Flash Report: EPA Finalizes RVOs for 2023, 2024, and 2025; Drops Proposed eRIN Provisions

Link to article: https://stillwaterassociates.com/flash-report-epa-finalizes-rvos-for-2023-2024-and-2025-drops-proposed-erin-provisions/

June 23, 2023

On June 21, 2023 EPA released the final “Set Rule” covering RFS RVOs for 2023, 2024, and 2025. Per requirements of the Administrative Procedures Act, this final rule considers issues raised by respondents during the public comment period and in the public hearing which EPA held after release of the proposed rule. This final rule notably omits the e-RIN provisions which were contained in the proposed Set Rule published for comments in December.

This flash report summarizes key items from this rulemaking.

Key Points

- All four of the volume standards were changed based on comments received and further EPA analysis of the markets.

- The percentage standards were adjusted based on the updated volume standards and updated EIA estimates of U.S. gasoline and diesel fuel demand.

- The proposed e-RIN provisions were dropped from the final rule.

- Elimination of Cellulosic Waiver Credits (CWCs) was confirmed.

Annual Volume Standards

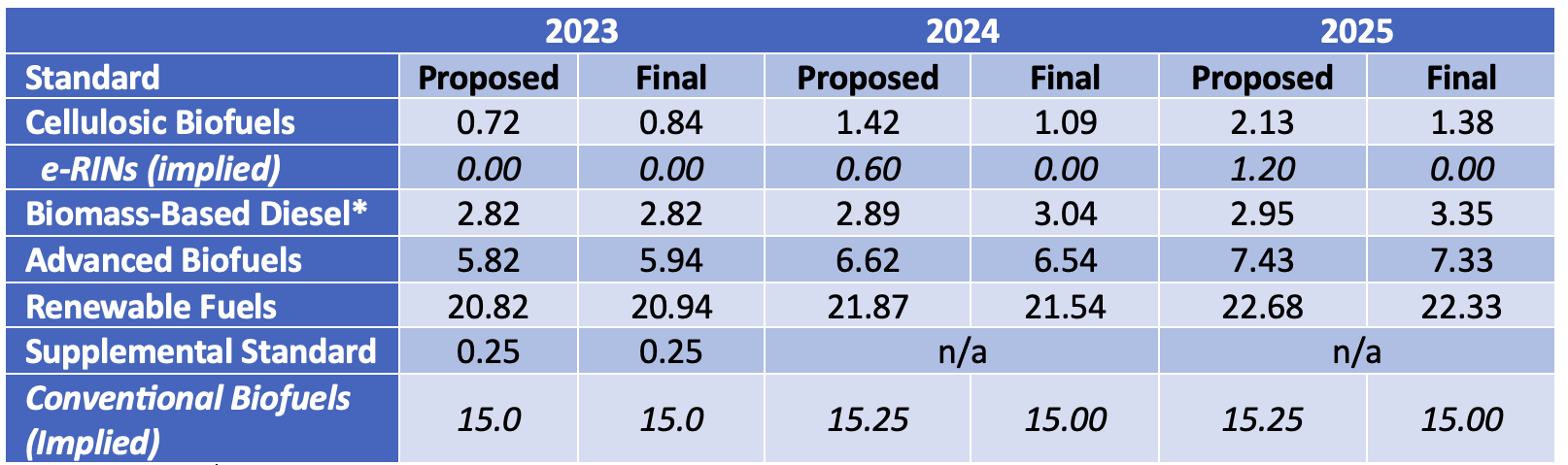

As shown in Table 1 below, the annual volume standards were extensively revised from the original proposal –

- Cellulosic Biofuels – the elimination of the e-RIN provisions was partially offset by higher estimates for RNG.

- Biomass-Based Diesel – in response to extensive industry comments, the volume obligations were increased for 2024 and 2025. This reflects substantial growth in production capacity tempered by concerns over feedstock availability.

- Conventional biofuels – EPA canceled proposed increases in the implied conventional biofuels obligation from 15.0 billion gallons to 15.25 billion gallons in response to industry comments.

