Greening Oregon’s Diesel Pool: Biodiesel and Renewable Diesel Supply

Link to article: https://stillwaterassociates.com/greening-oregons-diesel-pool-biodiesel-and-renewable-diesel-supply/

February 22, 2023. Updated on February 24, 2023 with the latest Oregon CFP quarterly data.

by Megan Boutwell

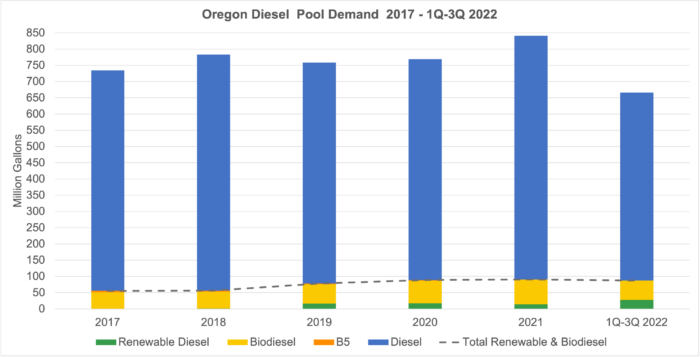

Since the start of the Clean Fuels Program (CFP), the share of renewables in Oregon’s diesel pool has grown. As can be seen in the figure below, biodiesel (BD) is the dominant renewable fuel in the diesel pool.

Source: Oregon DEQ

We don’t have the full year of data for 2022, but in 2021 the total Oregon diesel volume, including BD, renewable diesel (RD), and a small amount of B5 (petroleum diesel blended with 5% BD) was 841.5 million gallons (mg) or 54.9 thousand barrels per day (kbd). Total 2021 diesel volumes have risen 13% since 2017. Total 2021 BD volumes were 76.6 mg (5 kbd), an increase of 33% from 2017. Total 2021 RD volumes were 14 mg (0.9 kbd). This represents a 98% increase from 2017. In 2021 BD and RD made up 11% of the total diesel pool, with BD making up 9% and RD making up 2%. Based on data through 3Q 2022, BD/RD made up 14% of the diesel pool: 10% BD with 59 mg (4.2 kbd) and 4% RD with 28 mg (2.4 kbd).

Oregon relies on out-of-state supply for biodiesel

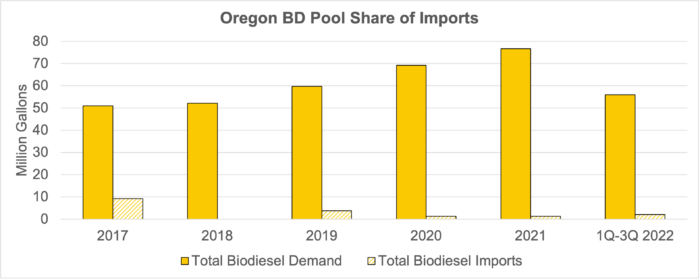

Most of Oregon’s biodiesel supply is produced in the U.S. but outside the state with volumes delivered via rail from production centers in the Midwest, with smaller volumes arriving from the REG facility in Grey’s Harbor, WA.

Oregon also receives small volumes of BD imports from Canada and South Korea. The figure below shows BD volume in Oregon growing since 2017 while imports from outside the U.S. remain a small percentage of total volume.

Source: Oregon DEQ, EIA

Oregon is losing in-state BD production capacity

Oregon has one BD production facility, the 17 million gallon per year (1.1 kbd) SeQuential biodiesel plant in Salem. However, Crimson Renewable Energy which owns the plant recently sold its used cooking oil (UCO) collection and aggregation business and related assets, including the SeQuential production facility, to Neste. UCO is a valuable low-carbon feedstock for both BD and RD. Because Neste does not produce BD, the company plans to close the Salem BD production facility and keep the valuable UCO collection and aggregation business to fulfill their RD feedstock needs. Most of the UCO is expected to be shipped to RD production facilities in California, particularly the Neste-Marathon joint venture Martinez refinery which is currently being converted to RD production.

