Lessons from 2021 Winter Storm Uri for the August 2023 Heat Wave in Texas

Link to article: https://stillwaterassociates.com/lessons-from-2021-winter-storm-uri-for-the-august-2023-heat-wave-in-texas/

September 12, 2023

By John Wolff

In early 2021, winter storm Uri’s cold snap caused blackouts in Texas. The natural gas market and power generation in the Electric Reliability Council of Texas (ERCOT)1 region did not play well together at that time, but since then the state is slowly advancing arrangements to add new dispatchable power generation with billion-dollar annual demand charges paid by Texas ratepayers. This summer, with plenty of 100°F days, was another test of the ERCOT grid. This article reviews “post-action” Uri studies from ERCOT and others and evaluates how a scenario with more dispatchable generation could have saved Texas ratepayers billions of dollars in August 2023.

Electricity Market in February 2021

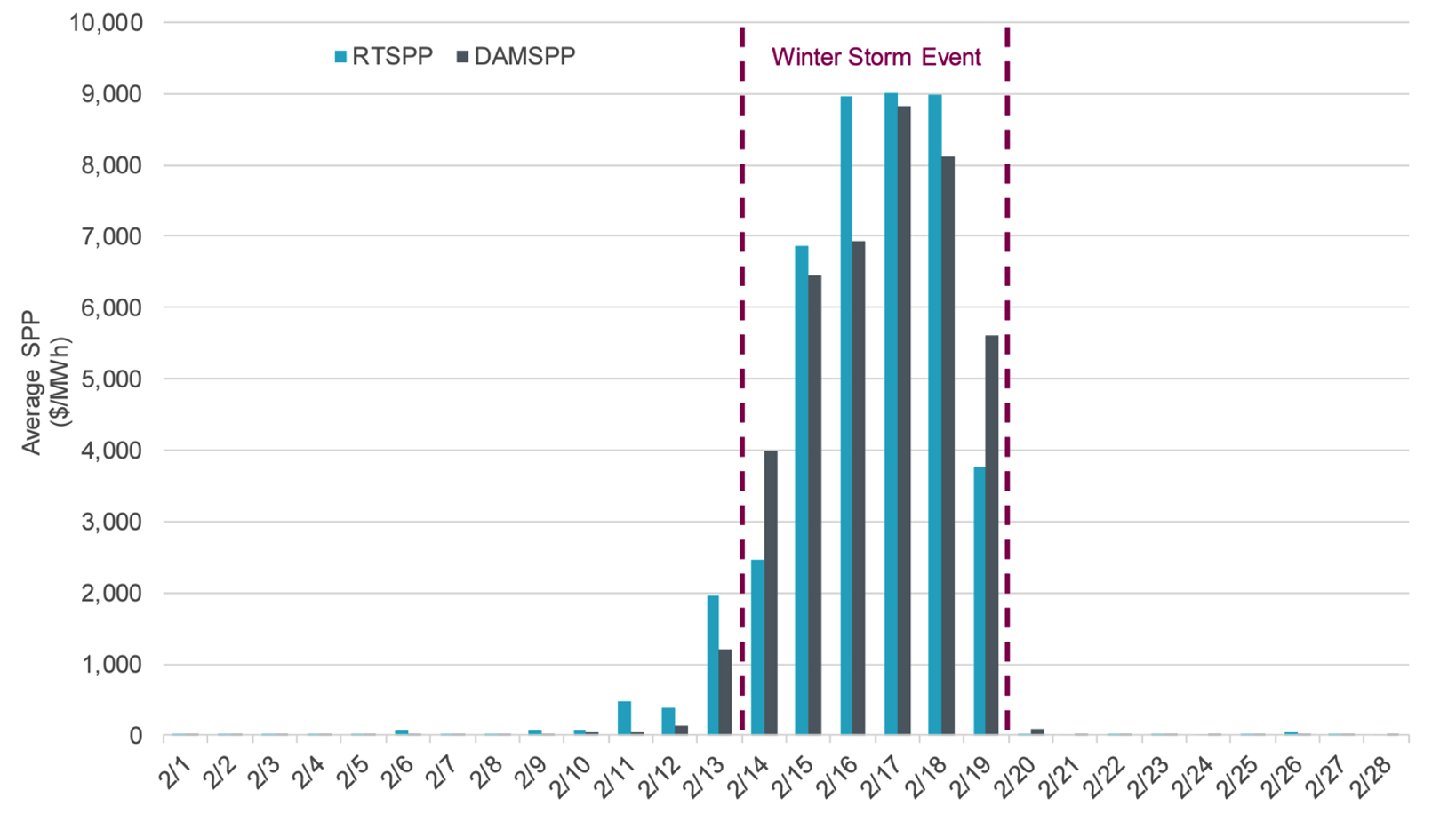

Just weeks before weather forecasters predicted the bitter weather, the February 2021 Henry Hub benchmark for natural gas settled at $2.76/MMBtu ($28/MWh given approximate power plant efficiencies). As electricity curtailments arose in Texas during winter storm Uri, however, the posted wholesale electricity price rose to $9,000/MWh for several days, as shown in Figure 1. The Natural Gas Daily Price at the Panhandle Eastern Pipe Line Company’s Texas/Oklahoma (PEPL TX/OK) point was $2.55/MMBtu on February 1, 2021 (before the cold weather hit), and rose to $224.56/MMBtu on February 16, 2021 deliveries on that day as demand for natural gas in power generation surged and end-user demand was also high.

Figure 1. Daily Day-Ahead and Real-Time Market Price Differences

Source: ERCOT Monthly Operational Overview (February 2021)

Notes: Averages are weighted by Real-Time Market Load; RTSPP is Real-Time Settlement Pricing Point; DAMSPP is Day-Ahead Market Settlement Pricing Point

