Rebalancing Refinery Jet Production for Covid-19 – How Low Can You Go?

Link to article: https://stillwaterassociates.com/rebalancing-refinery-jet-production-for-covid-19-how-low-can-you-go/

April 14, 2020

By Adam Schubert

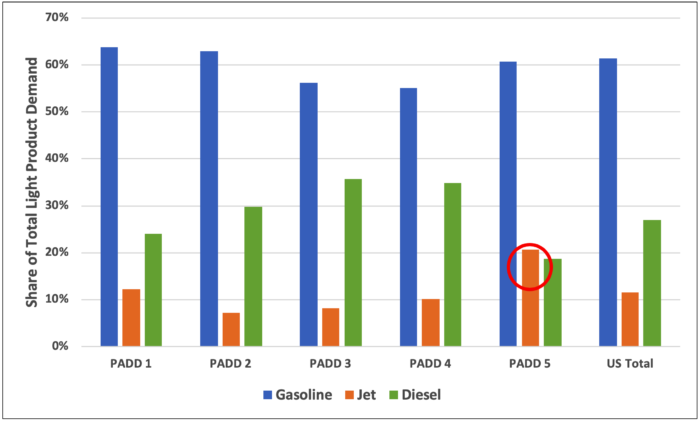

For U.S. refiners, profitability is tightly linked to production of the three major “light” petroleum fuel products – gasoline, diesel, and jet fuel. Individual refineries are typically configured to optimize the yield of these three products with the most economical crudes available in their region and demand in accessible markets. Relative demand for the three products varies regionally within the U.S. as can be observed in 2019 market demand data by Petroleum Administration for Defense District (PADD) as compiled by the U.S. Energy Information Administration (EIA) and illustrated in Figure 1.

Figure 1. U.S. Light Product Demand Mix for 2019

Sources: EIA data and Stillwater analysis

As illustrated above, the light products demand for the U.S. as a whole in 2019 was 9,274 KBD (or thousand barrels per day) of gasoline, 1,740 KBD of jet, and 4,083 KBD of diesel (61% gasoline, 12% jet, and 27% diesel). The percentage of jet in this mix, however, varies from 7% in the Midwest (PADD 2) to 21% on the West Coast (PADD 5). The high share of jet in the PADD 5 mix is due to the high demand for trans-Pacific air transport (both passenger and freight), the high volume of domestic coast-to-coast air travel and a large share of military demand.

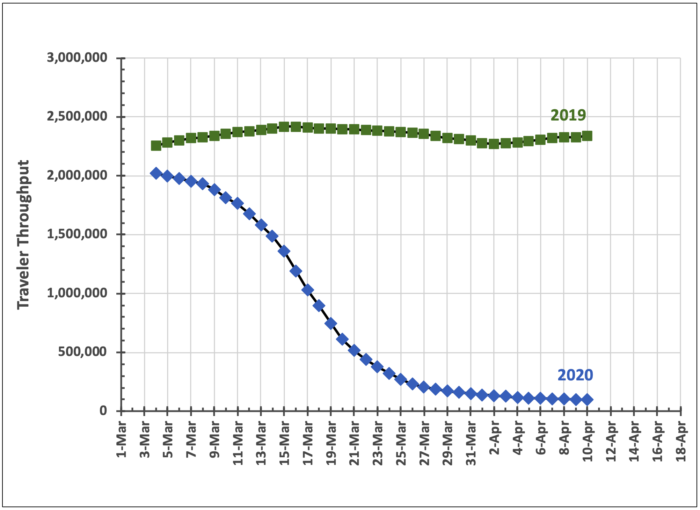

The impacts of COVID-19 on U.S. transportation fuel demand are massive, with declines greater than 40% for gasoline and 20% for diesel shown in the latest EIA data. Demand for jet fuel has declined by more than 70% according to EIA data, and U.S. Transportation Security Administration (TSA) data on the number of passenger screenings conducted each day match that sharp decline. These data from TSA, presented as seven-day moving averages to smooth out day-of-the-week effects, are presented in Figure 2 below.

Figure 2. TSA Checkpoint Traveler Numbers – 2019 vs. 2020

Sources: TSA data and Stillwater analysis

In addition to the substantial losses in revenue attributable to the decreased demand across all three light products, refiners are challenged with not only reducing operations to match current demand but also to substantially changing their operations to adjust to the different impact on each product. A further challenge going forward is that demand for each of these products can be expected to recover at differing paces.

- Diesel – Demand for diesel has experienced the least impact as much of the demand is for transport of goods for which demand has been minimally impacted by the virus. Much of the lost diesel demand is likely due to reduced need to transport raw materials and intermediate goods while many factories are shut down. This demand is expected to recover as businesses re-open and manufacturing recovers.