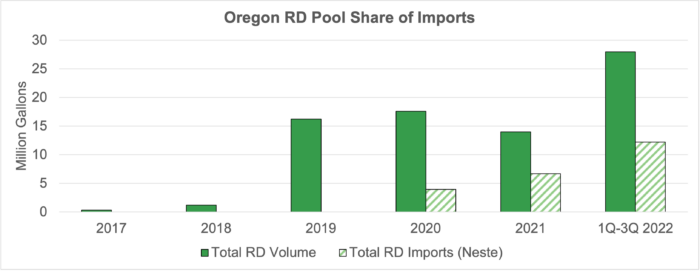

Oregon RD supply is a mix of U.S. produced and imported volumes

Currently all of Oregon’s RD supply comes from outside the state, with the majority delivered from production facilities like BP’s Cherry Point refinery – which co-processes RD with petroleum diesel – and dedicated RD facilities in North Dakota (Marathon) and Wyoming (HF Sinclair). Volumes from North Dakota and Wyoming are delivered via rail. U.S. production facilities in the Gulf Coast and California direct most of their production to the California market. Oregon also relies on RD imports from Neste’s Singapore facility. The figure below shows Oregon began importing volumes from Neste in 2020 totaling 3.9 mg (0.3 kbd) or 22% of the state’s total RD volume. In the first three quarters of 2022 Oregon imported 12.2 mg (1.1 kbd) from Neste, 44% of the state’s total RD volume in that time period.

Source: Oregon DEQ, EIA

U.S. RD production capacity is on the rise and directed at LCFS jurisdictions

Programs like clean fuels standards and cap & trade programs in California, Oregon, and Washington, along with the federal renewable fuel standard (RFS), current tax incentives like the biomass-based diesel blenders tax credit (BTC), and new tax incentives in the Inflation Reduction Act of 2022 (IRA) are driving investment in new RD production. While BD also qualifies for these incentives, production capacity and supply is unlikely to increase much beyond current volumes because BD producers must compete with RD producers for feedstocks and, in most cases, BD’s blend rate with petroleum diesel is limited. In contrast RD, is a low-carbon drop-in fuel that can be blended at any level and is fully compatible with existing diesel vehicles and infrastructure.[1] According to the Energy Information Administration (EIA), U.S. RD production surpassed BD production starting in November 2022.

Based on publicly announced projects, by 2025 total U.S. production capacity may be as high as 7,865 mgy (513 kbd). This includes the possible 767 mgy (50 kbd) NEXT Renewables production facility planned in Clatskanie, OR. However, some of this announced capacity may be challenged due to competition for expensive low-carbon feedstocks and delayed production start-up. The EIA estimates actual U.S. production capacity in 2025 could reach 5,900 mgy (384 kbd).

The CFPC creates a barrier to imports and co-processed volumes

Neste’s Singapore refinery has been an early and primary supplier of RD to California and Oregon, supplying 241 mg (16.7 kbd) to both states in 2022 (through November). However, because of “Made in the U.S.A” provisions in the IRA’s Clean Fuels Production Tax Credit (CFPC), which begins in 2025, imports from Neste will be disadvantaged compared to U.S.-produced volumes. Also, volumes of co-processed RD do not qualify for the CFPC. Because foreign and co-processed volumes are disadvantaged under the CFPC, the outlook for supply to Oregon after 2025 may not include imports from Neste or volumes from the BP Cherry Point, WA refinery.

Oregon’s demand for RD is expected to increase

The Oregon Department of Environmental Quality’s (DEQ) 2023 Clean Fuels Forecast estimates that RD volumes will grow from 19.3 mg (2.5 kbd) in the first half of 2022 to 27 mg (1.8 kbd) in 2023. While Oregon has struggled to maintain consistent supply of RD in the early years of the CFP, several factors are in place now to increase demand which may lead to a steadier increase in supply by 2025. These include:

- Increase in CFP carbon intensity (CI) reduction standard to 10%, which should lead to higher CFP credit prices and attract more low carbon fuels to the market.* The CI reduction standard increases linearly to 37% by 2035.

- Climate Protection Program (CPP) carbon cap decreases, incentivizing fuel suppliers to increase renewable fuel supply to lower their emissions.

- Portland’s renewable fuel standard (RFS) mandates a 15% < 40 CI RD/BD blend rate. This rises to 50% by 2026 and 99% by 2030.

*Note that a large increase in low-carbon renewable fuel supply that exceeds the annual CFP standard may result in falling CFP credit prices (as has happened in the California LCFS program).

RD supply will be available but competition for volumes will increase

The outlook for U.S. RD production capacity should be able to meet growing demand in Oregon and California. However, Oregon must compete with California’s large market and strong incentives, including the LCFS, Cap & Trade, and Cap-at-the-Rack. Going forward, Oregon will also have to compete with Washington state’s larger transportation fuel market and growing RD demand driven by their nascent Clean Fuels Standard (CFS) and Cap & Invest programs. New clean fuels programs are being considered in state legislatures around the country, including in New York and New Mexico. As new states add clean fuels programs the demand for RD will grow. Oregon’s challenge will be to continue to build the incentives and a robust market to grow supply in the state.

[1] Fuel dispensers are required to label RD and BD blends above 5%

Need more in-depth supply and demand information?

Stillwater offers expertly crafted supply/demand outlooks for transportation fuels markets in the U.S.

Contact us to learn more.

Categories: News