California fuel prices soar ever higher on the wings of taxes and fees

Link to article: https://stillwaterassociates.com/california-fuel-prices-soar-ever-higher-on-the-wings-of-taxes-and-fees/

November 15, 2023

By Leigh Noda

Stillwater has regularly written about California retail gasoline prices compared to the U.S. average. It has been eighteen months since we last posted an article about the cost of California’s climate change programs and excise taxes. With carbon prices and excise tax rates in the Golden State on the move, it is high time to post an update.

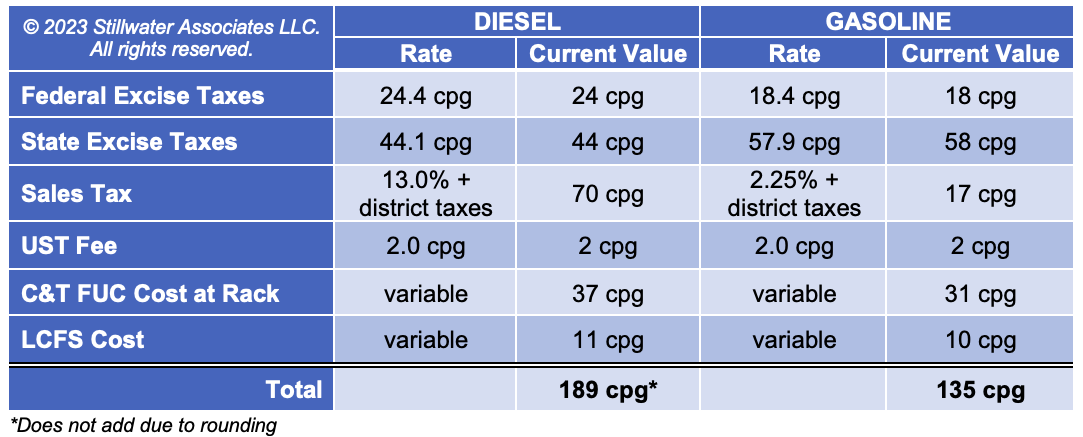

Bottom Line Up Front (BLUF): The average retail prices for gasoline and diesel fuel in California are the highest in the country and exceed the U.S. average gasoline price by a significant amount. Gasoline and diesel prices in California are impacted not only by the price of crude oil and the cost of refining and transport, but also by federal and state excise taxes, sales tax, underground storage tank (UST) fees, the California Cap & Trade (C&T) program including the fuels under the cap (FUC) provision, and California’s Low Carbon Fuel Standard (LCFS). Stillwater’s calculation of the current value of these taxes and fees is summarized in the table below.

Table 1. California Transport Fuel Taxes & Fees (Nov. 2023)

On November 14th, according to AAA, the national average regular gasoline price was $3.353 per gallon while in California regular gasoline price was $5.059; and national average diesel price was $4.343 per gallon while in California average diesel price was $5.975. California’s gasoline prices have historically been higher than the rest of the country due to the logistical isolation of the West Coast from alternate sources of gasoline and diesel supply, and because of the unique California reformulated gasoline (RFG) specifications. With the passage of SB1 (The Road Repair and Accountability Act of 2017 which raised California’s gasoline excise tax, diesel excise tax, and sales tax on diesel), California’s total state and federal taxes on gasoline and diesel became the highest in the country. And, as listed above, California’s climate change programs further add to the cost of supplying gasoline and diesel to the state. As a point of reference for analyzing the impact of these taxes and fees on the price trend in California, Stillwater uses 2014 as a marker year; as of 2014, the cost of the LCFS program on petroleum fuels was small, fuels did not yet fall under C&T, and SB1 had not yet been enacted.