Since installed gas-fired generators sought fuel to generate power during the freeze but the natural gas market faced its own problems, the generators were willing to pay marginal costs for natural gas. That works out to be a very high natural gas price given breakeven generation economics:

$9,000/MWh price (reported by ERCOT as the ceiling price)

* 1 MWh/1000 KWh unit conversion

* 1 KWh/10,000 Btu (indicative 34% simple cycle gas turbine fuel efficiency) =

$0.0009/Btu= $900/MMBtu for natural gas

Of course, some generators were willing to pay more than a breakeven cost for natural gas, given that the generators could have sold power from lower cost units running on lower cost fuel supplies as well as the high marginal cost ones.

If the ERCOT wholesale market had been priced at $100/MWh rather than the actual prices, Texas ratepayers would have saved $11.4 billion in power costs. As it is, utilities were permitted to “rate base” the costs and recoup the fees plus interest over several years, instead of trying to collect huge monthly utility bills after the storm in March 2021. Customers may continue paying down these balances for years.

Natural Gas Market Prices

The above disparity in prices was remarkably wide, but it is not uncommon for there to be a variety of prices in the U.S. natural gas market at one time. For example, Natural Gas Intelligence publishes 170 unique price points, each for a specific natural gas pipeline point where there may be transactions.

For a natural gas producer, there can be a variety of contracts with different buyers, resulting in pricing variances:

- Fixed-price Contracts: Annual or even multi-year contracts

- Monthly or Index Contracts: Citing a basis differential to Henry Hub settlement prices or prices cited in specified newsletter(s).

- Daily Prices: Linked to price(s) published in newsletter(s) or other arrangements.

