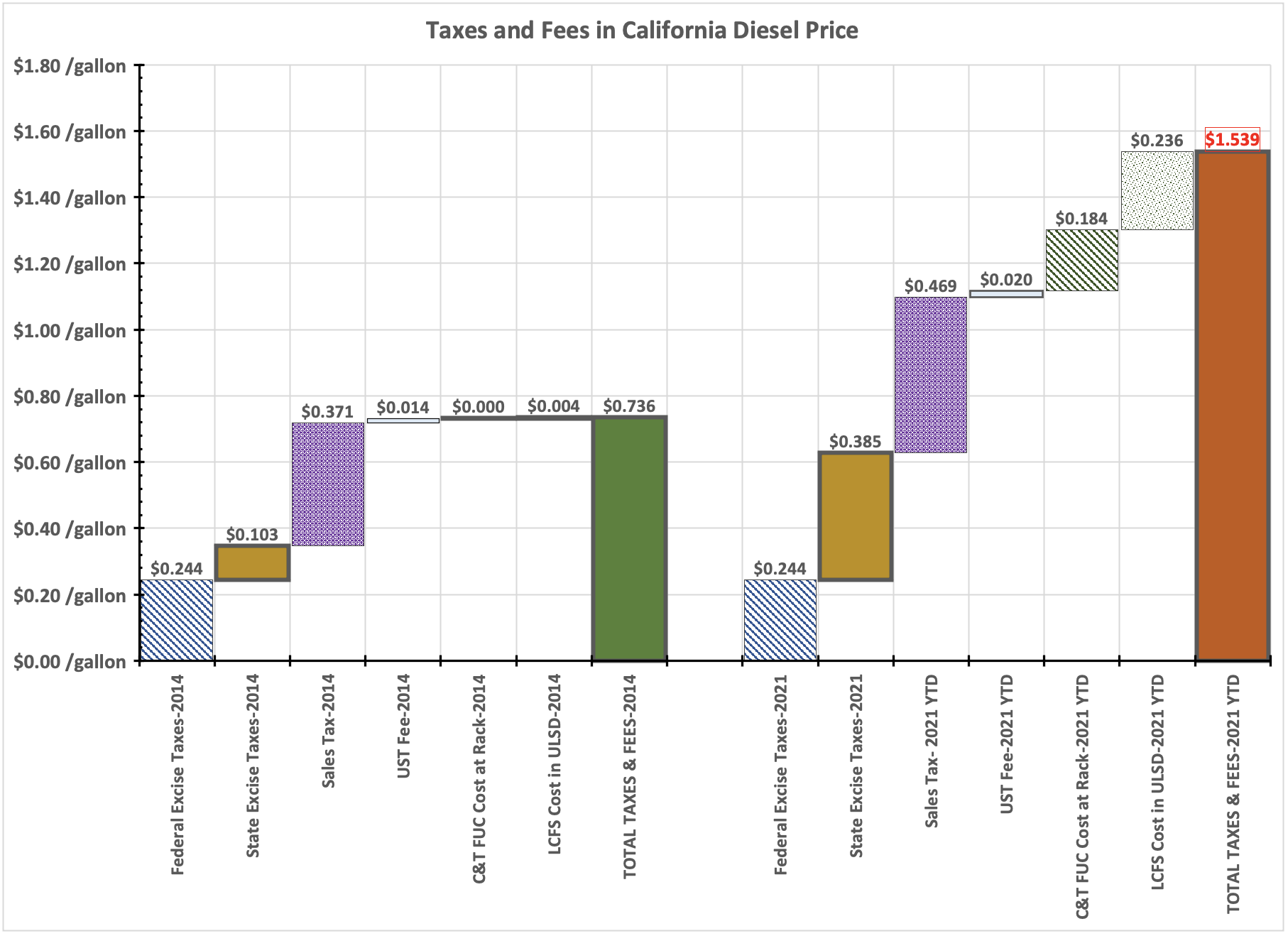

How much are the components of Taxes and Fees for Diesel Fuel?

The following figure illustrates each of the components included above for 2014 and 2021 which covers the period when California’s taxes and fees for on-road diesel fuel increased sharply. As can be seen, the total taxes and fees in California imposed for on-road diesel fuel has more than doubled since 2014. State excise and sales taxes account for about one-half of the increase with the two climate change fees accounting for the other half.

