So Long BTC, Hello CFPC

Link to article: https://stillwaterassociates.com/so-long-btc-hello-cfpc/

November 7, 2022

Background

The recently enacted federal Inflation Reduction Act (IRA)(1) includes the sunsetting of the Biomass-Based Diesel Blenders Tax Credit (BTC) at the end of 2024 and replaces it with the Section 45Z Clean Fuel Production Tax Credit (CFPC) defined in Section 13704 of the IRA. We have previously described how this new credit will work with Sustainable Aviation Fuel (SAF). In this article, we focus on how it will work with other fuels, most particularly biodiesel (BD). Before this happens, the IRS will need to publish regulations and guidance on how they will implement this new tax provision. This document is based on the language in statute and interpretation of the IRS’s approach to similar issues in other regulations.

The CFPC has several key differences from the BTC which it replaces:

- The credit is earned by the producer of the qualifying fuel rather than the blender. This would be expected to impact how contracts need to be structured to enable the sharing of this value between seller and buyer of the fuel.

- The credit is available to any transportation fuel (generally defined as fuels “suitable for use in a highway vehicle or aircraft”) rather than limited to biofuels used as a substitute for diesel or jet fuel. The “suitable for use” reflects the fact that the credit is earned by the producer, who is often unaware of the ultimate disposition of the fuel, rather than the blender, who is expected to know the ultimate disposition. With this definition, the credit is potentially applicable to ethanol, renewable natural gas (RNG), hydrogen, etc. in addition to renewable diesel (RD), biodiesel (BD), and sustainable aviation fuel (SAF).

- The credit can only be earned for production of fuels in the U.S. Thus, imported RD and SAF from Neste-Singapore is not eligible. However, the fuel does not need to be used in the U.S.

- The amount of the per gallon credit is calculated from the “emissions rate” of the fuel measured in kilograms of CO2 equivalents per million BTU (kgCO2e/mmBTU).(2) For non-aviation fuel, this is to be determined using the current version of the GREET model, developed and published by Argonne National Laboratory.

- The IRS will annually publish a table of emission rates for each applicable fuel. Presumably this will result in a single value for each combination of fuel type (i.e., BD, RD, SAF, etc.) and feedstock (e.g., soybean oil, used cooking oil, tallow, etc.) rather than plant-specific values for each registered facility.

- The same fuel cannot earn both the 45Z PTC and the 45Q carbon capture and storage (CCS) credit.

The following section reviews the calculation of the tax credit based on the emissions rate.

- Calculation of the Tax Credit

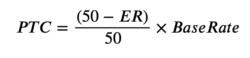

For each eligible fuel, the amount of the tax credit is calculated by the following equation –

Where –

Where –

PTC = The amount of the per gallon tax credit ($/gal), rounded to the nearest penny;

50 = The maximum emissions rate to be eligible to collect the PTC (kgCO2e/mmBTU), this value is specified in the statute;

ER = The emissions rate (kgCO2e/mmBTU), rounded to the nearest multiple of 5 kgCO2e/mmBTU ;

BaseRate = The base tax credit. This is initially established as $1.75/gal for aviation fuel and

$1.00/gal for all other fuels in 2022 dollars. This value is adjusted annually for inflation (presumably using annual-average CPI). The base rate is divided by a factor of five for any facilities which fail to meet the statutory requirements for prevailing wages and apprenticeships.

The term (50-ER)/50 is referred to as the “emissions factor” (EF).

Key implications of this equation –

- Fuels with an emissions rate greater than 50 kgCO2e/mmBTU do not earn any CFPC

- A fuel needs an emissions rate of 0 kgCO2e/mmBTU to earn the nominal CFPC

- A credit higher than the base value can be earned by fuel pathways with a negative emissions rate.

Until the IRS publishes regulations and guidance on how they will implement the 45Z CFPC, it is not possible to do an exact calculation of the potential CFPC. While the statute specifies use of the GREET model, use of the model will require a number of assumptions; it is likely that the IRS will consult with EPA on how best to approach this calculation as they don’t have in-house expertise in this analysis. They may also seek input from other qualified parties as part of the rulemaking process.

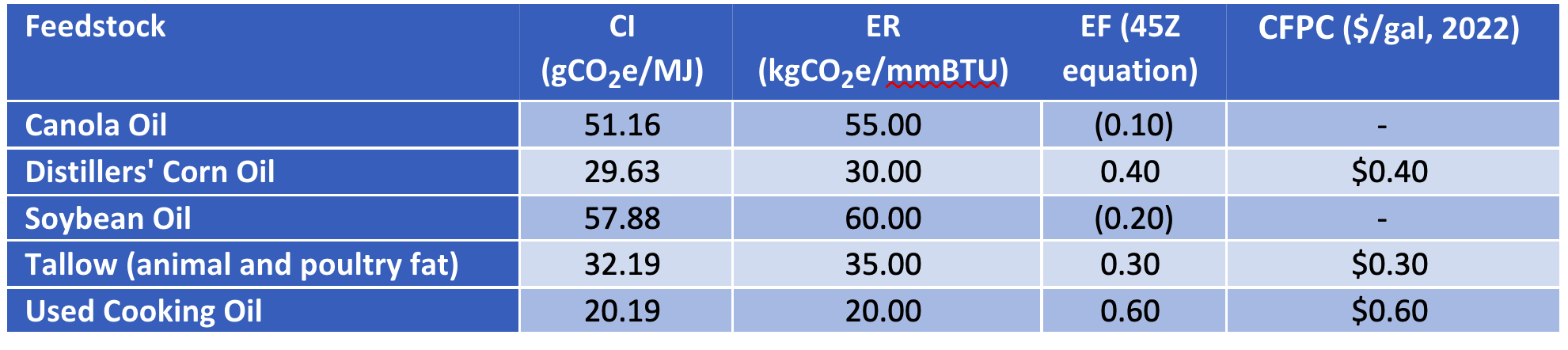

For purposes of illustration, we can estimate the expected emissions rate for BD produced from different feedstocks using CARB’s average LCFS CI’s, converting the units, and rounding the ER to the nearest 5 kgCO2e/mmBTU. These estimates are provided in the following table. The actual values will depend on the details of IRS’s interpretation of statute and assumptions for their use of the GREET model.

A key conclusion is that few forms of BD are likely to earn the full $1.00/gal nominal credit, particularly as supplies of the lowest carbon feedstocks, such as distillers corn oil, tallow, and used cooking oil are likely to be limited. The net result is that BD producers and blenders will receive a significantly lower incentive than they currently receive under the current BTC regime. This impact, however, may be offset by higher D4 RIN values as the price of these credits considers the value of the BTC.

BTC, CFPC, or other letters of the transportation fuels alphabet? If you have questions, we can work with you to find the answers. Please reach out to us.

(1)PL 117-169

(2) Note that these are different units than the Carbon Intensities (CI), measured in grams of CO2 equivalent per Megajoule (gCO2e/MJ) in the California LCFS and other similar programs.