Oregon’s Embattled CPP: Back to the Future

Link to article: https://stillwaterassociates.com/oregons-embattled-cpp-back-to-the-future/

February 1, 2024

Much has been reported around the embattled Oregon Climate Protection Program (CPP) in recent weeks. As an Oregon resident, I’m particularly interested in the status and future of this program. For others who are interested in a quick recap of the program, the status of the legal battle, and the likely future of the program, read on!

The CPP is Oregon’s version of a cap-and-trade (C&T) program but with unique provisions. The program sets a declining limit, or cap, on greenhouse gas (GHG) emissions from fossil fuels used in the state’s transportation, residential, commercial, and industrial settings. The goal of the program is to reduce emissions in the state and accelerate the transition from fossil fuels to lower carbon energy sources while containing costs and promoting equity. The primary difference between the CPP and C&T programs is that under C&T programs entities are required to purchase allowances through auctions while the DEQ distributes compliance instruments freely (in accordance with the declining cap) under the CPP. The program was finalized in late 2021 and implemented beginning in 2022 with an initial compliance period spanning 2022 to 2024.

But…

On December 20, 2023, however, the Oregon appeals court ruled that the CPP is invalid due to the Oregon Department of Environmental Quality’s (DEQ) failure to “substantially comply,” with disclosure requirements when adopting rules under the federal Clean Air Act. Subsequently, on January 22, 2024, DEQ indicated that they will repeat the required rule-making process rather than appeal this ruling. They further indicated that this is likely to require 12 months during which time the CPP will not be in effect. As such, the CPP is temporarily not effective while DEQ works its way through the repeat rule-making process. Stillwater anticipates that the CPP will be re-implemented once this repeat rule-making is complete, and that the program will look similar to the program as it was initially implemented.

Ok, so what was the CPP’s original structure?