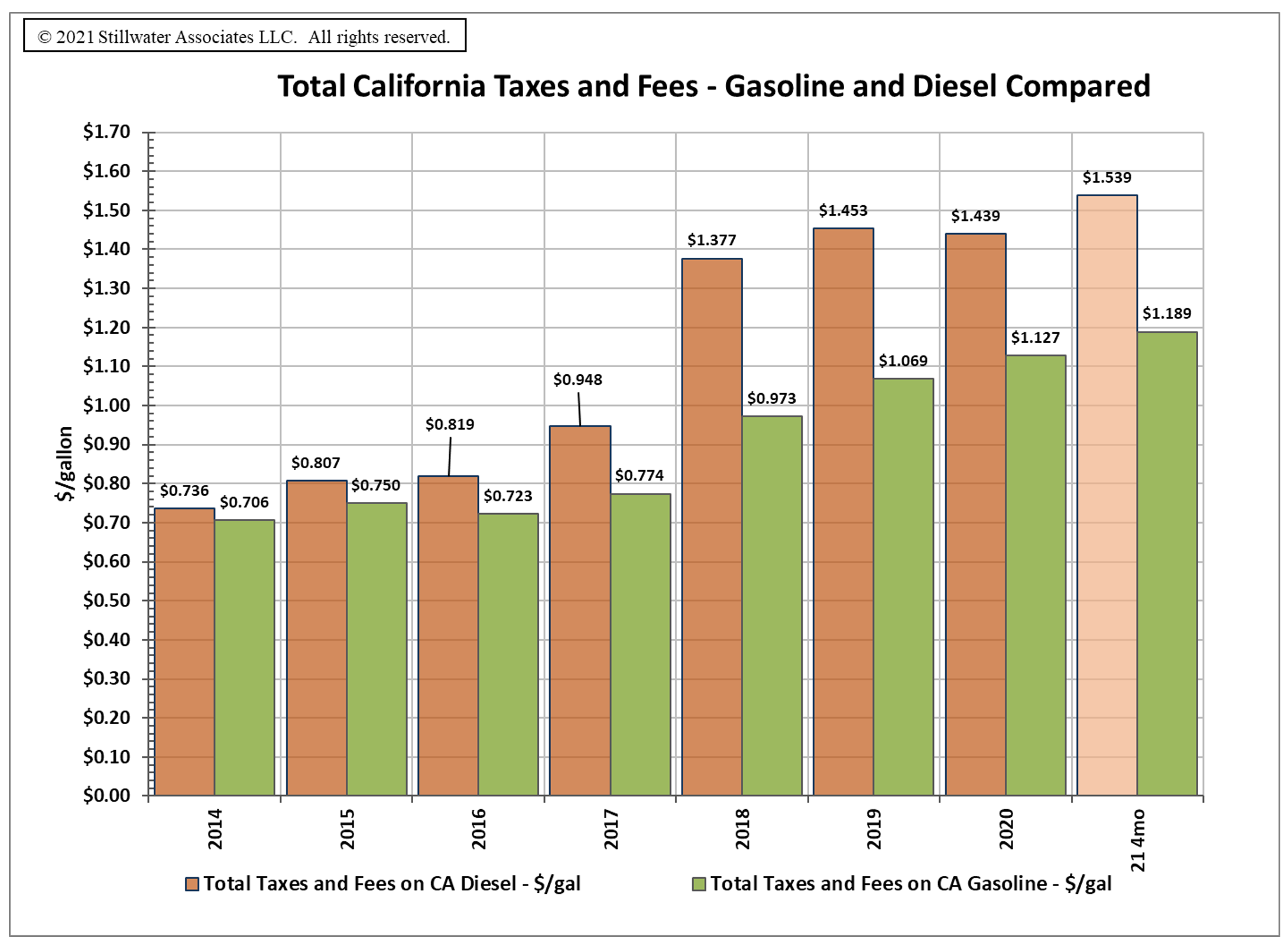

As can be seen, price increases due to taxes and fees for on-road diesel since 2014 are not insignificant. Compared to gasoline, the burden of the excise and sales tax increase has fallen on diesel fuel as illustrated in the following figure.

