Cap & Invest – Allowance Price Containment Reserve Auction

Link to article: https://stillwaterassociates.com/cap-invest-allowance-price-containment-reserve-auction/

November 7, 2023

(updated November 15, 2023)

By Leigh Noda

Tomorrow, Wednesday, November 8th, the Washington Department of Ecology will hold its second Allowance Price Containment Reserve (APCR) auction for the Cap and Invest (C&I) program. This auction was triggered when the settlement price in the August 30, 2023 auction ($63.03 per allowance), exceeded the Tier 1 price for allowances in the APCR ($51.90 for 2023). This is the second APCR auction as the APCR Tier 1 price was also exceeded by the May 31st settlement price. The APCR auctions are intended to inject additional Washington carbon allowances (WCAs) into the market to temper high prices that are indicated by high auction prices. APCR auctions differ from the regular auctions as the APCR auctions are not open to investors or other entities without a compliance obligation; instead, APCR auctions are open only to businesses and entities that are required to obtain allowances to cover their emissions under the program. Allowances purchased in an APCR auction can only be used for compliance by the purchaser, they cannot be sold or traded among market participants. Another key difference between an APCR auction and a regular auction is that only volumes are bid as the prices are fixed.

Washington’s C&I program became effective as of January 1, 2023. Although Washington’s program was modelled after California’s Cap and Trade (C&T) program, this first year of C&I has been uniquely impactful. In July, after the retail gasoline prices in Washington surpassed those in California, we published an article exploring why the retail fuel price spread between CA and WA had collapsed. Our analysis indicates that the implementation of C&I added to the cost of selling fossil fuels in Washington and was a significant contributor to the run up of Washington’s gasoline prices earlier this year.

One reason for the high impact on gasoline prices is the fact that prices for WCA compliance instruments have been much higher than the corresponding California Carbon Allowance (CCA) prices. As usual with a new regulatory program, this first year of C&I has been and will continue to be a learning experience for the covered entities and the markets for WCAs.

