Why is the Price of Diesel Higher than Gasoline?

Link to article: https://stillwaterassociates.com/why-is-the-price-of-diesel-higher-than-gasoline/

May 25, 2022

By Leigh Noda

*updated June 16, 2022 with current pricing data.

Stillwater Associates has been queried why the retail price of diesel fuel is higher than gasoline—even higher than the retail price of premium gasoline. “According to AAA, as of June 16, 2022 California average diesel price breached $7 per gallon at $7.002 per gallon while the average regular gasoline price was $6.428 per gallon, and the average premium gasoline price was $6.761 per gallon. Nationwide, AAA had the average diesel price at $5.786 per gallon, regular gasoline at an average of $5.009 per gallon, and premium gasoline at $5.694 per gallon.”

Of course, the rising cost of diesel is of great concern to all of us as diesel is used to deliver critical necessities like food and Amazon packages (just kidding!). The rising cost of fuel can be traced to several factors including but not limited to the Russian invasion of Ukraine, the EU turning away from Russia for its energy supply, a global economy recovering from the pandemic, a post-COVID shortage of refining capacity. The bottom line is that the cost of diesel in the country has gone up 55% since January 1st.

The rise in the overall level of U.S. fuel prices can be seen in the table below.

Table 1. Crude Oil, Gasoline and Diesel Price Changes 2022 To-Date

Source: EIA

Source: EIA

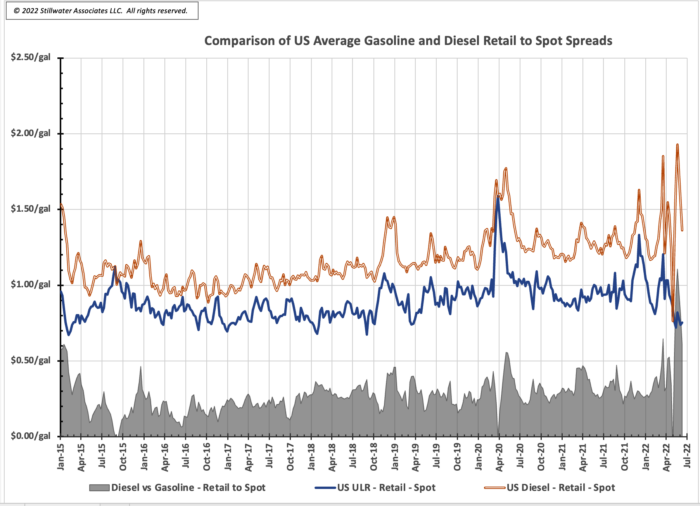

Although the spot or bulk price of gasoline and diesel are near each other, on a nationwide basis diesel is priced more than $1 per gallon higher than gasoline at a retail level. A difference in taxes and fees between gasoline and diesel accounts for a portion of the difference between the retail price of gasoline and diesel. According to the American Petroleum Institute the U.S. weighted average state and federal taxes and fees equal $0.5709 per gallon of gasoline and $0.6464 per gallon of diesel. The rest of the difference is because gasoline margins to the spot price have declined while diesel margins to the spot price have increased since May 13, 2022. The following chart illustrates the history that shows the normal difference between retail diesel and spot diesel, and the difference between retail regular gasoline and spot gasoline as being in the range of 30 cpg. It appears that the most recent data is likely an anomaly in the trend unless it in fact proves to hold over time going forward.

Figure 1. Comparison of U.S. Average Gasoline and Diesel Retail to Spot Spreads

California Diesel Prices driven by Sales Tax

As usual, California has a differential story from the rest of the country. Although the U.S. retail gasoline to diesel price difference is based on difference in spot prices and a difference in the retail to spot spreads, California’s difference can be attributed to unique differences in California’s taxes and fees that are applied to gasoline and diesel. The Low Carbon Fuel Standard (LCFS) and fuels under the cap (FUC), which is part of the Cap & Trade (C&T) regulation, adds to the price of petroleum fuels that sets California prices apart from the rest of the U.S. These programs do have some differential costs between gasoline and diesel that contributes to the retail price differences.

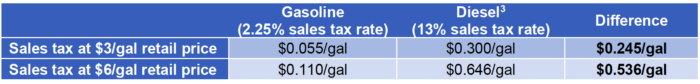

However, the big differentiation in taxes and fees levied on gasoline compared to diesel is the differential sales tax rates. Diesel is assessed a 13.0% state sales tax rate while gasoline is assessed a 2.25% state sales tax rate.[1] Currently, diesel does enjoy a lower 38.9 cpg excise tax than gasoline at 51.1 cpg.[2] But the difference in the excise tax rates is overwhelmed by the difference in sales tax rates when the fuel price is north of $6 per gallon. The feature that sales tax has is that it is a percent of the pre-tax price that will increase as the price of fuel increases. As illustrated in the example below the price level matters as the sales tax difference more than doubles as the retail price doubles. The sample calculations illustrate what the included sales tax is when the retail price is $3.00 per gallon and when it is $6.00 per gallon.

Table 2. Comparison of Sales Taxes for Gasoline and Diesel at Two Retail Prices

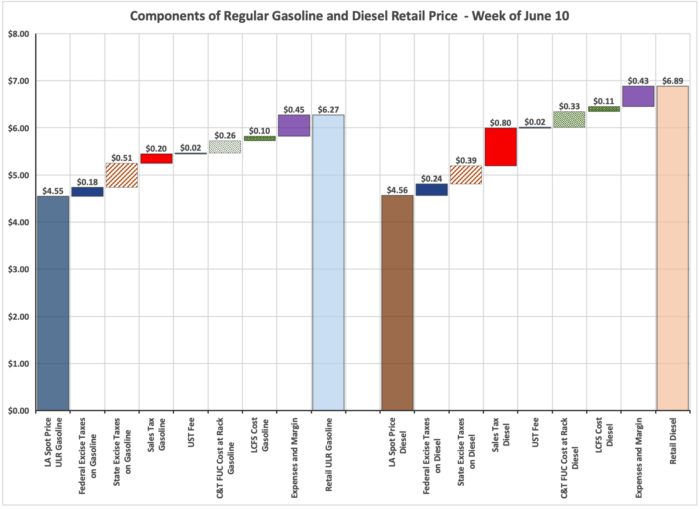

When added to all the other taxes and fees, with the price from the preceding week, a chart illustrates the components of gasoline and diesel retail price with the sales tax highlighted.

Figure 2. Components of Retail Gasoline and Diesel Price

While California’s difference in retail diesel price to retail gasoline price is not out of line with the national prices, the difference in sales tax on each fuel stands out as a difference that does not apparently exist in other states.

__________________________________________

[1] The actual sales tax percentages are increased by local and district sales tax that depend on location.

[2] California excise taxes are scheduled to increase to 41.0 cpg for diesel and 53.9 cpg for gasoline on July 1, 2022.

[3] The sales tax does not apply to the state excise tax of 38.9 cpg.