CPP: The Freshest Noodles in the Alphabet Soup of Oregon’s Climate Programs

Link to article: https://stillwaterassociates.com/cpp-the-freshest-noodles-in-the-alphabet-soup-of-oregons-climate-programs/

July 26, 2023

By Allison Bergquist, Kendra Seymour, Leigh Noda, and Adam Schubert

The Oregon Climate Protection Program (CPP) sets a declining limit, or cap, on greenhouse gas emissions (GHGs) from fossil fuels used in the state’s transportation, residential, commercial, and industrial settings. The goal of the program is to reduce emissions in the state and accelerate the transition from fossil fuels to lower carbon energy sources while containing costs and promoting equity. The program was finalized in late 2021 and implemented beginning in 2022 with an initial compliance period spanning 2022 to 2024. In this article, we offer an overview of the program and its impact on the fuels markets in Oregon.

Liquid Fuels & Stationary Sources

The CPP has two compliance categories – fuels and stationary sources. Oregon’s covered fossil fuel suppliers are regulated under the first compliance category and are subject to declining emissions caps which eventually reach a 90% reduction by 2050. This category includes natural gas utilities and suppliers of gasoline, diesel, kerosene, and propane. As of this writing, there are 23 covered fuel suppliers in the CPP program.

Separately, stationary sources (i.e., industrial facilities) are required to reduce covered emissions via the Best Air Emissions Reduction (BAER) process, which involves working with the Oregon Department of Environmental Quality (DEQ) to establish site-specific strategies to meet targets and timelines for compliance. These entities are then charged with implementing these strategies to reduce their covered GHG emissions. As of this writing, there are 14 industrial facilities in Oregon subject to BAER.

Covered Emissions

For liquid fuel suppliers, in-state producers, and local natural gas distribution companies, covered emissions include “anthropogenic greenhouse gases that would result from the complete combustion or oxidation” of fuels including gasoline, diesel, kerosene, propane, and natural gas. These emissions relate to the end use of the fuel supplied rather than the production of that fuel. (Note that Oregon does not have any refineries.) For Stationary Sources, covered emissions relate to combustion of solid or gaseous fuels in that source’s industrial process(es).

Exempted emissions

There are a few notable exemptions concerning covered emissions. First, only emissions from the combustion of fossil fuels are included; emissions from the combustion of biomass-derived fuels including biomethane, biodiesel, renewable diesel, renewable propane, woody biomass, and ethanol are exempted. Emissions from aviation fuel are also exempt. Additionally, emissions described in 40 CFR part 98 Subpart W – Petroleum and Natural Gas Systems are exempted, thus avoiding the double-reporting of emissions from upstream petroleum and natural gas production, gathering and boosting, storage, and transmission.

Covered Entities

Fuel suppliers and stationary sources who meet or exceed applicable covered emissions thresholds are Covered Entities under the CPP. A fuel supplier qualifies as a Covered Entity if their covered emissions meet or exceed the 200,000 metric ton (MT) threshold of carbon dioxide equivalent (CO2e) emissions for any year since 2018. As an illustrative example, this equates to approximately 20 million gallons per year (or 1.3 thousand barrels per day) of petroleum diesel fuel. Note that emissions are grouped for related entities, such as subsidiaries, for this threshold evaluation. This threshold will decline over time to 25,000 MT, thus including more entities in the future.

A stationary source is subject to BAER (i.e., is a Covered Entity under the CPP) if their covered emissions meet or exceed 25,000 MT of CO2e per year.