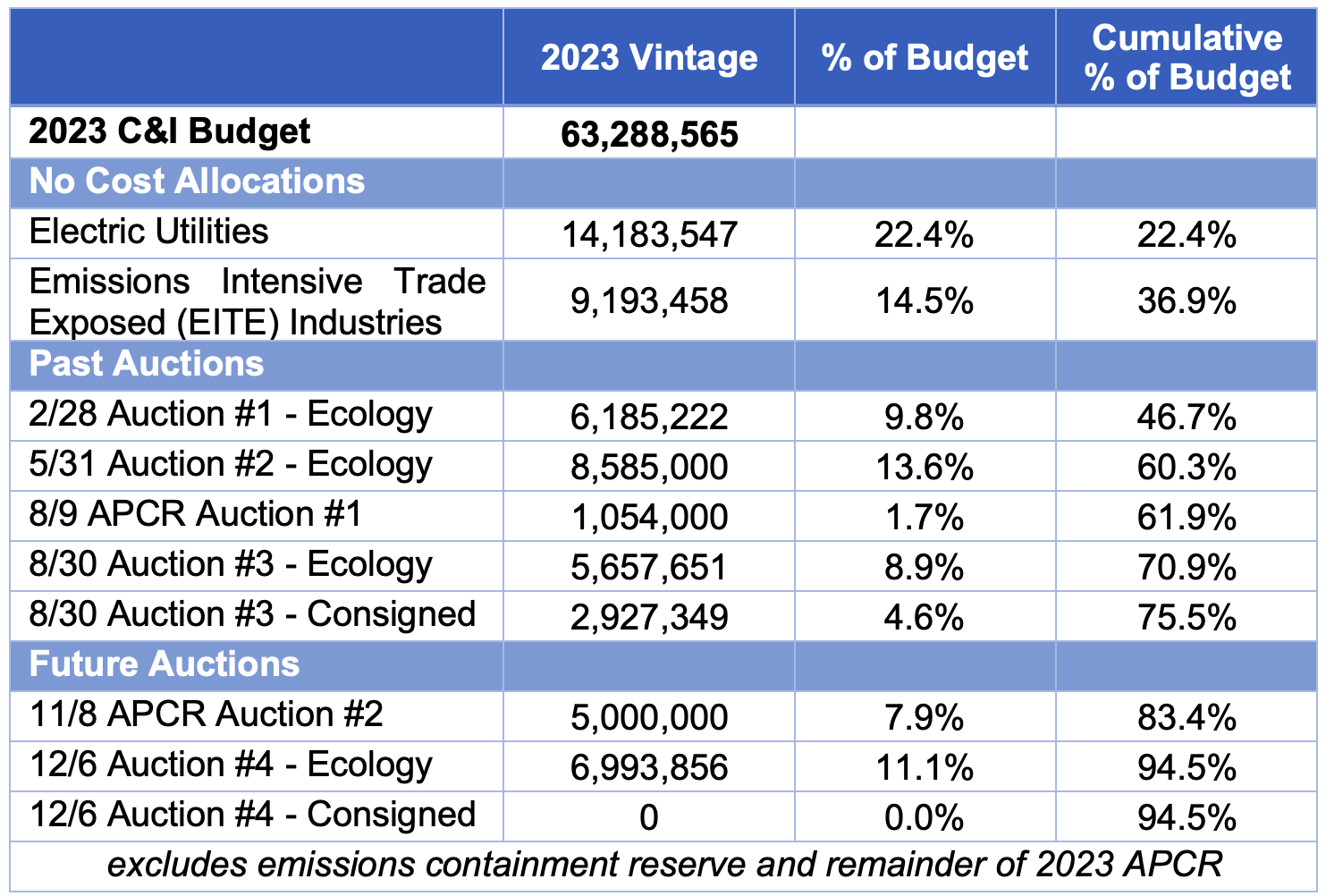

In tomorrow’s APCR auction, five million allowances will be offered at $51.90 per allowance. To put this in perspective, a look at the C&I budget and 2023 auctions reveals how this APCR auction adds to the number of no cost allowance allocations and the prior auctions is shown in the table. The number of allowances offered in this APCR auction is approximately five times that offered in the first APCR auction.

Tomorrow’s APCR auction, if fully subscribed, will supply nearly 8% of the 2023 C&I budget and will increase the total WCAs supplied in 2023 from 75.5% of the budget to 83.4%. The final auction of 2023 will be held in December.

In the August regular auction, a total of 8,585,000 allowances were sold, and the total qualified bids were 1.79 times the number of WCAs offered. This result would indicate there were 15,367,000 qualified bids – 6,720,000 more than were sold. Since this was a regular auction, the total bids included bids by general market participants (investors or other entities without a compliance obligation). If the unfulfilled bids actually indicate the unfulfilled demand for allowances by compliance entities, we would expect that the APCR auction tomorrow will be sold out with a qualified bid to allowances offered ration of 1.36. This would compare to a ratio of 12.79 for Tier 1 allowances and 3.11 for Tier 2 allowances observed in the first APCR auction on August 9, 2023. Since the APCR auction is at a fixed price, this auction will not reset market prices. The APCR will, however, give a signal of compliance entities’ need for allowances, and the magnitude of that demand would impact future WCA pricing.

***UPDATE on NOVEMBER 15, 2023***

And the Results Are…

Ecology published the November 8th APCR auction results on November 15th. All 5,000,000 allowances offered at the Tier 1 price of $51.90 were sold. There were no prices offered at Tier 2. Of note: 30 qualified bidders bid a total volume that was 3.20 times the offering or approximately 16,000,000 allowances. This compares to approximately 6,700,000 Tier 1 allowances bid in the August 9, 2023 APCR auction.

Are you looking for regular C&T and C&I insights from industry insiders who consistently monitor and analyze these markets?

Stillwater’s C&T Newsletter offers insights into the allowance demand and price trends that affect the downstream fuels market.

Learn more and subscribe here!