Trans Mountain Pipeline Expansion Set to Impact West Coast Markets

Link to article: https://stillwaterassociates.com/trans-mountain-pipleine-expansion-set-to-impact-west-coast-markets/

April 9, 2024

By Vaughn Hulleman

Source: https://www.transmountain.com/pipeline-system

After a long, and dramatic history, the Trans Mountain Pipeline expansion project (TMX) is set to enter commercial service on May 1, 2024. The project has been controversial based largely on environmental and stakeholder concerns but has been promoted based on several benefits, the most consistently cited is to provide additional access to Asian markets. Some of the first committed shipments are destined for Asia, but we see the project having impacts across North America’s West Coast, particularly Californian refineries’ crude sourcing.

What is the Project?

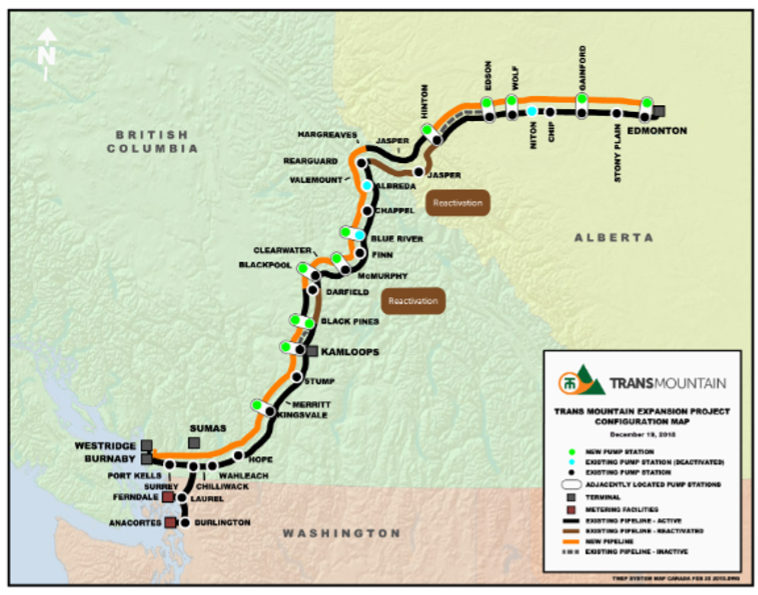

The Trans Mountain Pipeline (TMPL) first became operational in 1953 with a capacity of about 300 thousand barrels per day (kbd). TMPL is North America’s only pipeline that carries both refined product and crude in batches; it is also the only pipeline system transporting oil/products to the west coast of Canada. The pipeline links the oil-producing center of Edmonton, Alberta, to tidewater at Burnaby, B.C. (near Vancouver) with a lateral extension to Washington state refineries.

The expansion project (TMX) follows the existing 1,150-kilometer pipeline (TMPL) and adds about 590 kbd capacity bringing the system to a total of 890 kbd. While the existing pipeline had dual capacity to ship products and crude, historically it has mostly been used to ship light crude. According to the TMPL website, the expansion project will be a crude-only pipeline and “will carry heavier oils with the capability for transporting light crude oils.”

History

The TMX has had a long and dramatic history. Without going through the full details, the history is instructive in understanding that TMX likely will be the last major petroleum pipeline built for Canadian market egress, not because there is not enough Canadian oil production to fill a new pipeline, but because the political and execution risk involved in pipeline projects make it untenable.

TMX was first announced in 2012; at that time, it was competing with three other options – Northern Gateway, Energy East, and Keystone XL projects. The competing projects also were controversial, and eventually all three were denied through regulatory proceedings or political decree. In 2018, with the TMX as the last option standing, Kinder Morgan Canada threatened to scrap the project, and the Canadian Federal government stepped in to purchase the project for C$4.5 billion with construction commencing in 2019.

During the construction period, the project faced challenges related to COVID, global supply chain bottlenecks, severe flooding in British Columbia, and routing changes, eventually bringing the total project cost to over C$30 billion with commissioning over twelve years after the project’s effective start date.

Accessing Asian Markets

Despite cost escalations, proponents maintain TMX’s economic viability. The project is over 80% contracted with the remaining 20% reserved for spot shipments as required by the Canadian regulator.

The viability of the project is in part based on reducing “differentials.” These are the price differences between that received for Canadian crudes compared to others which is driven by differences in quality, transport costs, and market dynamics. Over the past decade, Canadian crude has often been sold at significant discounts based on transportation costs and market dynamics (i.e., beyond quality differences). These should be reduced with the additional transport capacity provided by TMX.

Proponents of the project have consistently cited market access and diversification away from the United States (which takes most Canadian crude – 94% in 2022), as the main benefit of the TMX claiming it “helps ensure Canada gets full value for its oil”. Bloomberg reported that China’s Sinochem will take the first oil cargo from the project, and Stillwater’s analysis of the committed customers supports the view that Asia will take TMX deliveries.

But what about the West Coast?

Contrary to the statements about Asian markets, Stillwater sees TMX also affecting markets along the West Coast of North America.

The base TMPL (300 kbd) is a dual, product-crude capable pipeline, but historically most of the volumes shipped have been Canadian light-crudes. The TMX website explicitly states the purpose of the expansion pipeline is to carry “heavier oils with the capability for transporting light crude oils”.

Despite these facts, it is difficult at this point to speculate how the expansion will affect the balance of shipment-types on the 890 kbd pipeline in the future (product vs. light / heavy oil). However, if we take at face-value the website statements, a lot of heavy oil be delivered to Burnaby, but to which markets?

Certainly, China’s refinery stock (volumes / capabilities) could take the entire expansion volumes of heavy oil, but will it? Bloomberg recently noted that volumes of Canadian heavy are surging in 2024, speculating that it could be “a sign of things to come.” Stillwater sees the 2024 increase in Canadian crude in California is because of specific refinery circumstances instead of some sort of dry-run for TMX volumes.

Nonetheless, California has had a long-standing decline of in-state heavy-oil production which has been offset by imports from the Americas. Netbacks for TMX deliveries to California will be higher than Asian deliveries particularly as the Burnaby terminal for TMX cannot receive takers larger than Aframax.

While the TMPL (300 kbd) has dual capability (products / crude), most of the volumes have been light crude. With the additional crude capacity of the TMX, it is possible that there will be increases in product shipments on TMPL. If this occurred, distillates that are currently being shipped from Washington into British Columbia would be backed out increasing product length on the West Coast.

Conclusion

We see a very likely scenario where heavy oil supplied from the Americas is displaced by TMX-delivered Canadian heavy oil. On a more speculative basis, Canadian products delivered by TMPL will back out Washington state distillates being sold into British Columbia markets.

So much for diversifying away from Unites States markets, eh?