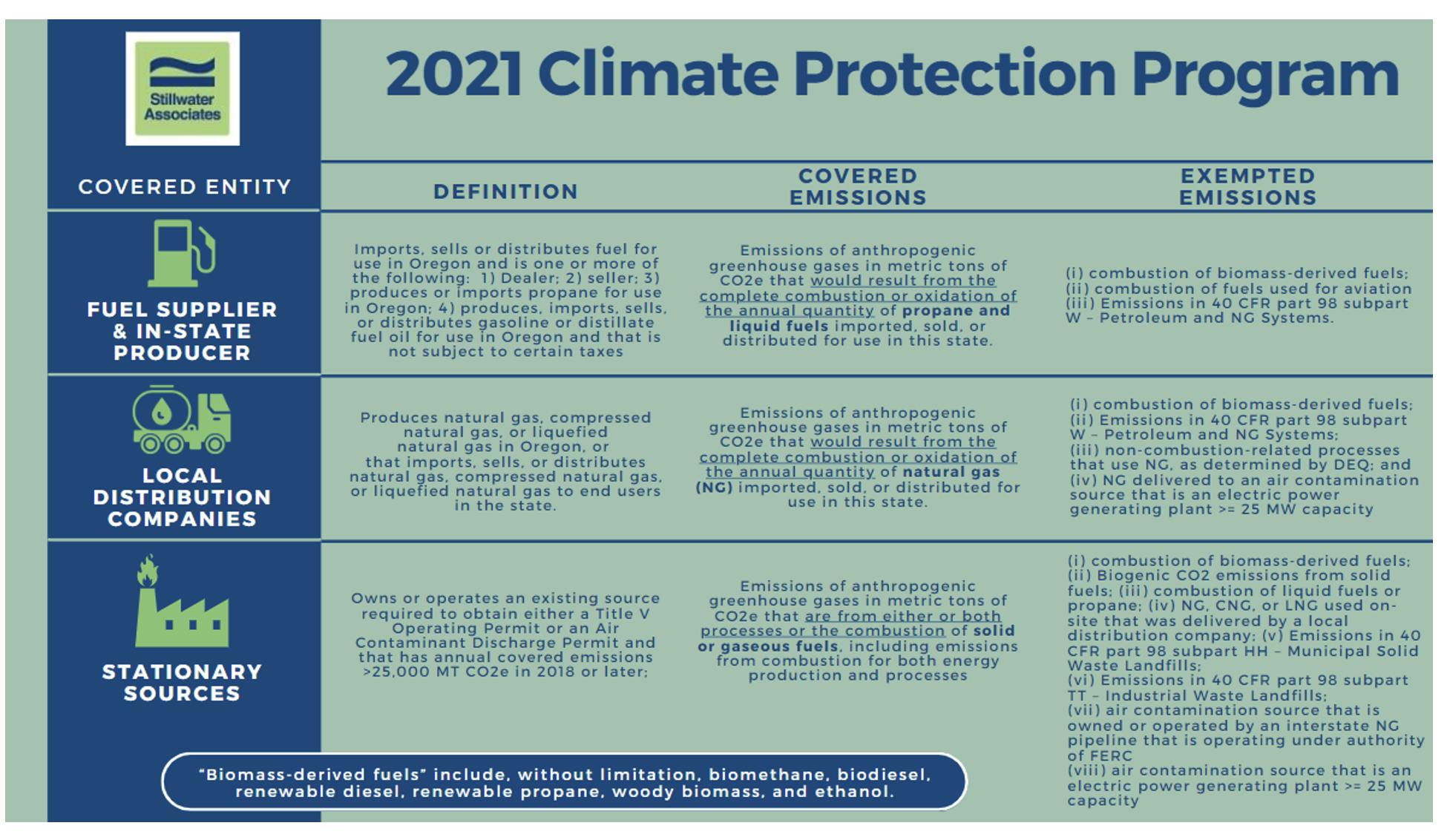

A Covered Entity must apply for a CPP permit and will remain in the program until they cease to be covered (i.e., until their covered emissions drop below the annual threshold). Covered emissions and exemptions vary by covered entity. See the table below for specifics about covered entities, covered emissions, and exempted emissions.

Compliance

A Covered Entity must demonstrate compliance with the declining cap on emissions. The regulation prescribes a state-wide emissions “compliance instrument” budget for each year through 2050 and prescribes a method for DEQ to freely allocate the appropriate number of compliance instruments to fuel suppliers based on the cap and the fuel supplier’s market share. Each compliance instrument accounts for 1 MT CO2e of covered emissions and are analogous to the California Carbon Allowances (CCAs) in California’s Cap and Trade (C&T) program, and the Washington Carbon Allowances (WCAs) in Washington’s Cap and Invest (C&I) program. Unused compliance instruments can be sold and transferred between Covered Entities or may be banked for future use.