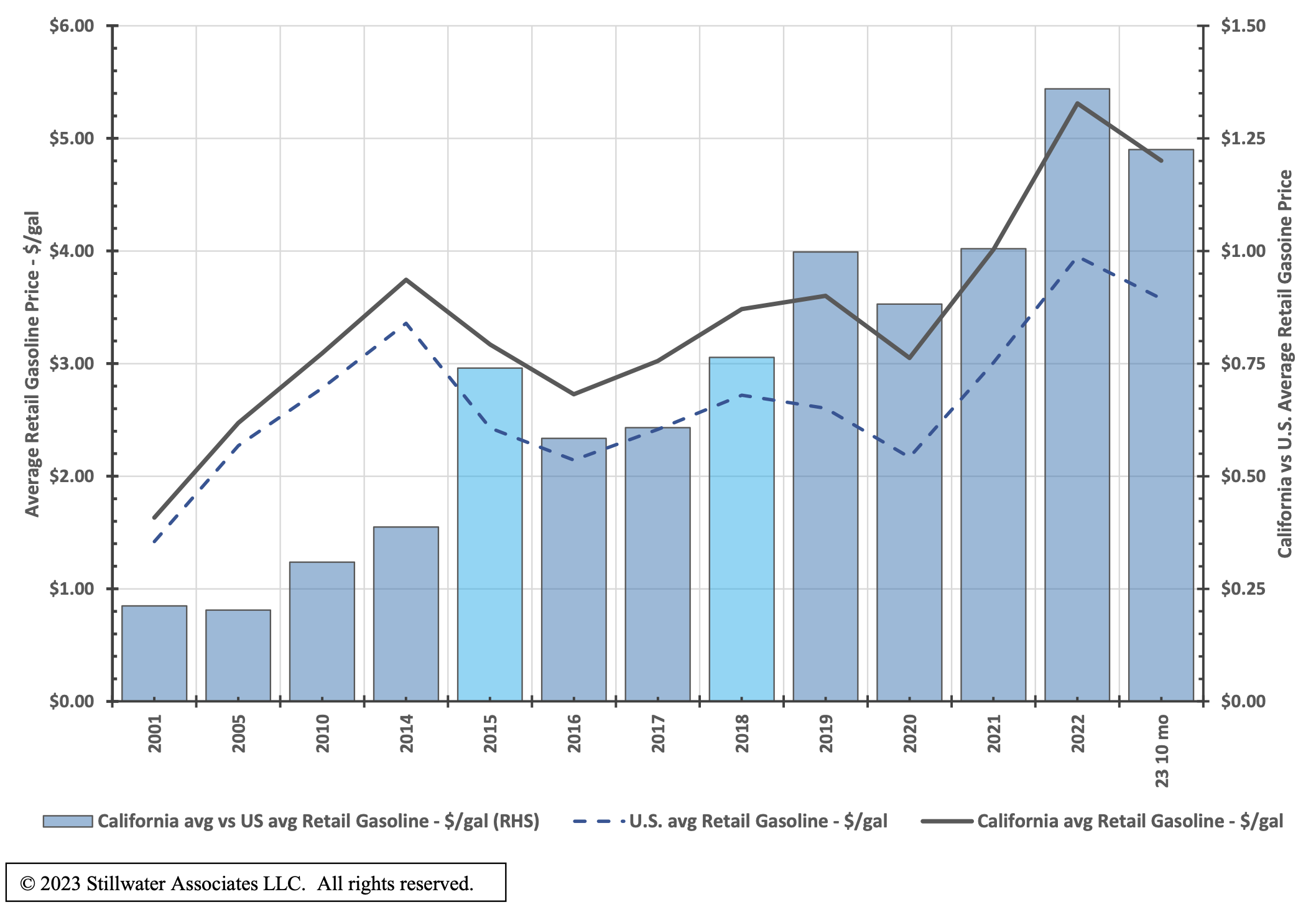

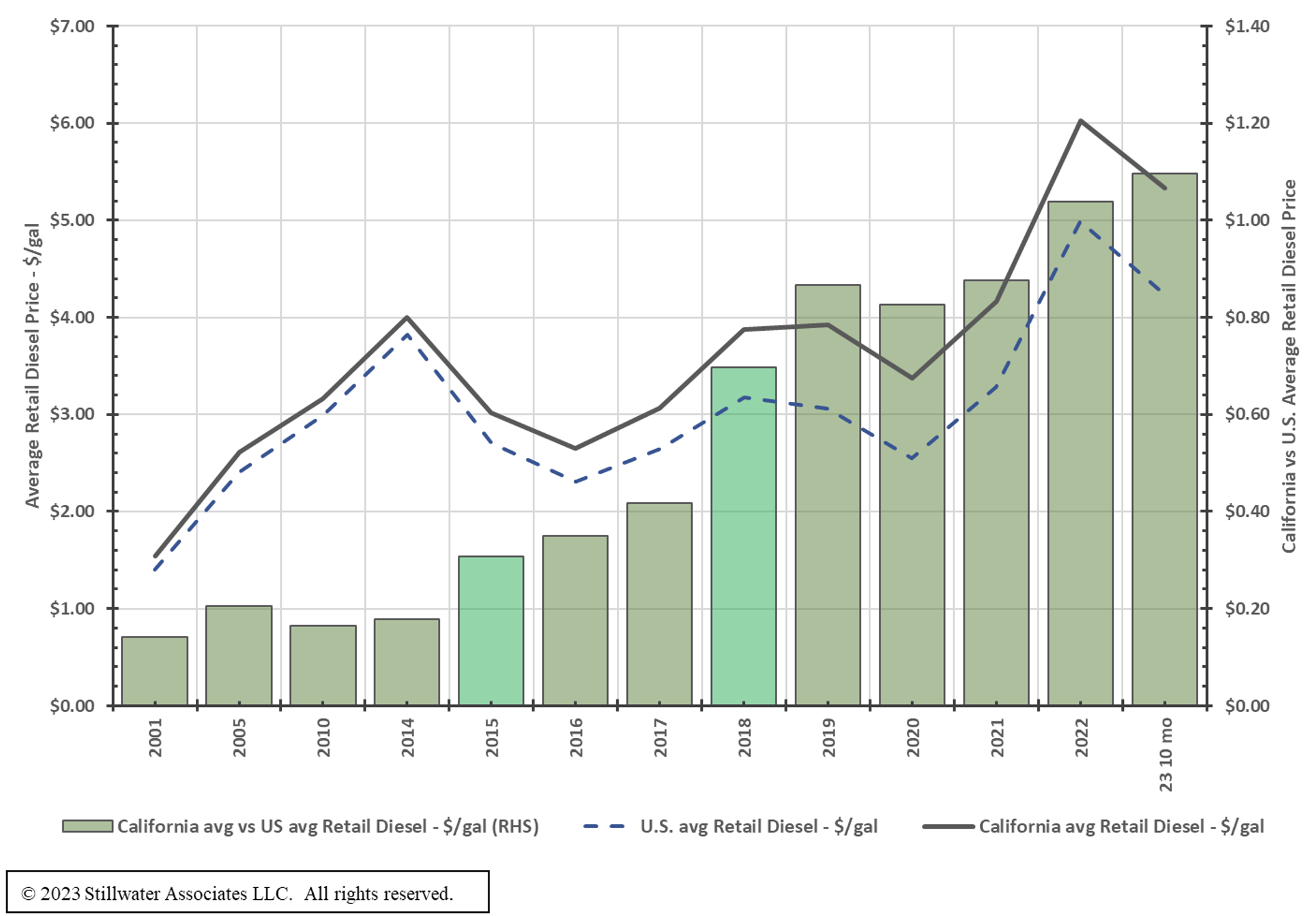

The following two charts show the California gasoline and diesel price differential to the U.S. average over time from 2001 through the first ten months of 2023. The years 2015 and 2018 are highlighted as those are the years that fuels came under the C&T program and the first full year of the SB1 excise tax increases, respectively. The years prior to 2015 are shown to illustrate the relative stability of California retail prices compared to the U.S. average while the upward trend since 2014 is quite evident.