Sources of Market Disruptions

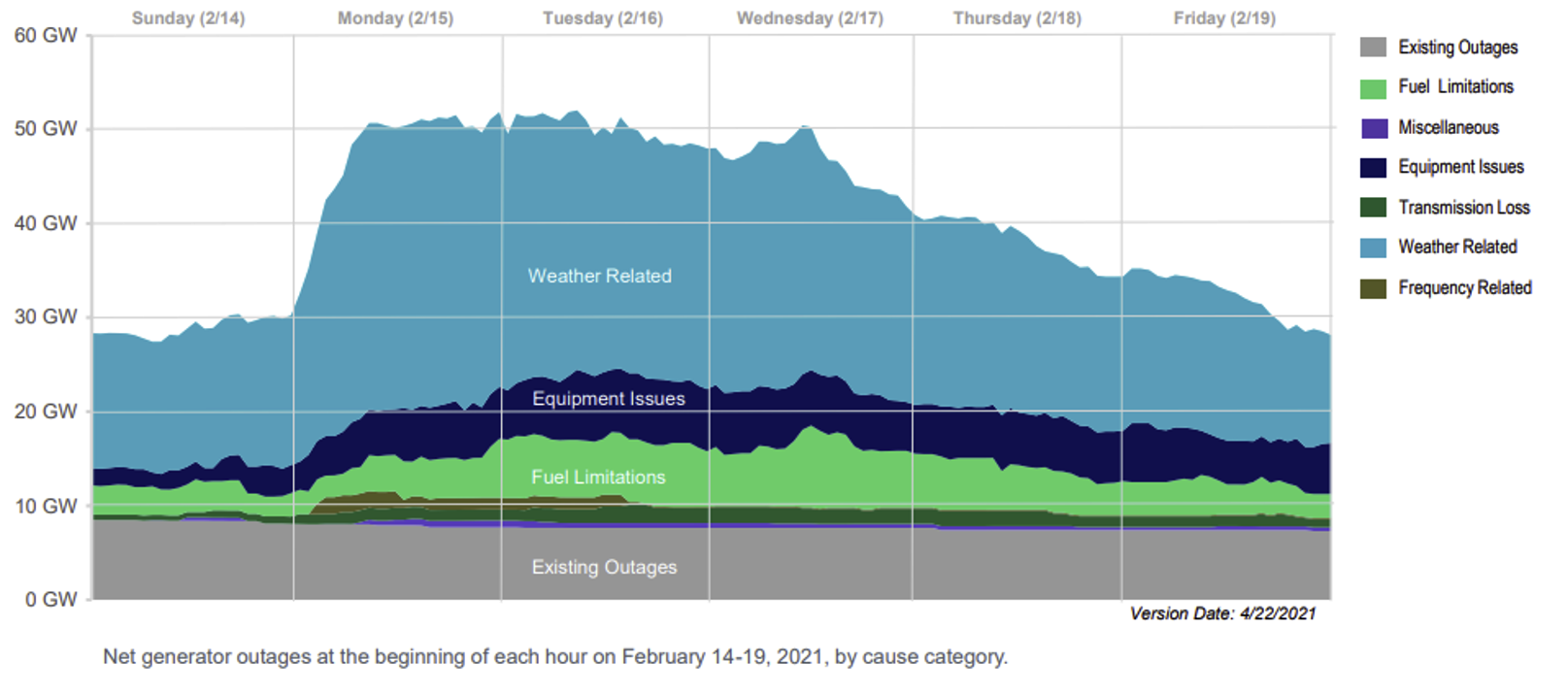

The power market disruptions associated with Winter Storm Uri had several causes. The decline in ERCOT’s power supply was investigated by ERCOT, and its study was posted in April 2021. The report found that weather-related issues, equipment issues, and fuel limitations played key roles in the disruptions.

Figure 2. Net Generator Outages and Derates by Cause (MW) – February 14-19, 2021

Weather-Related Issues

As can be seen in the figure above, ERCOT’s investigation concluded that weather-related operating problems were the major issue that led to outages – more than fuel limitations or equipment issues. These weather-related operating issues include frozen equipment, boiler feed pump issues, boiler leaks, condensate system issues, control system issues, exceeding high or low temperature limits, solar panel snow/ice buildup, and wind turbine blade icing.

Texas was uniquely unprepared for this sort of weather. Wind turbines in the North Sea, for example, use heated blades to minimize ice build-up; that feature was not installed on many wind turbines in Texas, and ice-covered wind turbine blades caused turbine shutdowns. Following Winter Storm Uri, Texas began requiring the “weatherization of power generation facilities, natural gas facilities, and transmission facilities” to handle extreme weather. The Texas Railroad Commission and ERCOT will be required to inspect these facilities, and failure to weatherize these facilities can result in future penalties.

Fuel Limitations

Several “after action” investigations evaluated poor interactions between the natural gas and power markets. The Texas Energy Reliability Council was set up to better coordinate state agency and industry response during extreme weather emergencies. For example, natural gas pipelines and gas storage operators have established that the necessary power supplies will be contracted at a higher level of “firm” service rather than a lower cost “interruptible” rate. Some natural gas storage fields needed gas compressors to produce natural gas into the gas transmission systems, but the compressors used electric motors. The operators had contracted to use lower cost interruptible power contracts to operate gas compressors. During Uri’s cold weather, interruptible power customers were curtailed so the gas storage fields were not able to send out natural gas. Without the gas compressors running, gas supplies were curtailed or cut off to the power generators resulting in lost power output. Greater reliance on power purchases had arisen when it was easier to get emission permits for natural gas projects using electric-driven compressors. In earlier periods, natural gas-fueled engines or gas turbines were used for gas transmission project compression requirements so the natural gas transmission networks could operate autonomously from the electric grids. Since Uri, the electricity contracts have been adjusted to provide more reliable firm service for the key gas infrastructure.