In addition to freely allocated or purchased compliance instruments, compliance can also be partially achieved through community climate investment (CCI) credits. CCIs are generated by DEQ-approved GHG-reduction projects, and Covered Entities can purchase CCIs from third parties with approved projects for $107 (in 2021 dollars) per CCI. Usage of CCIs is limited to 10 percent of a given fuel supplier’s compliance obligation at the start of the program during the first three-year compliance period (2022-2024), increasing to 20 percent for the third compliance period (2028-2030) and all periods thereafter.

To demonstrate compliance, every three years each covered fuel supplier must surrender to DEQ sufficient compliance instruments or CCIs to match their covered emissions in that three-year period. The first compliance deadline (which encompasses the 2022-2024 reporting period) is November 2025.

The compliance process for Stationary Sources differs from the process applicable to liquid fuel suppliers. Rather than submitting compliance instruments or CCIs, Stationary Sources are required to reduce their covered emissions via the BAER process which is unique to each entity. As our focus is on the transportation fuels sector, we will not dive further into this aspect of the CPP.

2023 Developments

As of this writing, the regulation is still being fine-tuned, with the CPP currently in a joint rulemaking which also includes the Greenhouse Gas Reporting Program and Third-Party Verification programs. DEQ is also considering revisions to the allocation methodology of the CPP with the potential addition of biomethane, hydrogen, and ministerial changes. Most of the proposed changes to the CPP revolve around the distribution and timing of compliance instruments.

How will the CPP impact the Oregon fuel market?

Oregon’s CPP is similar to California’s C&T program and Washington’s C&I program, both of which have had a clear impact on the prices of gasoline and diesel. (In case you missed it, Stillwater’s C&T Newsletter explores these issues on a quarterly basis.) However, there is not yet enough information or data to reliably predict the type and magnitude of impact the CPP may have on prices in the Oregon market. Some of the key unknowns at this time are:

- Whether a credit market will develop for CPP compliance

- Whether Covered Entities will need CCI credits to attain compliance

- How the fixed price of CCI credits will impact a potential CPP credit market

More broadly, the proliferation of C&T-style carbon-reduction programs along the U.S. West Coast has the potential to create such a high level of competition as to shift the primary pricing mechanism away from the original goal of reducing the carbon intensity of the transportation fuel pool, thus diluting the GHG reduction efficacy. The CPP and other C&T style programs are essentially CI agnostic – because renewable fuels are exempt from C&T style programs, no additional value is gained via the further reduction of the CI of the biomass-based fuel which replaced the original petroleum fuel. Low Carbon Fuel (LCF) programs – such as Oregon’s Clean Fuels Program (CFP), California’s Low Carbon Fuel Standard (LCFS), or Washington’s Clean Fuel Standard (CFS) – by contrast, incentivize the continued CI reduction of the fuels used to displace petroleum gasoline and diesel.

LCF and C&T-style program values are stacked, and if the value provided by an LCF program (like the CFP in Oregon) is larger than the accompanying C&T-style program (like the CPP in Oregon), continued CI reductions in renewable fuels will be incentivized. If, however, the portion of the stack taken up by the CI-agnostic C&T style program overshadows the value provided by the accompanying LCF program, producers of ever-lower CI fuels may be somewhat disincentivized to produce more costly low-CI products for these jurisdictions. If that were to happen, parties would still achieve compliance with both programs (a clear requirement and constraint) but may be able to do so whilst achieving an overall lower GHG reduction. Although counter to the goals of the regulatory entities and climate-conscious parties, depending on how the various carbon markets develop, this counterintuitive and counter-productive outcome is possible. Currently, it seems that the carbon markets along the West Coast are not yet oversaturated. However, with the Oregon CPP launching in 2022 and the Washington CFS and Canadian Clean Fuel Regulations (CFR) starting up in 2023, the development and interplay between the markets is now something to watch closely.

Do you need help strategizing how to navigate the increased complexities of the West Coast markets? Contact Stillwater to leverage our deep bench of industry experts to help.