Figure 1. California Average Retail Gasoline Prices vs. U.S. Average Retail Gasoline Prices Regular Grade

source: Energy Information Administration

Figure 2. California Average Retail Diesel Prices vs. U.S. Average Retail Diesel Prices

source: EIA

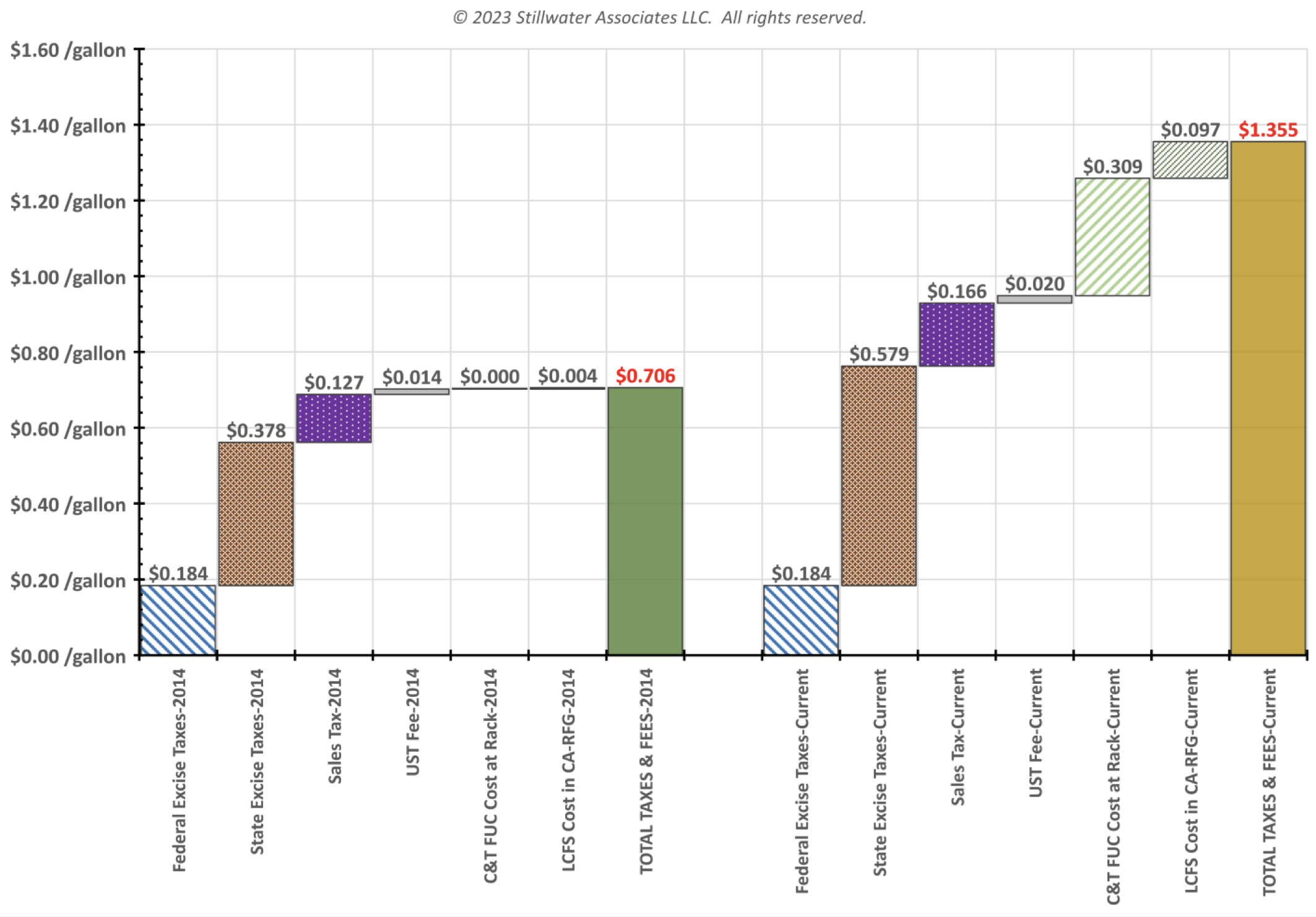

The next two charts break out the tax and fee components of California’s gasoline and diesel fuels in 2014 and today. (Detailed descriptions of each component are provided at the end of this article.) As can be seen in Figure 3, since 2014, excise taxes and the two climate change fees – FUC and LCFS – have jumped, causing an almost doubling of taxes and fees for gasoline (up from 70.6 cpg in 2024 to nearly $1.36 per gallon in 2023).

