What’s up with the collapse of CFP credit prices?

Link to article: https://stillwaterassociates.com/whats-up-with-the-collapse-of-cfp-credit-prices/

April 24, 2024

by Leigh Noda

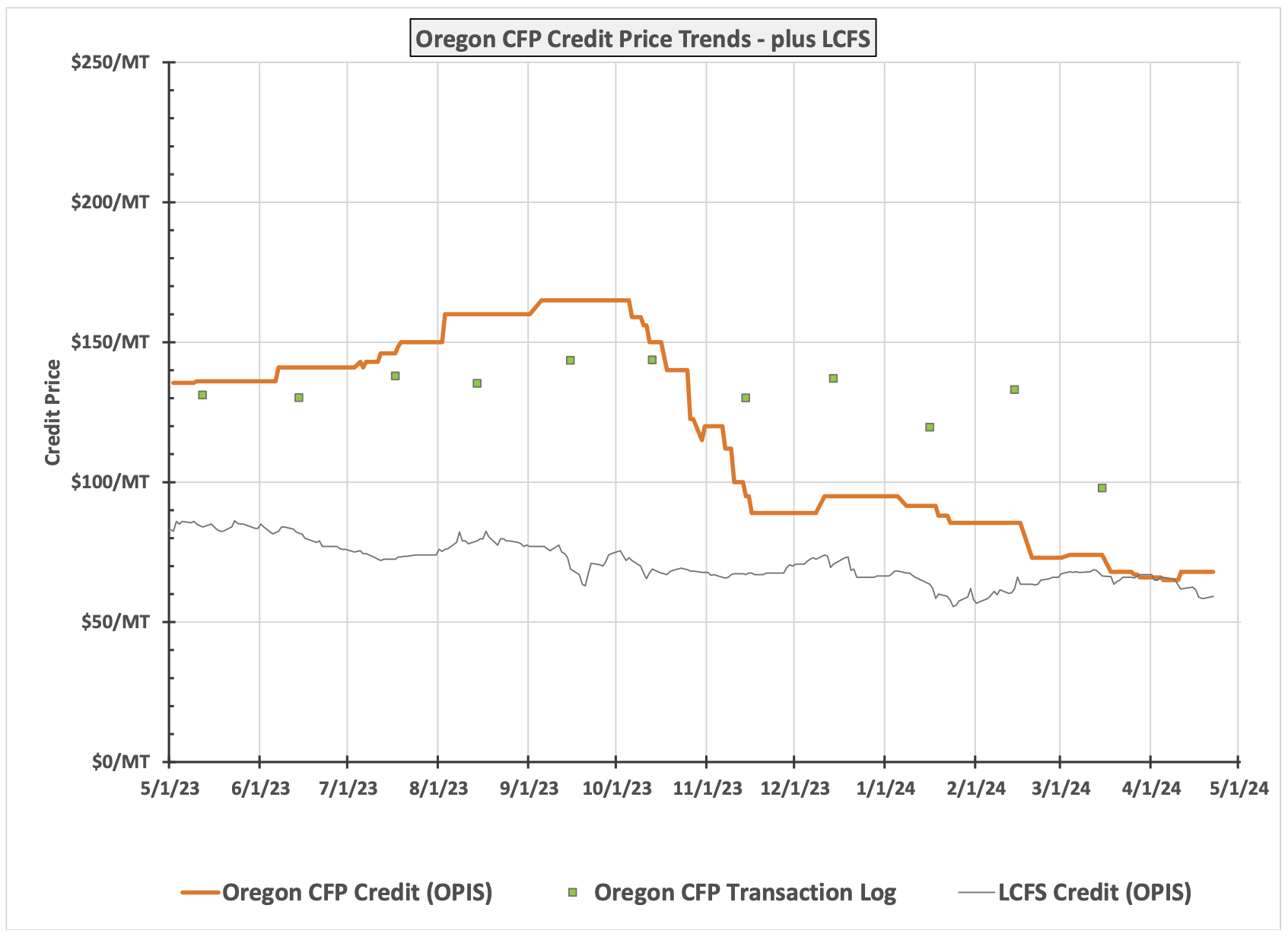

Observers of Oregon’s Clean Fuel Program (CFP) have probably noticed that after two years of being significantly higher and more stable than California Low Carbon Fuel Standard (LCFS) credit prices, CFP credit prices have fallen to near parity with those observed in California. In the article in our March 2024 LCFS Newsletter (subscription required), we examine CFP credit price movements and the data, the reasons behind the decline, and the rationale for why CFP prices could not continue to be priced independently of (and much higher than) LCFS credit prices. In this abbreviated analysis, we offer a few of these insights “in front of the paywall.”

Since October 2023, CFP credit prices have fallen off by more than 60% to levels near the recently depressed LCFS credit prices. This behavior marks a departure from the historic relationship between CFP and LCFS credit prices.

CFP and LCFS Credit Prices Converging

Given the similarities between the structure of the two programs and the fact that the same fuels can be used for compliance in both programs, Oregon’s CFP credit prices and California’s LCFS credit prices should track each other. Any offset in prices should be attributable to program differences, variances in the local fuels markets, impacts of other regulations, and the level of the credit bank in each program.

In the first few years of Oregon’s program, we found that CFP prices did have an offset that followed the valuation of corn ethanol in the two jurisdictions due to differences in the treatment of indirect land use change on carbon intensities for fuels under the two programs. Starting in 2020, however, the ILUC-based credit price relationship disintegrated, and the relationship between the two credit prices departed from any meaningful correlation. As we watched this decoupling occur, we suspected that the divergence was related to biodiesel (BD) being the marginal compliance fuel under the CFP and while RD was driving compliance under the LCFS. We have since confirmed that regulations had limited RD use in Oregon, confirming our theory regarding the cause of the price correlation divergence.

That brings us back to today. We are now in another new phase of LCFS-CFP credit price correlation. In our LCFS Newsletter article (subscription required), we explore the reasons for the recent convergence of these credit prices. We discuss the changes and impact that growing renewable diesel (RD) production, Oregon’s Climate Protection Program (CPP), Portland’s Renewable Fuel Standard, and the 5% biodiesel (BD) requirement in Portland had on recent usage and compliance with the CFP. In short, the convergence of the credit prices is a result of the convergence of a number of factors, not a simple one.

Don’t miss out. Subscribe to the Stillwater LCFS Newsletter to get the in-depth analysis around the Low Carbon Fuel (LCF) programs on the U.S. West Coast. We provide subscribers with the information they need to make smart LCF program credit market decisions, including assessment of key market trends, aggregation of today’s important news in the LCF program space, updates on LCF program legislation making its way through new state legislatures, detailed fuel-by-fuel quarterly data analysis, and more!