Flash Report – 3Q2023 LCFS Data Show more than 2.2 million MT Net Credits

Link to article: https://stillwaterassociates.com/flash-report-board-meeting-carb-staff-update-on-2023-lcfs-amendment-process-2/

On January 31, 2024 CARB posted the third quarter 2023 data for the LCFS program. In today’s flash report, we offer a quick look at this third quarter data. Our comprehensive analysis will be published in Stillwater’s Quarterly LCFS Newsletter which will be available to subscribers on Thursday, February 15th.

The third quarter data show a net credit of 2,249,236 metric tons (MT), an increase of 650,177 MT from the second quarter net credit of 1,599,059 MT. With the 3Q2023 net credit, the credit bank now stands at a record 20.6 million MT.

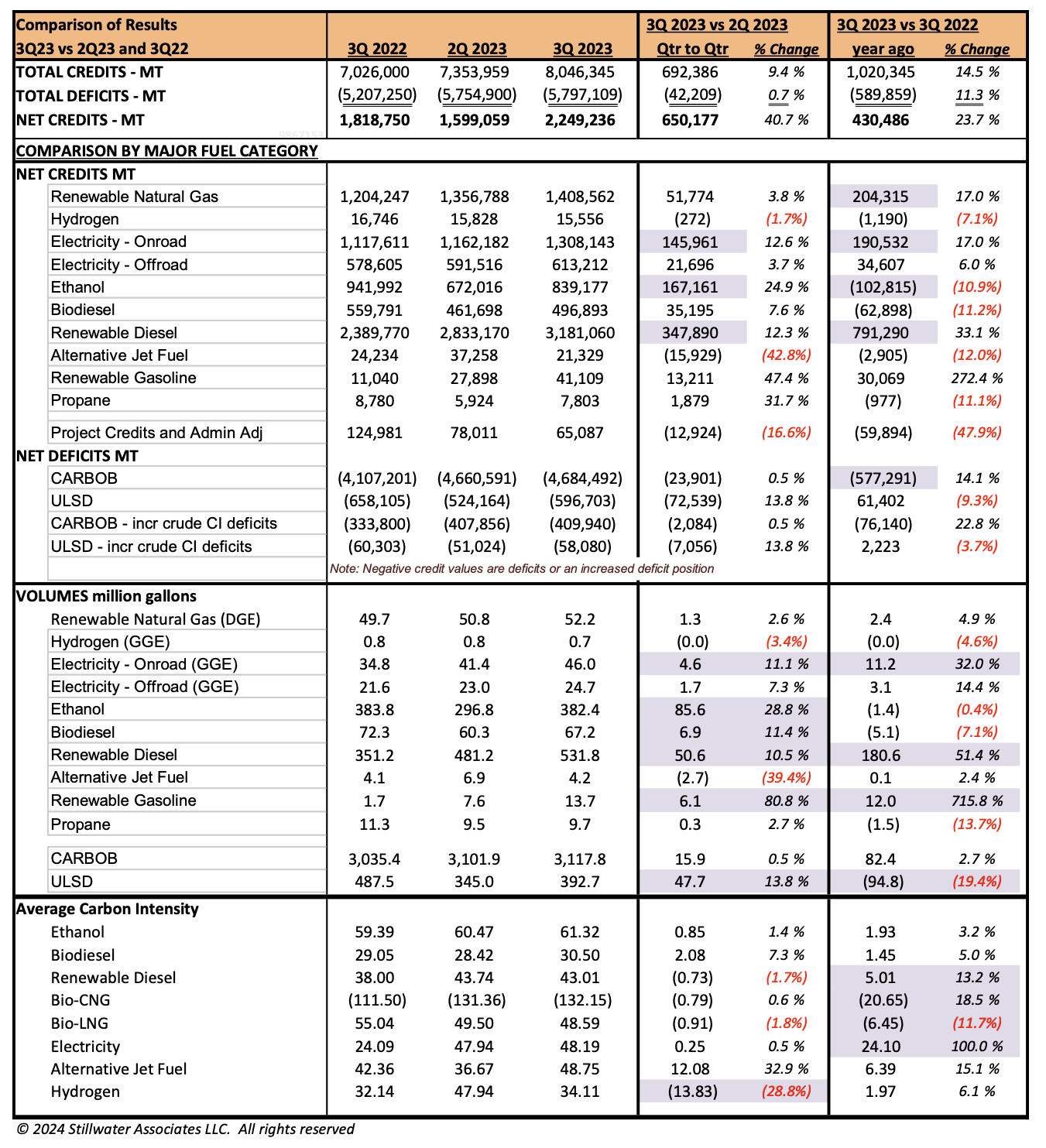

The table below summarizes the third quarter by fuel and compares it to the previous quarter (2Q2023) and to the same quarter last year (3Q2022).

A quick look at these data shows a few trends of interest. The major factors contributing to the increase in net credit in the third quarter compared to the second quarter were: large increases in net credits for renewable diesel (RD), ethanol, and on-road electricity. These increases in net credits were offset somewhat by smaller increases in CARBOB and ULSD deficits. Compared to the second quarter, 3Q2023 showed a 12.6% increase in RD credits on a 10.5% volume increase, a 24.9% increase in ethanol credits on a 28.8% volume increase, and a 12.6% increase in on-road electricity credits on a 11.1% volume increase. Net credits for RNG were up a small 3.8% on a 2.6% volume increase. BD showed a 7.6% increase in net credits on a volume increase of 11.4% compared to 2Q2023. Net credits for alternative jet fuel decreased 42.8% on a 39.4% volume decrease. CARBOB deficits increased by only 0.5% on a similar increase in volume. ULSD deficits and volumes increased 13.8% from 2Q2023. Of note: the total liquid diesel volume (including all ULSD, RD, and BD) was up 11.9%.

The total net credit for the third quarter was up 0.65 million MT from the prior quarter and marked a 0.4 million MT increase compared to a year earlier (3Q2022). Together, RNG, on-road electricity, and RD played the biggest roles in the year-on-year increase in net credits.

We will provide an in-depth analysis of this data in our upcoming quarterly newsletter, to be published on February 15, 2024. Access to Stillwater’s LCFS Newsletter is only available to subscribers. For more detailed information on LCFS data trends and analysis, be sure to subscribe!

What does this quarterly data mean for Credit Prices?

Stillwater offers a full suite of credit price outlooks offering our view of the California Low Carbon Fuel Standard (LCFS), Oregon Clean Fuels Program (CFP), British Columbia LCFS (BC-LCFS) and U.S. Renewable Fuel Standard (RFS) markets through 2035. These outlooks are offered through our consulting practice, and each outlook comes with a one-hour, one-on-one Q&A session with our senior subject matter experts!

To learn more, reply to this e-mail or set a time to chat with us using this Microsoft Booking link.

Categories: News