As LCFS Programs Proliferate, Don’t Get Behind the 8-Ball

Link to article: https://stillwaterassociates.com/as-lcfs-programs-proliferate-dont-get-behind-the-8-ball/

February 27, 2023

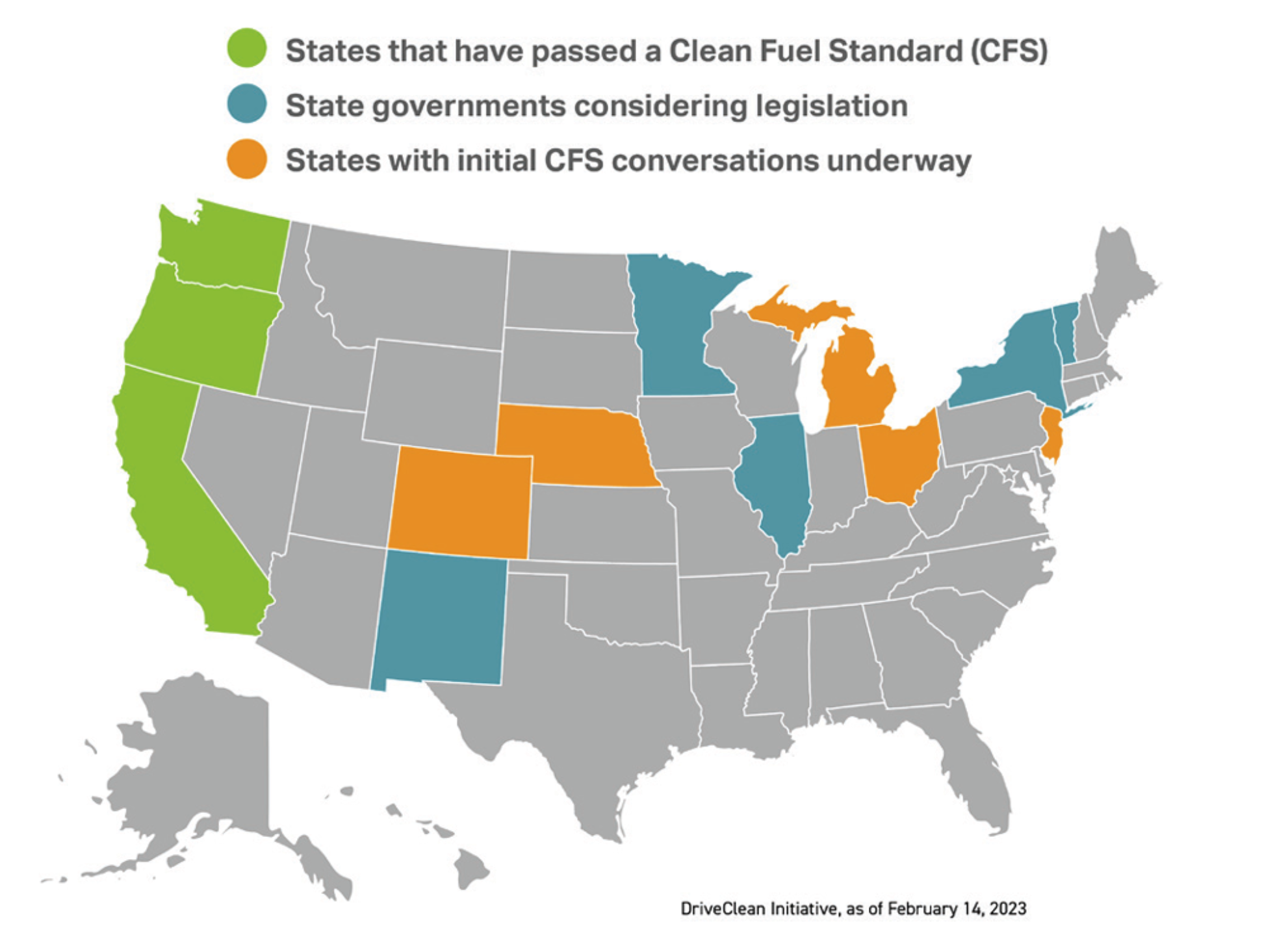

A quick Google image search of “state LCFS policy maps” results in numerous versions of a U.S. map (and sometimes Europe or Canada) with different states annotated as considering a low carbon fuel standard (LCFS). Note: Program names vary, so LCFS is used throughout this article for simplicity. Though British Columbia (2010), California (2011), and Oregon (2016) were alone for many years in the LCFS world, activity over the last couple of years indicates momentum is gaining in this space. Multiple states proposed LCFS legislation during the 2021-2022 sessions, and new programs were started this year in Washington State and Canada. Watching the west coast markets “storm and norm” over the next couple years will be interesting, insightful, and may portend a future with a patchwork of LCFS programs throughout the U.S. In addition, Canada’s federal program is working to harmonize with British Columbia’s provincial program, the outcome of which is unclear.

Source: Drive Clean U.S. Materials

Some businesses may be focused primarily on national-level policies such as the Renewable Fuel Standard (RFS). They may be waiting for Congress to pass a national LCFS, which is in the works under the Drive Clean banner and had its first Senate hearing on February 15th. However, a key principle of the Drive Clean effort is to complement existing or future state LCFS programs, not supersede them. As such, it remains prudent to pay attention to the impact of state policies.

While state legislative session schedules vary, many states opened a new two-year session at the beginning of 2023. Already, multiple states have made moves in the LCFS space. New Mexico introduced two different bills (HB 478 and HB 426) into the House, an interesting evolution in that state, which failed to pass an LCFS bill during the last session in 2022. Minnesota failed to pass LCFS legislation last session but has already proposed a fuels-only Cap & Trade program this year. Illinois introduced an LCFS bill into the state Senate in early February. Michigan, Minnesota, and Nebraska are expected to propose LCFS-style legislation in this legislative session.