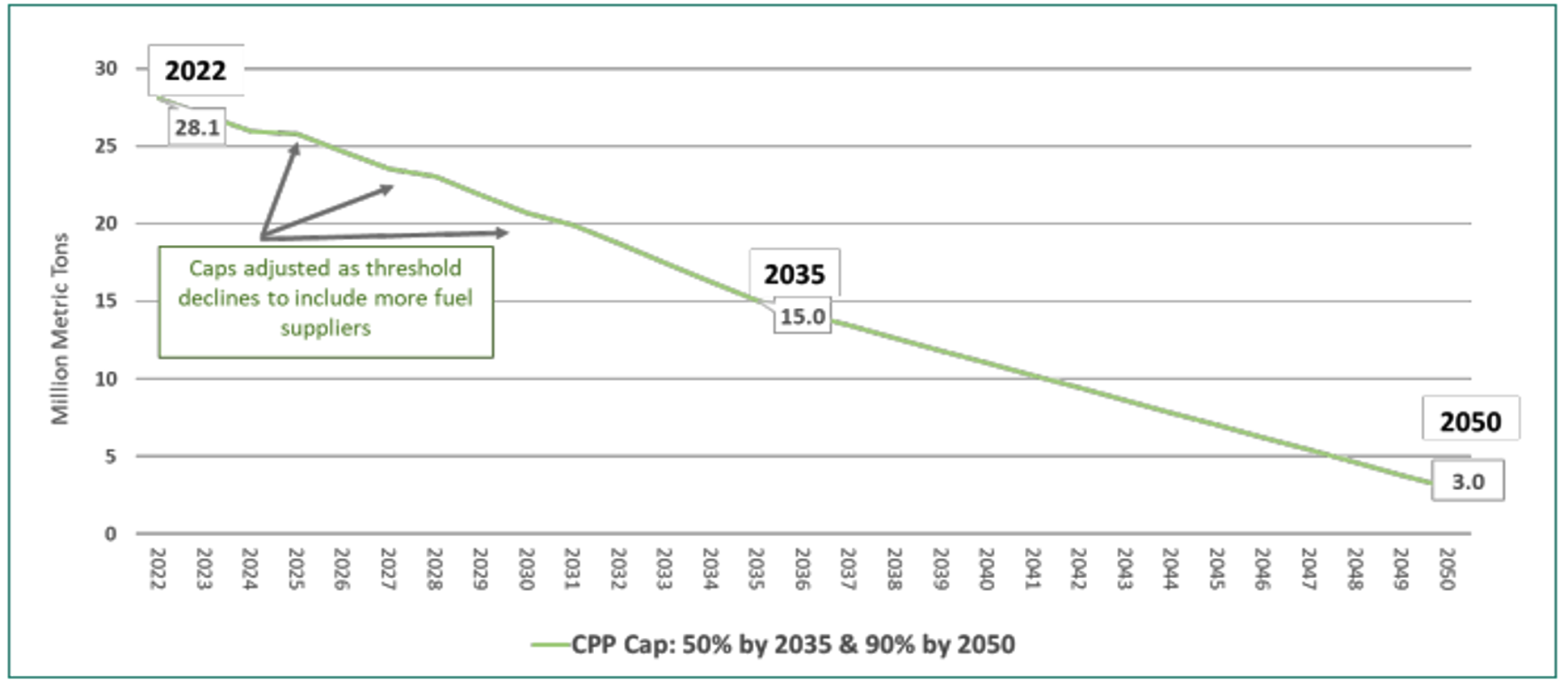

The CPP has two compliance categories – fuels and stationary sources. Oregon’s covered fossil fuel suppliers are regulated under the first compliance category and are subject to declining emissions caps which eventually reach a 90% reduction by 2050 as shown in the figure below.

Covered fossil fuel supplier required emissions reductions under the CPP Source: Oregon Department of Environmental Quality (DEQ)

Source: Oregon Department of Environmental Quality (DEQ)

Separately, stationary sources (i.e., industrial facilities) are required to reduce covered emissions via the Best Air Emissions Reduction (BAER) process, which involves working with DEQ to establish site-specific strategies to meet targets and timelines for compliance. These entities are then charged with implementing these strategies to reduce their covered GHG emissions.

Are there any exemptions or exceptions?

There are a few notable exemptions concerning covered emissions. First, only emissions from the combustion of fossil fuels are included; emissions from the combustion of biomass-derived fuels including biomethane, BD, RD, renewable propane, woody biomass, and ethanol are exempted. Emissions from aviation fuel are also exempt. Additionally, emissions described in 40 CFR part 98 Subpart W – Petroleum and Natural Gas Systems are exempted, thus avoiding the double-reporting of emissions from upstream petroleum and natural gas production, gathering and boosting, storage, and transmission.

What does compliance look like?

Fuel suppliers and stationary sources who meet or exceed applicable covered emissions thresholds are Covered Entities under the CPP. There were 23 fuel suppliers covered under the CPP and 16 stationary sources subject to the BAER program under the CPP. Covered Entities must demonstrate compliance with the declining cap on emissions using freely allocated “compliance instruments” or purchased compliance instruments. Each compliance instrument accounts for 1 MT CO2e of covered emissions and is analogous to the California Carbon Allowances (CCAs) in California’s C&T program, and the Washington Carbon Allowances (WCAs) in Washington’s C&I program. Unused compliance instruments can be sold and transferred between Covered Entities or banked for use in future compliance periods. In addition to freely allocated or purchased compliance instruments, compliance can also be partially achieved through community climate investment (CCI) credits which are similar to offsets under the California C&T and Washington C&I programs. CCIs are generated by DEQ-approved GHG-reduction projects, and Covered Entities can purchase CCIs from third parties with approved projects based on a schedule in the regulation that is adjusted for inflation. In March 2023, that value was $107 (in 2021 dollars) per CCI. Usage of CCIs is limited to 10 percent of a given fuel supplier’s compliance obligation at the start of the program, increasing to 20 percent for the third compliance period and all periods thereafter.

To demonstrate compliance, every three years each covered fuel supplier must surrender to DEQ sufficient compliance instruments or CCIs to match their covered emissions in that three-year period. The first compliance deadline (which encompasses the 2022-2024 reporting period) is November 2025.

Does the CPP impact other GHG reduction policies in Oregon?

At a high level, the CPP should serve as another policy instrument that should lower the net cost of renewable fuels, thereby making them more competitive with fossil fuels. That said, the covered emissions applicability across industries and the number of exempted emissions (covered under other programs) may limit the ability to directly tie this policy to changes in the Oregon Clean Fuel Program (CFP) credit prices.

Do you need help strategizing how to navigate the increased complexities of the West Coast markets? Contact Stillwater to leverage our deep bench of industry experts to help.