The Cost of the RFS on Refiners and Crack Spread Growth

Link to article: https://stillwaterassociates.com/the-cost-of-the-rfs-on-refiners-and-crack-spread-growth/

September 30, 2021

By Leigh Noda

What is RVO and how is it applied?

The Renewable Volume Obligation (RVO) on suppliers (refiners and importers) is the U.S. federal Renewable Fuel Standard (RFS) mechanism that creates the obligation to acquire and retire renewable identification numbers (RINs). For each calendar year, an RVO percentage (RVO%) is developed by the U.S. Environmental Protection Agency (EPA) through a rulemaking process. The RVO% is intended such that if the volume of petroleum gasoline and petroleum diesel supplied domestically (50 states except Alaska) is what is projected through the rulemaking process, the annual volume targets for each renewable fuel category (i.e., Renewable Fuels, Advanced Biofuels, Biomass-Based Diesel, and Cellulosic Biofuels) will be met.

For refiners and importers of petroleum gasoline and diesel, the RVO or RINs obligation for each of the four RFS fuel categories is set by their combined volume of petroleum gasoline and diesel times the RVO% for that fuel category. The RVO obligation to acquire and retire RINs is accrued to the refiner or importer when their gasoline and diesel is supplied from the refinery or imported for the U.S. market. A way to view the RVO is as an “output” cost similar to crude oil being an “input” cost. A difference is that the crude cost applies to all of the crude processed by a refinery while the RVO applies only to the volume of gasoline and diesel produced by the refinery for use in the U.S.; thus, the RVO cost will vary from refinery to refinery depending on their gasoline and diesel yields and mix of export versus domestic sales. Since the RFS is designed to consider fuels supplied domestically, a refiner or importer does not incur an RVO for any gasoline or diesel that is exported.

What has been the RVO cost trend?

For the purposes of this discussion, we treat the RVO cost as the composite of each of the four obligations. Since it applies to all of these fuels that are supplied to the marketplace, the RVO obligation – or RINs Cost – effectively raises the cost of producing these fuels and thus the refinery gate price. The cost of this RVO will vary with the price of each type of RIN and will change with annual change in the RVO percentages. Since it is not a requirement that each obligated party retire their RVO daily (compliance is on an annual basis, months after the close of the year), any calculation of the RVO cost is really an estimate.

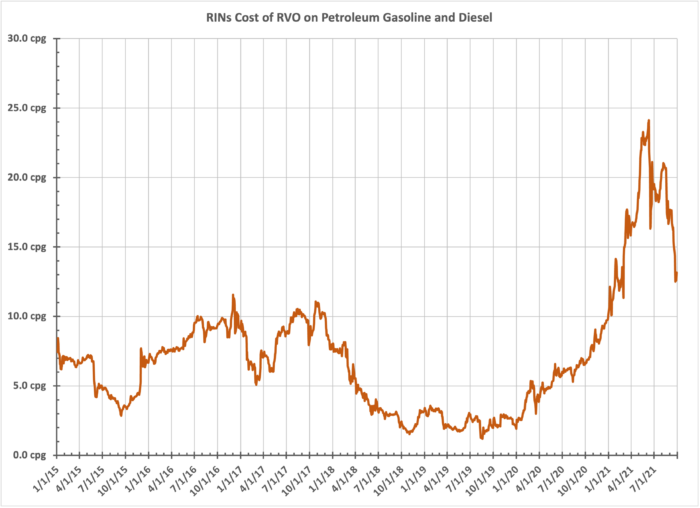

The figure below illustrates the trend of our estimated composite RVO cost on each gallon of BOB, ethanol-free gasoline (E0), and ULSD to refiners and importers supplying these products to the domestic market. For 2021, since the 2021 RVOs (other than for biomass-based diesel) have not been proposed or finalized, the 2021 RVO percent obligations are estimated based on the final 2021 biomass-based diesel RVO and the 2020 RVO percentages adjusted for the final 2021 biomass-based diesel RVO.

Cost of RINs for Petroleum Gasoline and Diesel Produced or Imported

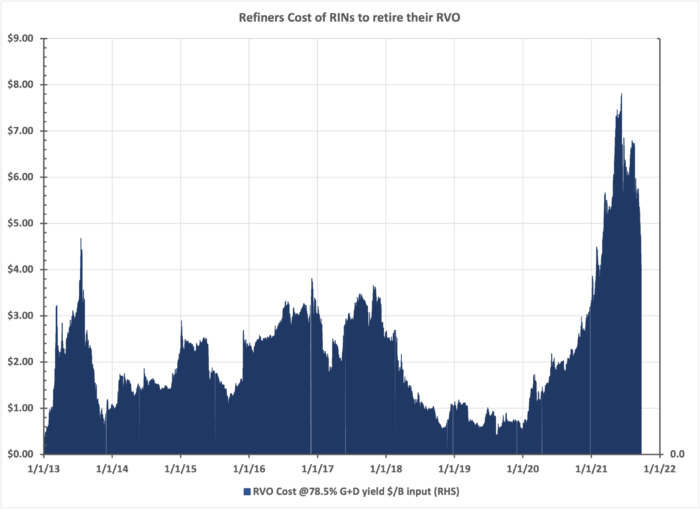

The cost of the composite RVO on any specified refiner depends on its yield of gasoline plus diesel, the four RVO%s for the year, and the price of each type of RIN. Over the past nine years, the RVO cost has been most dependent on RINs prices and to a lesser extent on the annually rising RVO%. The chart below illustrates the trend of the cost of RFS to a refiner per barrel of crude input, assuming the 2019 U.S. average 78.5% yield of BOB, E0, and ULSD. Although the RVO cost has declined significantly from its earlier peak, the RVO cost is still very significant.