Table 1. Annual volume standards (Proposed and Final) (billion RINs)

⃰ billion gallons

⃰ billion gallons

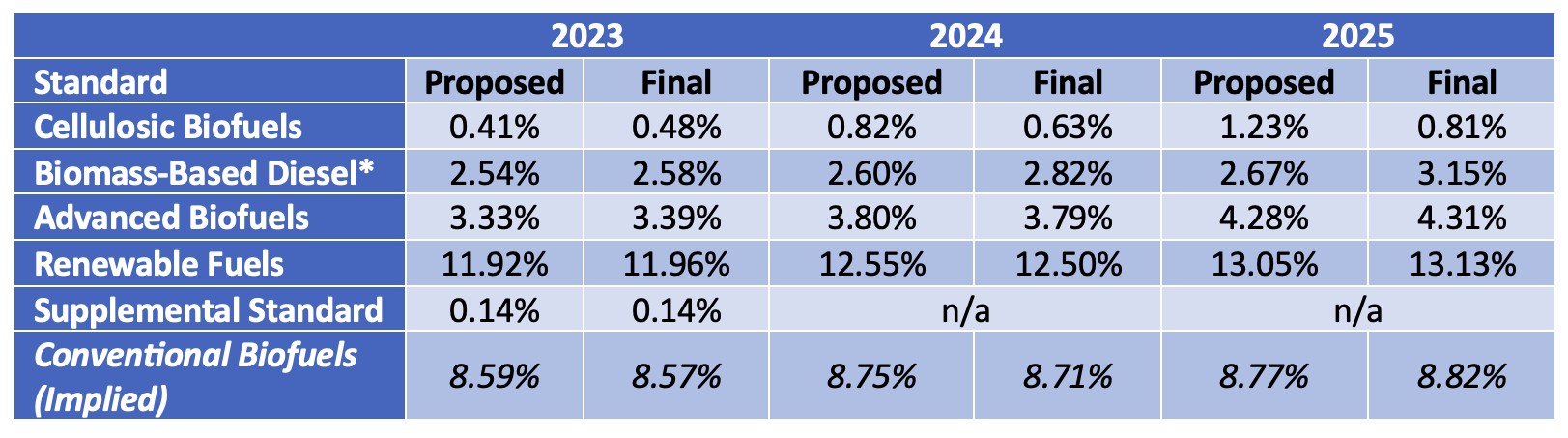

Annual Percentage Standards

These standards, which ultimately determine the compliance requirements for individual obligated parties, are calculated from the volume standards and estimates of U.S. gasoline and diesel demand for each of the covered years (2023, 2024, and 2025) as provided by EIA. Since the release of the proposed standards, EIA’s estimates for U.S. gasoline and demand have been updated, resulting in the final percentage standards presented in Table 2 below.

Table 2. Annual percentage standards (Proposed and Final)

e-RIN Provisions

Provisions for the generation of D3 RINs for the use of biogas or renewable natural gas to produce power for charging EVs (“e-RINs”) as contained in the proposed rule were dropped in the final rule. As the proposed provisions would have constituted a major addition to the program with features and processes very different from the existing RIN generation and separation mechanisms, it is unsurprising that the proposed rule received extensive, substantive comments. As EPA was under a court consent decree to finalize the 2023 volume obligations by June 14th (extended to June 21st at the last minute), they apparently determined that they would be unable to appropriately address the many concerns raised over the e-RIN proposal and elected to drop it from the final rule. Given the high level of support for EVs in the current administration, it is reasonable to expect EPA to continue working on a revised e-RIN program informed by the many comments received – this could happen in a standalone proposal or, more likely, as part of the next RFS Set proposed rule, potentially as early as June of 2024. If this lags until after the November 2024 presidential election, the future for e-RINs becomes much less clear.

CWC Elimination

The final rule confirms the elimination of CWCs. CWCs existed as an alternative compliance mechanism for obligated parties to meet the Cellulosic Biofuels obligation. By statute, EPA has the authority to offer CWCs in years where they reduce the statutory Cellulosic Biofuels volume obligations below statutory levels. As there are no statutory volumes after 2022, EPA determined that offering CWCs was no longer appropriate. The existence of CWCs placed an effective price cap on D3 (Cellulosic) RINs, thus the elimination of CWCs removes this cap, leaving D3 RIN prices highly sensitive to the market’s perception of supply and demand for D3s. It is now unclear how high D3 RIN prices would need to go before EPA feels the need to take action (e.g., implement a waiver of the D3 volumes).

Market Reaction

In the immediate aftermath of the announcement of the final rule, the prices for D3 RINs have jumped to levels not seen since last summer while the prices for D4, D5, and D6 RINs have fallen somewhat. This suggests that the market saw e-RIN generation as likely to exceed EPA’s estimates in the proposed rule and now sees the market as much more tightly balanced with the elimination of e-RINs and slightly higher volume targets for other D3 RIN sources (primarily RNG). The drop in D4 RIN prices suggests that the small increase in D4 obligations combined with the decrease in the 2024 and 2025 implied D6 RIN obligations will leave the market over-supplied in D4 RINs. As D5 and D6 RIN prices are effectively capped by D4 prices, this resulted in a corresponding decrease in the prices of those RINs as well.

Looking for a long-term outlook for RIN prices? We offer a RIN price outlook through 2035. Contact us for more information.