Interview: Canadian Clean Fuel Regulations with Advanced Biofuels Canada

Link to article: https://stillwaterassociates.com/interview-canadian-clean-fuel-regulations-with-advanced-biofuels-canada/

October 17, 2023

Back in May, ahead of the July implementation of the Canadian Clean Fuel Regulations (CFR), several members of Stillwater’s Carbon Crew chatted with Ian Thomson, President of Advanced Biofuels Canada about the state of biofuels production and usage in Canada. Our write-up of that conversation is available here. By way of follow-up, this month we checked in with Ian’s colleague Fred Ghatala, Director of Carbon & Sustainability at Advanced Biofuels Canada to see how things are going in the early days of the CFR roll-out. We offer his insights here for our readership’s edification.

Question: Three months in, what is your overall perception of how the roll-out of the CFR is going?

Answer: I give staff at Environment and Climate Change Canada (ECCC) high marks for the rollout of the regulation so far. Of course there are questions, areas where guidance is needed, and potential updates to improve the Regulations. We shouldn’t forget that Canada just put in place what is essentially a national LCFS policy with a compliance credit market.

The response from the North American and global low-carbon fuel market has been remarkable with regard to registrations and new actors who have not previously been in the Canadian market.

Are there any data on supply and demand for compliance credits at this point?

To date there have been no reports out by ECCC on the supply and demand balance for compliance credits or prices at which credits have transacted. Everyone realizes that transparency is important for market-based regulations like the CFR. Watch this space…

Who are the most significant credit generators?

One class of CFR compliance credits arise from the production and import of Low Carbon Intensity Fuels (LCIF) net of exports. LCIF are defined as ethanol, biodiesel (BD), renewable diesel (RD), and synthetic fuels. These have, and are anticipated to have well into the program, the largest shares of credit creation as credits from upstream oil and gas reductions have not entered the market in significant quantities yet. Electric mobility (charging), hydrogen, and renewable natural gas (RNG) are a third class of compliance options. While EV crediting is expected to grow substantially, hydrogen and RNG crediting is expected to grow more gradually.

Currently, almost all credits being created from RD are from imported fuel; RD makes up about 55% of the low-carbon diesel used in Canada (per the 2023 version of the Biofuels in Canada report). RD was coming from Singapore but that has recently shifted to being supplied from RD producers on the U.S. Gulf Coast.

Ethanol credits are driven by producers supplying the Canadian market in Alberta (AB) and Ontario (ON) as well as importers who supply about 45% of the ethanol used in Canada.

Biodiesel credits are from imported BD while most domestic BD production is sold to the U.S. So, primarily importers/BD suppliers are creating the credits rather than producers who must retire credits upon export.

It is anticipated that Canadian low-carbon diesel demand will grow through to 2030 and most of that growth will be met with RD. The capacity of announced plans for new RD facilities could almost meet the entire demand thus reducing our import dependence.

RD, along with BD, generate credits at a faster rate than ethanol because their average carbon intensities (CI) are lower than that of ethanol and because they are closer to energetic equivalence with fossil diesel as compared to ethanol versus gasoline. The combination of strong demand and low CI will make RD a significant contributor to credit creation. Expect the trajectory to be similar to California where, in 2022, RD provided 37% of credits while electricity provided 25%, biomethane 16%, ethanol 14%, and BD 8%.

What is the hierarchy of obligated parties by size and/or sector?

Top 5 Refiners: Imperial, Irving, Suncor, Valero, Shell

Other Refiners: FCL, Parkland, Tidewater

The easiest way to get a broad look is to consider refining capacity as reported by the U.S. Energy Information Administration or the Canadian Fuels Association. However, this doesn’t include fossil fuel importers and fuel distributors that are also subject to the CFR obligations if they are on title upon import.

What kind of insights do you have into the flows of renewable fuels into and/or out of Canada?

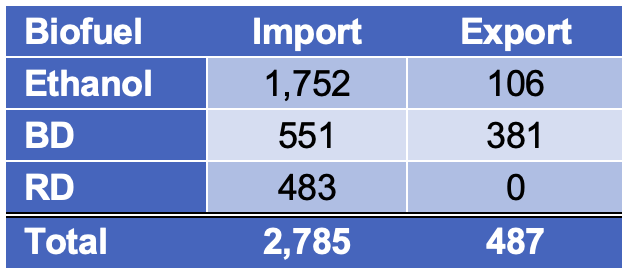

Insights available from Statistics Canada historically included just ethanol and biodiesel (RD was lumped in with BD). As of January 1, 2022, RD now has its own tracking, so the data set is improving. RD data in the table below is assumed to be incomplete (unreported volumes likely still in BD classification) as RD total does not correspond to actual RD consumed per the 2023 Biofuels in Canada report which estimated 597 million litres for 2022).

Table 1. Biofuel Trade Summary for 2022 (million litres)

What is the mix of fuels being used for compliance, and how is that expected to change over the next ~5 years?

Right now, per the 2023 Biofuels in Canada report the mix is ethanol at 59%, RD at 15%, BD at 12%, electricity at 11%, co-processed fuel at 3% when adjusted to an equivalent basis. Gaseous fuels are excluded from this.

Expect the trajectory to move in the direction of the current California alternative fuel mix where, in 2022, RD provided 45% of the energy while ethanol provided 32%, BD 10%, RNG 7%, electricity 6%.

Is there any significant variation between provinces/regions?

There is much variation between provinces. Provinces with most stringent volumetric regs drive demand while the British Columbia (BC) LCFS creates additional pull with compliance value of CI reduction thereby amplifying baseline demand.

BC consumes 62% of national RD, 26% of national BD, and 13% of ethanol (yet has only 12% of Canadian diesel demand). Meanwhile, ON consumes 22% RD, 18% BD, 41% ethanol. And AB consumes 1% RD, 33% BD, 18% ethanol.

Expect this to change as AB finds itself lagging as other regs increase in stringency: notably Quebec (QC) and Manitoba (MB).