Equipment Issues

Maintenance problems emerged from the cold weather and were exacerbated by widespread icing on the roads which made getting maintenance crews to sites difficult.

Revamped Price Cap

Many users faulted ERCOT’s high cap price put in place during the cold snap for allowing pricing to skyrocket. In response, ERCOT reduced its cap from $9,000/MWh to $5,000/MWh in Dec. 2021.

Texas Policy Evaluations Since the 2021 Storm

In 2023, the Texas legislature evaluated an alternative performance credit mechanism (PCM) that could help support dispatchable power generation. The PCM would reward eligible resources for actual performance during the hours of highest reliability risk periods. Effectively, it could pay natural gas and coal power plants a credit for being available during times of peak electricity demand. ERCOT had purchased power on the commodity price offered with no demand charges, although contract holders were not required to do so. The bill was passed but capped the support at $1 billion. The costs cited for larger alternative plans were as much as $18 billion. The Public Utility Commission of Texas will be establishing the rules to collect such fees. Such projects may need firm gas supplies as part of the assurance plan. Unfortunately, no large dispatchable generation projects have been built under the program.

ERCOT has been willing to pass on demand charges to rate payers to support the expansion of photovoltaic systems and wind turbines. Several billion dollars for new transmission systems have been billed to Texas ratepayers benefitting remote power generators. Historically, however, conventional power plants were sited closer to the customers since transmission charges were not amortized in that manner.

What About August 2023?

This summer, Texas has had many days where the temperatures rose above 100°F. The wholesale price in Houston reached $5,000/MWh for several hours this August. The demand at the highest price, 84,572 MWh for ERCOT at 8:00 pm on Aug. 17 can be compared to other periods with lower prices to test whether rate payers might have benefitted from more dispatchable power.

Note that the evening peak is untimely for photovoltaic power. Solar generation on ERCOT had tailed off from 11.9 GW at 4:30 pm, the peak demand, to 0.7 GW at 8:00 pm, the period with the highest price in August. Wind generation ramped up from 5.5 GW at 4:30 pm to 8.5 GW at 8:00 pm. However, Texas wind turbine generation peaked in August just past midnight when the winds in West Texas are stronger. The peak demand had reached 84,901 GW earlier in the day, at 4:30 pm, but the Houston price then was lower at $1,141.70/MWh.

While there were several conservation requests announced by ERCOT during August and September, there were no blackouts. The peak demand of 84,901 MW was 8.2% higher than 78,465 MW reported as the previous August peak in 2022. (That’s what 102°F weather can do for electricity demand.)

