SAF 201 – Digging a Bit Deeper into Sustainable Aviation Fuel

Link to article: https://stillwaterassociates.com/saf-201-digging-a-bit-deeper-into-sustainable-aviation-fuel/

October 5, 2023

By Allison M. Bergquist, Ph.D.

The advent of fueled flight introduced new emissions into the troposphere. Commercial aviation now accounts for roughly 2% of global CO2 emissions, and unless air travel is completely decarbonized, airplanes will continue to emit carbon dioxide into the air at elevations where emitters historically did not exist. The International Civil Aviation Organization (ICAO), the EU, the U.S. Department of Energy (DOE), and major airlines like United are all committed to reducing emissions from air travel. Sustainable aviation fuel (SAF) adoption is the leading method to help reduce emissions in this hard-to-decarbonize sector. SAF – a blended jet fuel developed with renewable feedstocks in addition to fossil fuel – receives a lot of press but is still a relatively new fuel on the market.

Currently, SAF represents a miniscule portion of the jet fuel pool, which means there is incredible opportunity in this area. Recent conversations at conferences and with Stillwater’s clients have brought to light some nuances and confusion around sustainable aviation fuel (SAF) worth explaining.

Let’s start by clarifying some terms.

- Fossil jet fuel refers to Jet A and falls under ASTM 1655. This is also known as conventional jet. (There are other fossil aviation fuels but this article is focused on Jet A.)

- Neat SAF is an umbrella term that refers to multiple synthetic jet products meeting ASTM D7566. Commonly known production pathways include alcohol to jet (AtJ), Fischer-Tropsch (FT), and hydroprocessed esters and fatty acids (HEFA), which all produce synthetic paraffinic kerosene (SPK). Lesser-known pathways include synthesized iso-paraffins (SIP) and synthetic paraffinic kerosene plus aromatics (SPK/A). These “neat SAF” pathways are where emissions reductions are found.

- Blended SAF (or what many simply call SAF) refers to a blended, finished fuel containing a renewable portion (neat SAF) and a fossil jet portion. Neat SAF has a lower CI than fossil jet, thus lowering the overall CI of the blended SAF put in an airplane. Most programs require SAF to have a 50% GHG reduction compared to fossil jet to qualify for incentives.

Put simply: Blended SAF = Neat SAF + Fossil jet fuel

SAF is commonly referred to as a “drop-in fuel” – a “fungible” or completely interchangeable substitute for a conventional, petroleum-derived fuel. More accurately, blended SAF is a drop-in fuel and is fungible with fossil jet fuel. Neat SAF (or SPK, SIP, SPK/A), however, is not a drop-in fuel and is not fungible.

50/50 SAF Blend Ratio Maintains Sufficient Aromatics

In contrast with SAF, the ability to incorporate lubricity additives in diesel enables neat renewable diesel (RD) to be a fully fungible, drop-in fuel. No permissible lubricity additives exist for jet fuel, so for blended SAF to have sufficient lubricity, a 50/50 blend ratio has been established.

Lubricity comes from aromatics and is essential to ensure safe aircraft operations. Jet engine fuel pumps are lubricated by the fuel and aromatics in the fuel provide lubrication. Elastomers in numerous components (e.g., fuel seals, o-rings, fuel hoses) rely on aromatics to maintain the structural integrity of the seal via a chemical reaction between the aromatics and elastomers. Integrated elastomer components in current and legacy equipment rely on the aromatic content in jet fuel. Most fossil jet fuels have an aromatics level around 20%. SPK has no aromatics because it is paraffinic – comprised of straight chain hydrocarbons lacking aromatic rings. A 50/50 blend results in a blended SAF aromatic content around 10%, which is sufficient to meet industry standards. In the future, material scientists may develop components that do not require aromatics or are compatible with synthetic jet fuel. Even then, considerations for legacy equipment would be required, as most aircraft are in service for multiple decades.

As the SAF market expands, research and development continues to pursue alternative pathways to produce SPK with aromatics (SPK/A), evaluate alternative jet fuel impacts on o-rings and seal swelling, increase iso-alkanes and cycloalkanes, among others. Virent conducted a third demonstration flight in January 2023 with Emirates Airline using 100% synthesized aromatic kerosene (SAK), showing a 100% non-fossil SAF drop-in fuel is technically feasible.

Logistics of Neat and Blended SAF

The logistics of blended SAF leave some opportunity to optimize as the market expands. In most cases, fossil jet, SPK and blended SAF need to be batched and stored separately. SPK and fossil jet are blended outside of the airport, and blended SAF is delivered to the airport to fuel planes. Lack of equipment, staff, and insurance at the airport drives this model. From a book-and-claim perspective, the segregated process can help simplify accountability. As the market continues to grow, however, the logistics ecosystem supporting blended SAF may need to evolve.

