July Update on the Mid Continent Bubble

Link to article: https://stillwaterassociates.com/july-update-on-the-mid-continent-bubble/

July 16, 2012

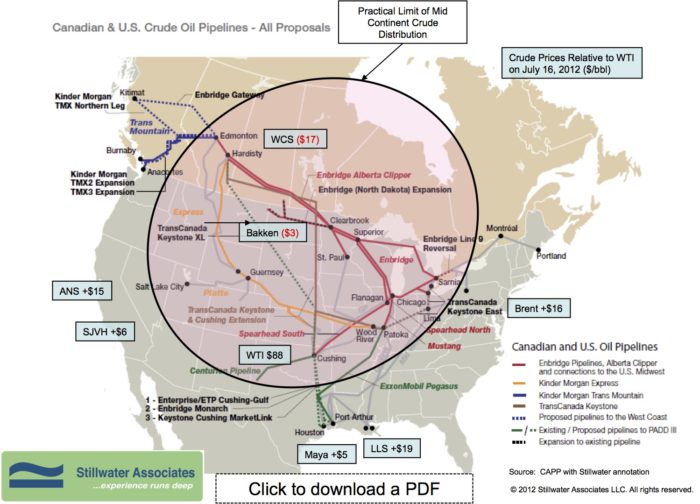

Since our last blog post, crude oil prices have rebounded. WTI closed at $88 on July 16th, up $4 since we last checked in. LLS and Brent prices have also risen. The spread between LLS and WTI is up $7 from our last post, to $19 on July 16th. The spread between Brent and WTI is also up $4 from June 19, to $16. While the Brent and LLS spreads are growing, the discounts in the Mid Continent have tightened. Bakken’s discount continues to narrow from $6 under WTI on June 19 to $3 under WTI this week. The spread between WCS and WTI has narrowed by an even greater margin, dropping $5 from our last post to $17 under WTI this week.

Bloomberg is reporting that the strengthening price of WCS is due to increased rail movements. Cenovus is also credited for moving WCS out of the Mid Continent bubble to the Gulf Coast, with smaller deliveries to California and the US East Coast.

Tags: WisdomCategories: Wisdom from the Downstream Wizard