- Gasoline – Demand for gasoline has been strongly impacted as most of the population is under some form of stay-at-home order. Such orders have greatly limited automobile travel for commuting, shopping, and recreation. This demand can be expected to recover relatively quickly once stay-at-home restrictions begin phasing out.

- Jet – Demand for jet has been substantially hit due to the near elimination of both business and vacation travel. This demand may be the slowest to recover as resumption of both business and vacation travel can be expected to lag economic recovery, and bans on a large portion of international travel may phase out very slowly.

So, What’s a Refiner to Do?

While refineries generally have some ability to vary their mix of gasoline, jet, and diesel, the current circumstances go well beyond the flexibility of most refineries. Many refineries on the Gulf Coast and West Coast will try to shift a significant portion of their production into export markets, but the pandemic’s global nature has resulted in greatly reduced demand in export markets as well. Perhaps the closest analogy to the current situation is the aftermath of the 9/11 attacks in 2001 when all civilian air traffic was grounded. A key difference between that circumstance and now is that 9/11 had a much smaller impact on gasoline and diesel demand, and air travel resumed quickly enough that refiners were able to ramp down their jet production before they ran out of storage capacity. By contrast, the steep coronavirus-induced decline in jet fuel demand is expected to persist for a much longer period of time. Given the magnitude of the changes required, refiners can be expected to make required adjustments in a stepwise manner to assure that they continue to operate safely while continuously meeting required specifications on all products.

Understanding the tools refiners have to vary their jet yield requires a basic understanding of how the composition of jet fuel compares to that of gasoline and diesel. Most simply, each fuel is a complex mixture of hydrocarbons over a range of volatilities. Gasoline is the most volatile of the three products and diesel the least volatile. Jet fuel is intermediate in volatility with the more volatile components of jet being usable in gasoline and the less volatile components of jet being usable in diesel. The largest source of jet fuel within a refinery is the kerosene produced at the crude distillation unit (CDU). Refineries with hydrocrackers also commonly produce some jet fuel from that unit. Finally, refineries with cokers produce a material which, after hydrotreating, can also be utilized in jet fuel. All three of these processes allow some variation in jet fuel yield through adjustments in their distillation processes (often referred to as changing the cut points). In addition, the operation of hydrocrackers can be very flexible in terms of both feedstocks employed and cracking conditions, and these variables can provide options for changing the mix of gasoline, jet, and diesel produced as well.

The extent to which any of these processing adjustments can be deployed is dependent upon not only the design of the process unit but also the impacts that these adjustments have on the quality of the products produced. Typically, the following quality parameters can limit the degree to which the refiner can use process changes to vary the product mix.

- Gasoline – The material which can potentially be shifted from jet to gasoline will be higher-boiling (less volatile) than the rest of the gasoline, potentially impacting compliance with the 90% and endpoint distillation specifications, particularly during summer months. The additional material, together with the refinery’s regular heavy naphtha stream, will need to be processed through the naphtha reformers to remove sulfur and raise its octane to acceptable levels. The reforming process increases the aromatic content, and this may also be a limiting specification.

- Diesel – The material which can potentially be shifted from jet to diesel will be lower-boiling (more volatile) than the rest of the diesel pool, potentially causing an adverse impact on flash point, a key safety specification. Additionally, this material is often lower in cetane, also a limiting specification (especially for California diesel which typically has a higher cetane number requirement). Additionally, the jet fuel sulfur specification is much less stringent than that for diesel fuel; accordingly, the refiner must have capacity in its diesel hydrotreater to process the additional material.

- Jet – When aiming to significantly reduce the refinery’s yield of jet fuel, it is necessary to move both “light” jet into gasoline and “heavy” jet into diesel in a proportional manner in order to assure that the remaining jet fuel remains on spec. Diversion of a disproportionate amount of jet into the gasoline pool can result in the remaining jet being constrained by maximum aromatics, final boiling point, or freezing point specifications. Conversely, diversion of a disproportionate amount of jet into the diesel pool can result in the remaining jet being constrained by minimum flash point or density specifications.

All of the complexity of maintaining product specifications can be further compounded by refiners adapting to additional constraints of operating units at their minimum rates as a way to limit overall production. Collectively, these operations represent corners of the operating envelopes where most refiners have limited experience and where their models may not be well-calibrated. As a result, they will seek to transition gradually, learning as they go. Overall, maintaining safe operations and keeping all products continuously on spec are the overriding concerns.

Have additional questions on this material or looking for analysis specific to your circumstances? Contact us!

Tags: coronavirus, COVID-19, jet fuel