In contrast, if neat SAF is co-processed with fossil jet at a petroleum refinery, an existing jet pipeline could be used to transport blended SAF to the airport directly. For example, refineries in Beaumont or Baytown, TX send jet via the Enterprise pipeline to George Bush Intercontinental Airport (IAH) so they could theoretically transport co-processed SAF via the same pipeline (it is important to note that commercializing this option would require pipeline approval). The limitation with this model is the geographic disparity between the existing pipeline infrastructure, petroleum refineries, and neat SAF production facilities. The Commercial Aviation Alternative Fuels Initiative (CAAFI)’s 2017 white paper about the transportation challenges of neat SAF provides a detailed account of logistics considerations as the SAF market evolves.

Lots of Opportunity in the SAF Market

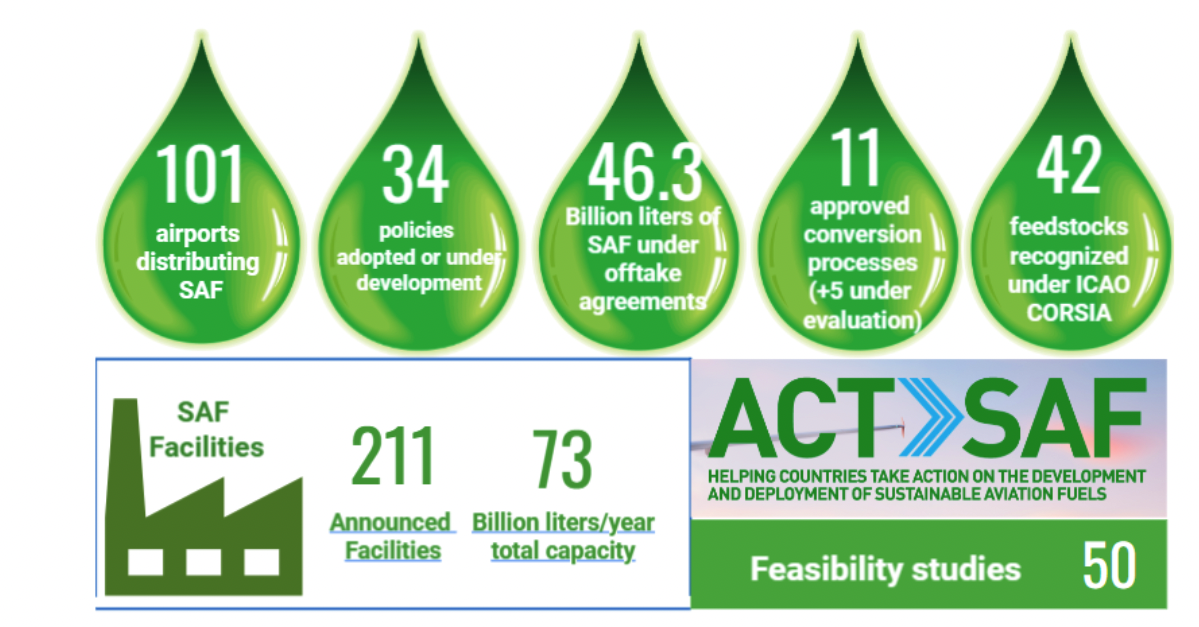

The graphic below from ICAO provides key stats about the SAF market today. Boeing has also developed an interactive SAF dashboard worth exploring. Bottom Line: SAF gets a lot of press but is still a very small part of the jet market across the U.S. As such, there is incredible opportunity in this space moving forward.

Source: ICAO

In California, SAF earns credits under the LCFS program, and CARB is currently considering making jet fuel a deficit generator. However, blended SAF comprised only 0.04% of the total jet consumed in 2019, according to the LCFS Reporting Tool (LRT) and the U.S. Energy Information Administration (EIA) data. Across the U.S., the SAF portion of the total jet fuel consumed was roughly 0.03% in 2019 and 0.06% in 2022, based on data from EIA and the U.S. Department of Energy (DOE). The DOE’s SAF Grand Challenge targets 2050 for meeting 100% aviation fuel demand via SAF, at a 50% GHG reduction threshold. Policy drivers, investment support, financial incentives and technology advances all play a role in supporting the burgeoning SAF market.

If you’re trying to figure out how to enter the SAF markets, contact Stillwater. We’re tracking all the new tax incentives for SAF and have experience evaluating what incentive stacks would provide the most favorable economics for your particular business case.