Figure 3. Components of California Gasoline Taxes and Fees

source: Stillwater analysis

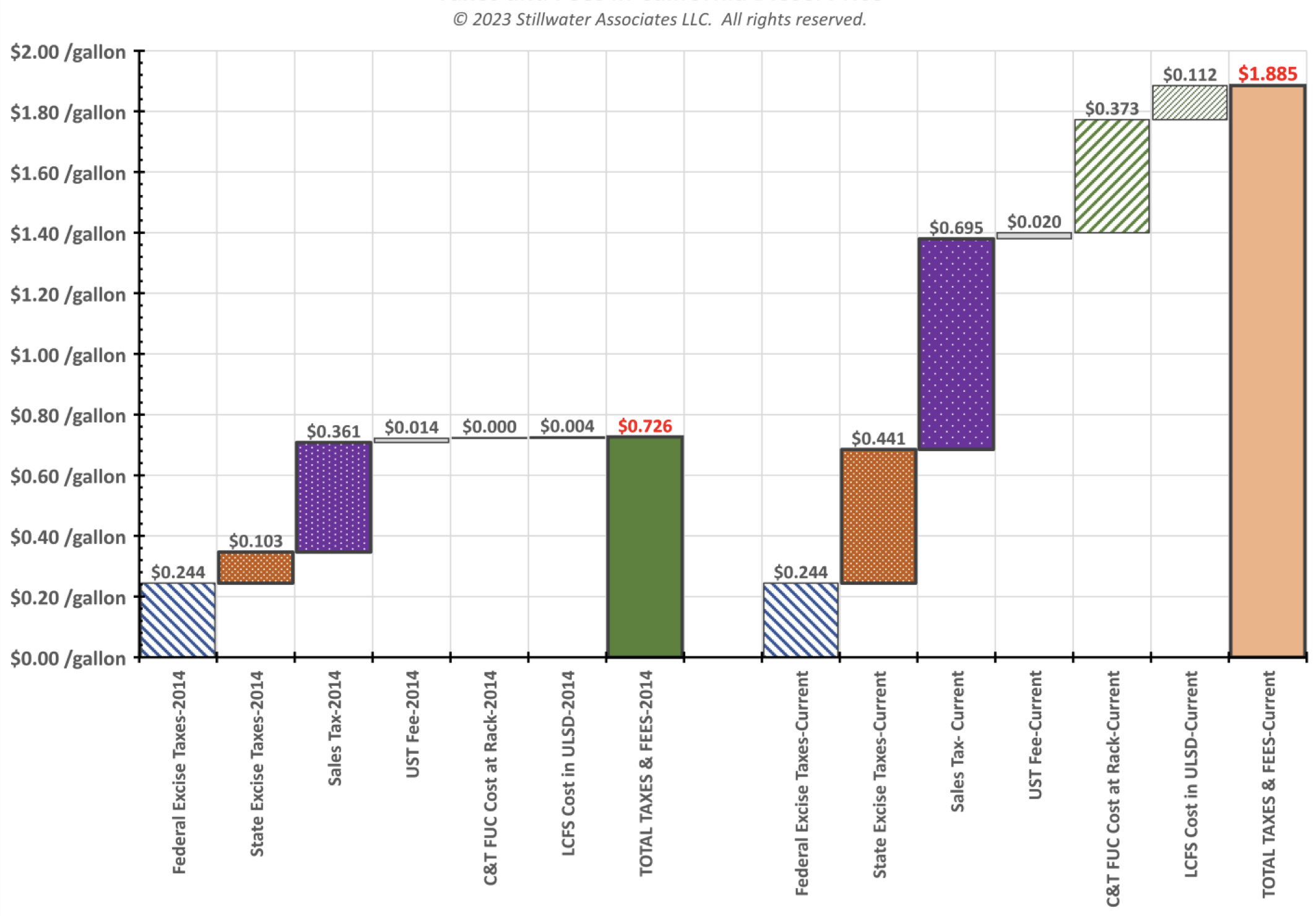

For diesel, Figure 4 shows that taxes and fees have increased more than 250% – from 72.6 cpg in 2014 to nearly $1.89 per gallon – as excise taxes, sales taxes, and climate change fees have increased.

