What Happened to California’s Cap-and-Trade Gasoline Price Hike?

Link to article: https://stillwaterassociates.com/what-happened-to-californias-cap-and-trade-gasoline-price-hike/

January 19, 2015

Oil industry observers, including the Downstream Wizard, predicted that California retail gasoline prices would go up around New Year’s Day as transportation fuels would come under California’s Cap-and-Trade regulation. At current prices for carbon, Covered Entities like refiners and marketers who pay the tax on fuels, should be passing through about 10 cents per gallon (cpg) for gasoline and 12 cpg for diesel.

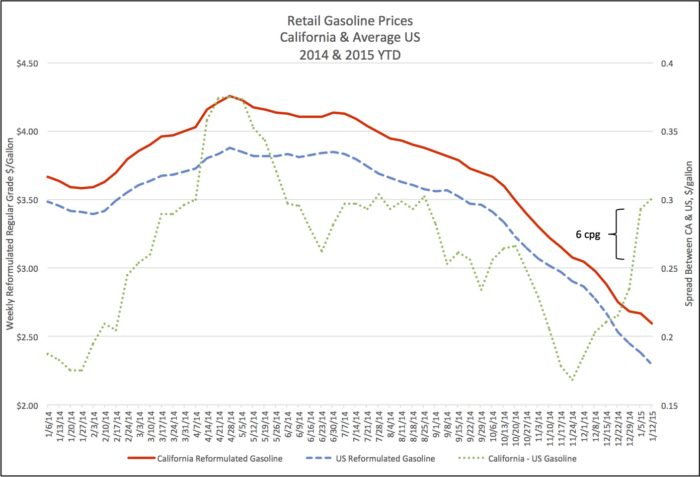

Looking at weekly retail reformulated gasoline price data from the EIA for the last year, you can see that gasoline prices peaked in late April at about $4.25 per gallon and have headed steadily downward since the end of July. The only blip on the California price line is on January 5th, when retail gasoline prices hardly changed from the prior week. Average U.S. gasoline prices continued down that week. You can see the 6 cpg increase between California and U.S. average prices with the green dotted line. The downward trend resumed with the data on January 12th.

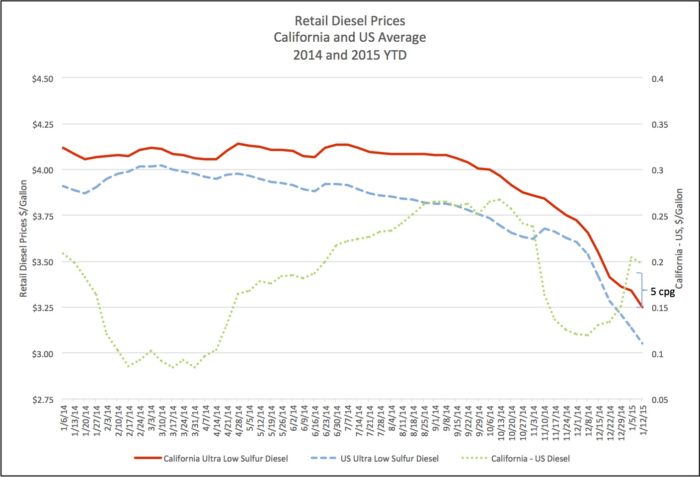

The retail diesel price history has a similar shape. Diesel prices have been in decline since the summer as well. The California diesel price reduction flattened out with the January 5th report and the spread between California and the U.S. average increased by about 5 cpg.

We can see about a 6 cpg impact on retail gasoline prices and about 5 cpg on diesel. It seems that Covered Entities are not able to recover their cost of compliance. This may be because January is a low demand month. Additionally, gasoline supply is abundant because it is produced to the easy-to-make winter specification.

Southern California will transition to summer gasoline in early February, which is likely to create an uptick in retail gasoline prices. The direction of gasoline prices from there will depend on crude oil prices and the regional gasoline supply/demand balance.

This analysis begs the question: Why are California’s retail fuel prices higher than the national average? Furthermore, why does retail gasoline price average about 26 cpg more than the U.S. average but diesel only averages 18 cpg above the national average?

Tags: gas prices, White PaperCategories: White Papers