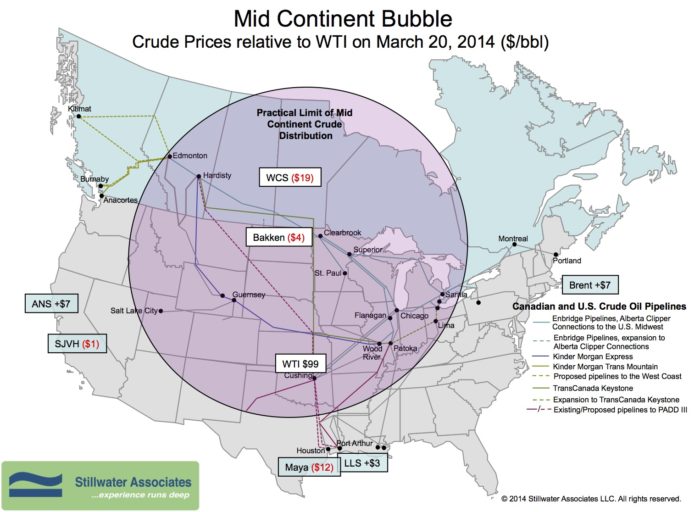

The Spring Bubble Map: Pipelines Help to Ease the Bottleneck

Link to article: https://stillwaterassociates.com/the-spring-bubble-map-pipelines-help-to-ease-the-bottleneck/

March 23, 2014

The latest Bubble Map shows the Bakken discount has narrowed considerably since we last checked in. On March 20th Bakken at Clearbrook, MN was posted at $4 under WTI. The WCS discount has also narrowed to $19 under WTI. On the Gulf Coast, the LLS premium to WTI has shrunk to $3 over while Maya’s discount has widened to a $12. The Brent-WTI spread has narrowed with Brent priced $7 over WTI. On the West Coast, the ANS premium has narrowed to $7 over WTI and San Joaquin Valley Heavy dropped to $1 under WTI.

The Brent-WTI differential has narrowed due to several pipeline projects that have come on line recently, easing the bottleneck. Plans to expand the Seaway Pipeline that runs from Cushing to the Gulf Coast will increase capacity from 400 kbd to 850 kbd this summer. Keystone XL’s southern leg came on line this January. Capacity is expected to reach 830 kbd later in the year. Pipelines brining crude oil from the Permian Basin to Houston have also helped relieve oversupply inside the bubble. Magellan’s Longhorn Pipeline reversal brings 275 kbd into Houston. Magellan’s BridgeTex pipeline carries 300 kbd from Colorado City, TX to Houston.

Don’t Miss Dave Hackett at the AFPM Annual Meeting

Dave Hackett will be presenting on The Effect of Crude by Rail on Refining and Logistics this Tuesday, March 25th at 10:30 at the AFPM Annual Meeting in Orlando. Don’t miss this informative discussion on the benefits and challenges of delivering crude by rail out of the mid continent bubble.

Tags: WisdomCategories: Wisdom from the Downstream Wizard