Refiners Cost of RINs to Retire their RVO

The RVO Cost to refiners is one that cannot be avoided if they are supplying petroleum gasoline and diesel to the domestic market (unless they are granted a Small Refinery Exemption (SRE) or supply fuel only to Alaska). As can be seen above, the RVO cost to a refiner is significant and only dipped in the 2018-2019 timeframe because of EPA’s liberal granting of SREs during that period.

To understand how significant the RINs cost is to a refinery, the recent values over $7 per barrel is higher than our rule of thumb estimated cash operating cost of $5 to $7 per barrel. Except for crude oil and the RINs for RVO cost, the operating costs do not vary appreciably since labor, supplies, and energy costs are relatively stable. The use of crack spreads to measure changes in refinery profitability have this basic underlying assumption that operating costs are fairly constant. However, unlike traditional operating costs, the cost of RINs for RVO are volatile as can be seen above. This volatility would manifest itself in any traditional crack spread calculation since the refinery gate product prices should be reflecting the RINs for RVO compliance cost. Thus, a move in the cracks may only be reflecting a move in RINs prices and not net refinery margins.

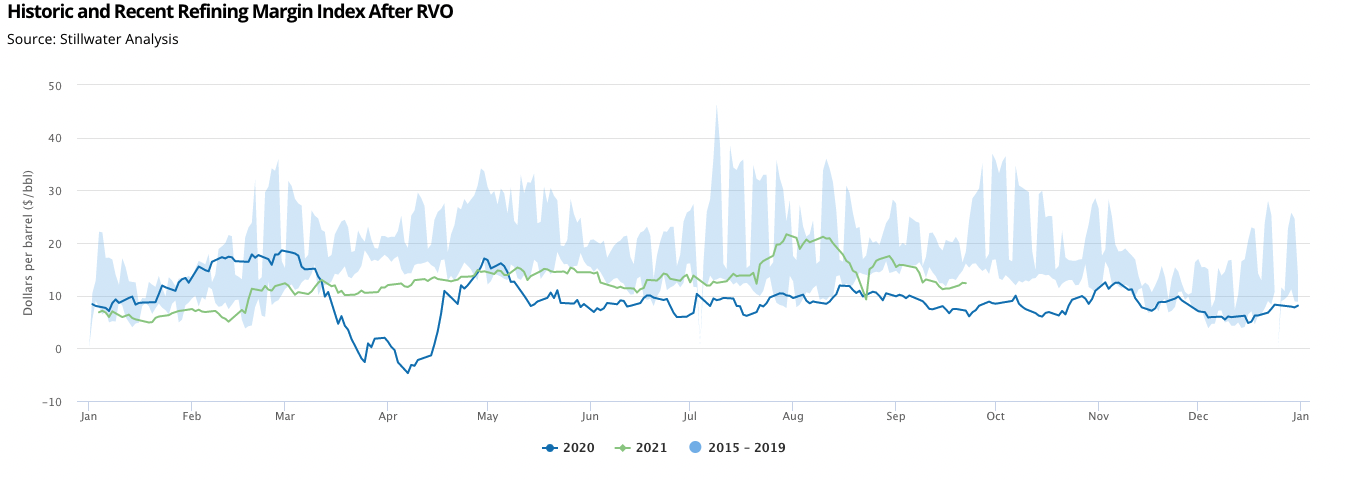

Stillwater’s West Coast Watch provides our exclusive Refining Margin Index along with petroleum product and renewable fuels supply and demand data. Our West Coast Refining Margin index on its own is a good indicator of the health of the refining industry, but we’re always striving to provide the most accurate picture of the West Coast transportation fuels market. To provide a more well-rounded view, we are adding a margin index that illustrates the impact of the RVO on refiners in our region. The WCW Refining Margin Index After RVO, displayed as the chart below, offers historical context showing the five-year average West Coast refining margins, including the cost of the RVO, with trends for 2020 and 2021.

Historic and Recent Refining Margin Index After RVO

For more analysis on the impact of the RVO on West Coast refiners, be sure to sign up for Stillwater’s West Coast Watch to gain access to our latest Monthly Market Analysis and get the full picture.

For more analysis on the impact of the RVO on West Coast refiners, be sure to sign up for Stillwater’s West Coast Watch to gain access to our latest Monthly Market Analysis and get the full picture.