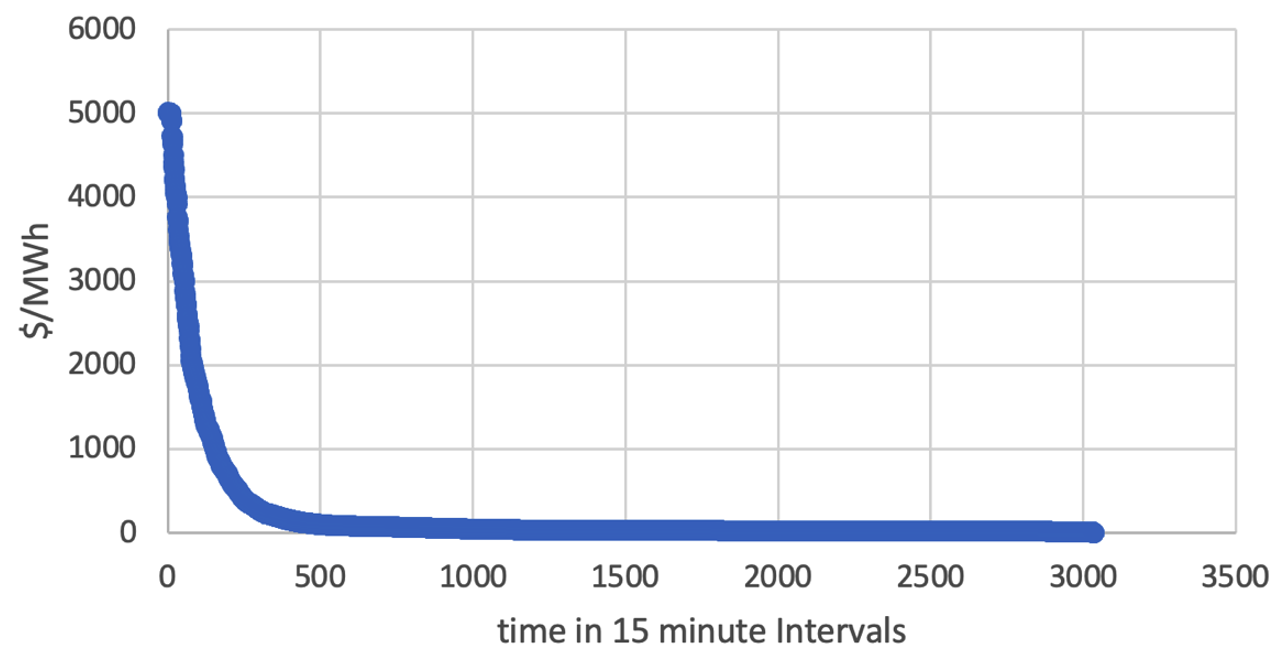

The prices at various trading points are reported in 15-minute intervals. The graph below plots the August price for the Houston area but sorted from the highest price to the lowest. We could assume that the Dispatchable Power Generation units could be used when power prices exceed some threshold.

Figure 3. August 2023 Houston Power Price

If there had been additional dispatchable power, how much would have been needed to constrain the price to $200/MWh? In this scenario, a benchmark price of $200/MWh was set when the power demand was 72.5 MW in an evening. If 12 GW of extra dispatchable capacity could have been on-line and dispatched at a price of around $200/MWh, the extra power supply should have moderated the pricing during the peak demand at 84.5 MW. That much generation could have helped, but the extra generation would have operated only 19 hours in August. Adding 2 MW of additional dispatchable capacity could also have lowered the costs and operated 260 hours in August. The estimated Texas bill (weighted average of Texas MWh x Houston price) in August is $11.4 billion. If the additional dispatchable units would have capped the wholesale price at $200/MWh, the wholesale cost would have been $3.3 billion, a one-month savings of $8.1 billion. If the extra generation capacity could lower the price to a cap of $100/MWh, the cost would have been $2.5 billion, a savings of $8.9 billion. At a recent natural gas cost, the fuel cost for the gas-fired peaking power plant could be recouped at approximately $30/MWh. At an approximate capital cost of $0.65 to $1.3 million/MW for a gas-fired peaking plant, $8 billion could purchase 6,000 MW of new gas-fired power plants assuming the high capital cost figure. New Plant owners may need to recoup their costs in demand charges from rate payers rather than through risky bets on future hot weather leading to high ERCOT power prices.

So, what are the lessons we can learn?

Policy makers expecting similar hot summers in the future should structure contracts to add more dispatchable power generation capacity on the ERCOT system. Additional dispatchable evening generation would have saved rate payers $8 billion during the August 2023 heat wave alone if the facilities had already been operational. But utility scale photovoltaic generation, including low electrical transmission charges from ERCOT, is not significantly helping ratepayers offset 8:00 pm peak pricing since there is little sunlight available then, and utility scale battery storage arrangements have been relatively small to-date. As such, photovoltaic generation did not effectively cap the August evening $5,000/MWh prices.

Adding dispatchable power generation capacity at natural gas-fired power plants located near load centers and increasing natural gas storage both seem prudent. Having contracts wherein gas-fired plants might operate only a few hundred hours in a future month from hot or cold weather, however, appears reasonable for Texas power buyers, but risky for power plant owners without some demand charge revenue.

In any case, given the prospect of large electric utility bills for many ratepayers and power marketers, it is surprising that Public Utility Commissions have not tried to address the looming cost recovery issues as they did after Winter storm Uri.

1 ERCOT manages the flow of electric power to more than 26 million Texas customers – representing about 90 percent of the state’s electric load. As the independent system operator for the region, ERCOT schedules power on an electric grid that connects more than 52,700 miles of transmission lines and 1,100 generation units.