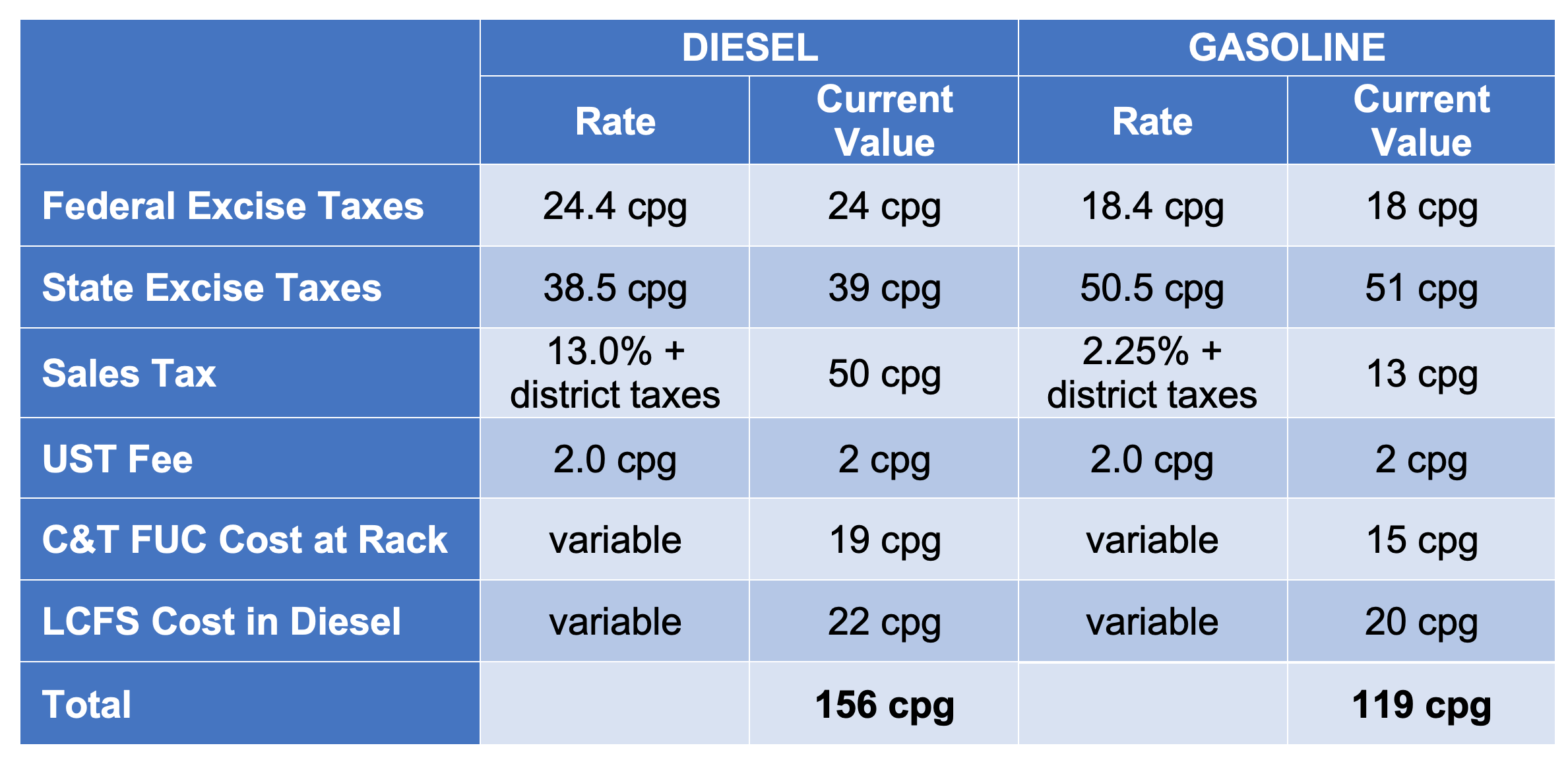

The following table contrasts the rates and current values of each tax and fee component on diesel compared to gasoline. As can be seen, the total value of taxes and fees on diesel fuel is higher than gasoline. This difference is mostly a result of the higher sales tax rate on diesel fuel.

So, what can we expect in the future? Based on current statute and regulations, we can expect:

- The California excise tax per gallon rate to increase each July 1 by the percentage change in the California Consumer Price Index (CPI) which is provided for in the SB1 legislation.

- The FUC cost to increase as the cost of C&T Allowances increases each year at a minimum of five percent plus CPI.

- The LCFS cost to increase each year as the LCFS standard gets more stringent and the cost per LCFS credit increases.

As a result, we expect that the spread between retail diesel in California compared to the national average to continue to grow.

Conclusion: GHG-reduction programs and taxes on petroleum fuels are costs which are passed through to consumers. Making the costs of combating climate change transparent can help consumers make a knowledgeable choice concerning how to reduce their carbon footprint.

Want a deeper or more specific analysis? Contact us!