Figure 4. Components of California Diesel Taxes and Fees

source: Stillwater analysis

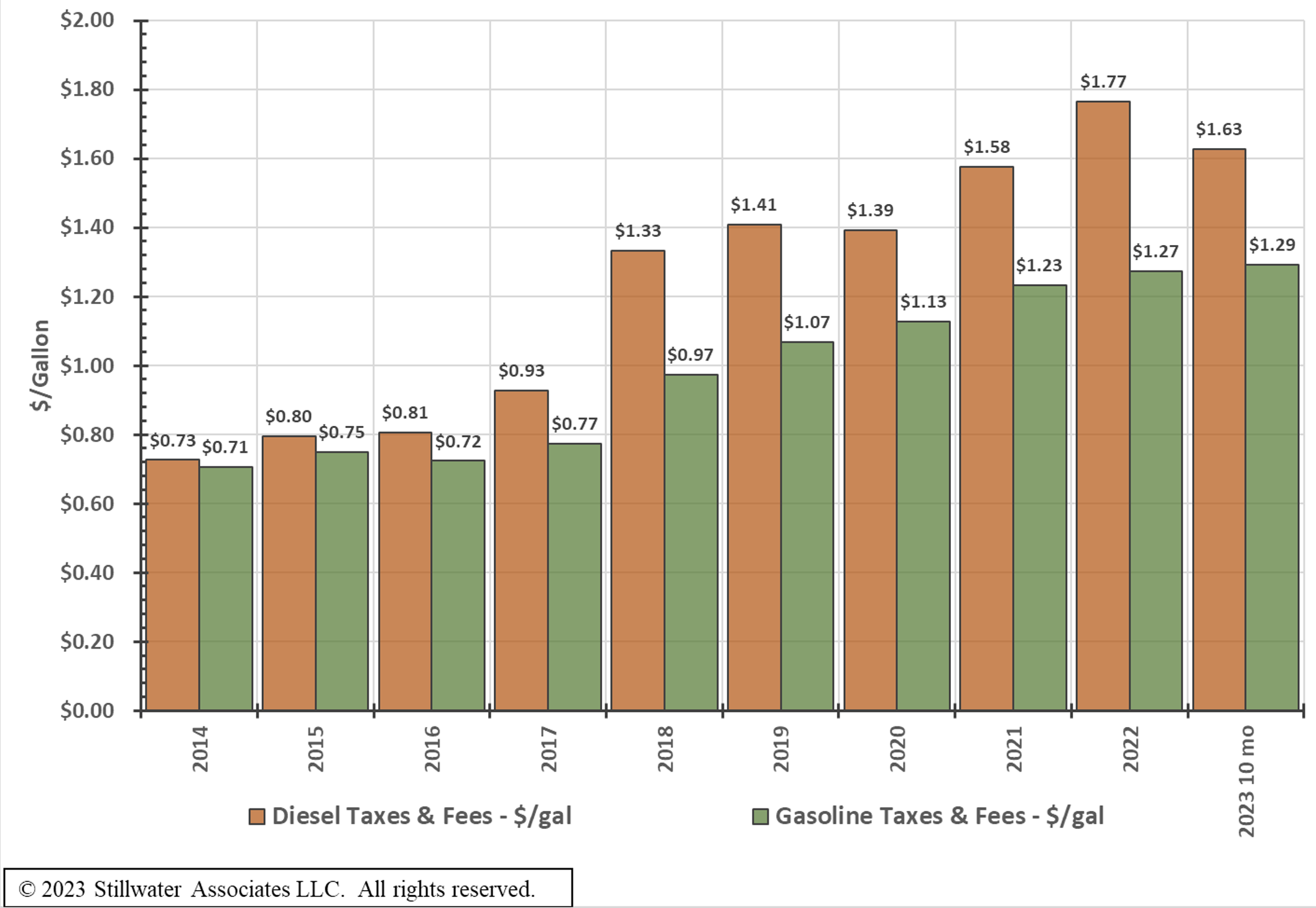

One feature of California’s taxes and fees regime since the implementation of SB1 is that the taxes and fees on diesel have risen relative to gasoline. Figure 5 compares the total taxes and fees on diesel fuel against gasoline since 2014. The plot shows that taxes and fees on diesel fuel jumped relative to gasoline in 2018 after the adoption of SB1.

Figure 5. Taxes and Fees – California Gasoline and Diesel Compared

source: Stillwater analysis

California Taxes and Fees 101: What taxes and fees contribute to the California retail gasoline and diesel fuel price?

The federal excise taxes of 18.40 cpg for gasoline and 24.40 cpg for on-road diesel fuel are the same across all states and have held steady at this level since 1997. State and local taxes and fees levied against on-road gasoline and diesel fuel, however, vary from state to state. According to the American Petroleum Institute (API), as of January 1, 2022, average taxes and fees across the U.S., including the federal excise tax, average 57.09 cpg for gasoline and 64.64 cpg for diesel. For California, API reports that total taxes and fees were 86.55 cpg for gasoline and 124.31 cpg for diesel, but API’s pricing index does not include the “hidden fees” imposed by the California’s GHG regulations such as the LCFS and C&T.

In California, the taxes and fees applied to on-road gasoline and diesel are:

- Federal Excise Tax – This includes a component for the Highway Trust fund and a 0.1 cpg component for the federal Leaking Underground Storage Tank Trust Fund.

- California State Excise Tax – This tax revenue is deposited into the State Transportation Fund. As mentioned above, near the close of 2017, the state legislature passed SB1, the Road Repair and Accountability Act of 2017, which raised the excise taxes on motor fuels effective November 2017 and provided to inflation-adjust the excise tax rate.