Moving further east, Vermont introduced an LCFS bill into the state Senate in January, and New York introduced bills in both the Senate and General Assembly, a move that proves particularly significant because New York is quite influential in the northeast region (not dissimilar to California’s influence over the west coast). New York’s draft legislation specifically requires coordination with other Northeastern states, which harkens back to the Transportation & Climate Initiative.

At this point, the only hard data available to enable estimation of the potential impact of multiple state programs would be gleaned from California and Oregon. That comparison is insufficient for this situation, however, primarily due to the small geographic spread and size of the relative markets. If state LCFS programs proliferate in a patchwork fashion across the U.S. but are still somewhat contained in local markets, things may get complicated. Arbitrages seem inevitable. It would be challenging to predict the arbitrages that may develop, to what extent, where, and what market signals will impact them. The associated logistics with all these new markets may also present complications with which the industry is currently unaccustomed to dealing, since LCFS is a west-coast-only reality to date. And let’s not forget our Canadian friends north of the border, which would be logistically close to these new state markets (except New Mexico). To top it off, while there has been some vague discussion of potentially considering “harmonizing” state-level LCFS programs, no serious efforts have been made in that area.

Bottom line: If your five-year business plan doesn’t include a projection of likely state LCFS programs, supply/demand changes and impacts to your specific business, you may find yourself behind the 8-ball in a few years. Most LCFS watchers anticipate a proliferation of state policies over the next couple years. While it generally takes about two years from passing legislation to LCFS program implementation, that’s not enough time for business strategies to make major pivots and may be especially challenging for smaller companies.

If you need help, contact Stillwater. By leveraging our price forecasts, supply and demand models, and decades of expertise in these areas, Stillwater can help you develop a business strategy that anticipates the markets to best position your company to compete as the LCFS landscape evolves.

Tags: BC, British Columbia, C&T, California, Canada, CFP, CFS, LCFS, Michigan, Minnesota, Oregon, Vermont, Washington