- Sales Tax – Sales taxes are applied to the price of on-road gasoline and diesel at a higher rate than general sales taxes. The sales tax rate in any given location includes county, transit, and local sales taxes in addition to the state sales tax. The base rate is 2.25% for gasoline and 13.0% for diesel fuel before the additional local and district tax rates.

- Underground Storage Tank Fee (UST) – UST is used to provide revenue for the state’s Underground Storage Tank Cleanup Fund. The primary purpose of the fund is to provide financial assistance to the owners and operators of USTs to remediate conditions caused by leaks, reimbursement for third-party damage and liability, and assistance in meeting federal financial responsibility requirements. California’s current UST tax rate is 2.0 cpg.

- Fuels Under the Cap (FUC) – This is part of California’s C&T program that requires fuel suppliers to purchase Allowances (basically a license to emit a ton of greenhouse gases (GHG) to offset the GHG from the combustion of the fuel. This fee varies with the price of C&T Allowances and the content of renewable fuel. This provision was applied to gasoline and diesel fuel in 2015.

- Low Carbon Fuel Standard (LCFS) – This program began in 2011 and requires suppliers of high carbon intensity (CI) fuels like petroleum gasoline and diesel to purchase credits from suppliers of low-CI fuels such as ethanol, biodiesel, renewable diesel, renewable natural gas, and electricity. Through 2015, the cost of the LCFS was low, but as the price of credits has increased and the LCFS standards have tightened, the costs have become more significant. This fee varies with the price of LCFS credits and will increase as the annual LCFS standard becomes more stringent.

Stillwater reports weekly on the variable added cost to diesel and gasoline in our LCFS Newsletter.

Be sure to subscribe to keep track of this important California transportation fuel price variable!