FLASH REPORT: Finally some detail around potential auto-acceleration & step-down mechanisms

Link to article: https://stillwaterassociates.com/flash-report-finally-some-detail-around-potential-auto-acceleration-step-down-mechanisms/

May 24, 2023

Yesterday, CARB hosted a public workshop to present its considerations around a potential auto-acceleration mechanism (AAM) for the LCFS CI-reduction schedule and a potential step change in the CI-reduction benchmark in the near term. Both proposals are being considered as a way to ensure a steady price signal for credits in the market to support ongoing investment in low-carbon fuels development and production. This workshop is a formal part of the rulemaking process during which CARB solicits feedback on concepts ahead of conducting a technical analysis and finally releasing the rulemaking package. CARB intends to release the rulemaking package “by late summer,” as it must be released at least 45 days ahead of the fall Board hearing in order to be considered.

In addition to CARB’s presentation, four stakeholder panelists presented their perspectives on these proposals – UC Davis (the Policy Institute for Energy, Environment, and the Economy), AJW (a consultancy that has advised CARB in the past), the Low Carbon Fuels Coalition (a trade association which advocates for the proliferation of clean fuel programs), and BTR Energy (an EV platform provider).

In this flash report, we highlight our key takeaways from this public workshop. Our LCFS Newsletter subscribers received a longer version of this flash report yesterday, and that edition also included our expert perspective on CARB’s most likely path forward. Want that kind of analysis in your inbox going forward? Sign up for Stillwater’s LCFS Newsletter. Your first week is free, and you can cancel at any time.

Without further ado, here’s our run-down of what happened in yesterday’s CARB workshop…

📊 What did CARB present?

CARB’s presentation consisted of an overview of AAM and step-down concepts being considered in the current rulemaking and Staff’s latest thinking around these concepts. According to CARB’s presentation, a near-term step-down in compliance target stringency could strengthen the near-term price signal while an AAM “could potentially increase the stringency of compliance targets, improving market certainty.”

Concerning the AAM, CARB Staff indicated that such a mechanism would need to be based on clear regulatory criteria in response to market conditions, but Staff are still open to feedback concerning which market indicators should serve as the trigger, the time period for measurement of such an indicator (or indicators), how much the CI target should increase, and how the AAM should be implemented.

Potential AAM Trigger(s)

Staff presented two main potential market conditions that might trigger an adjustment in CI schedule: a credit/deficit-based trigger and a price-based trigger. A credit or deficit trigger would require a deep understanding of the LCFS market, may reduce the ability for entities to bank credits, and may increase the risk of non-compliance (i.e., an inadequate bank). Meanwhile, a credit price trigger would provide a clear metric for investment decisions but may result in distorted credit prices and/or market manipulation. Staff offered two design concepts for a potential AAM Trigger:

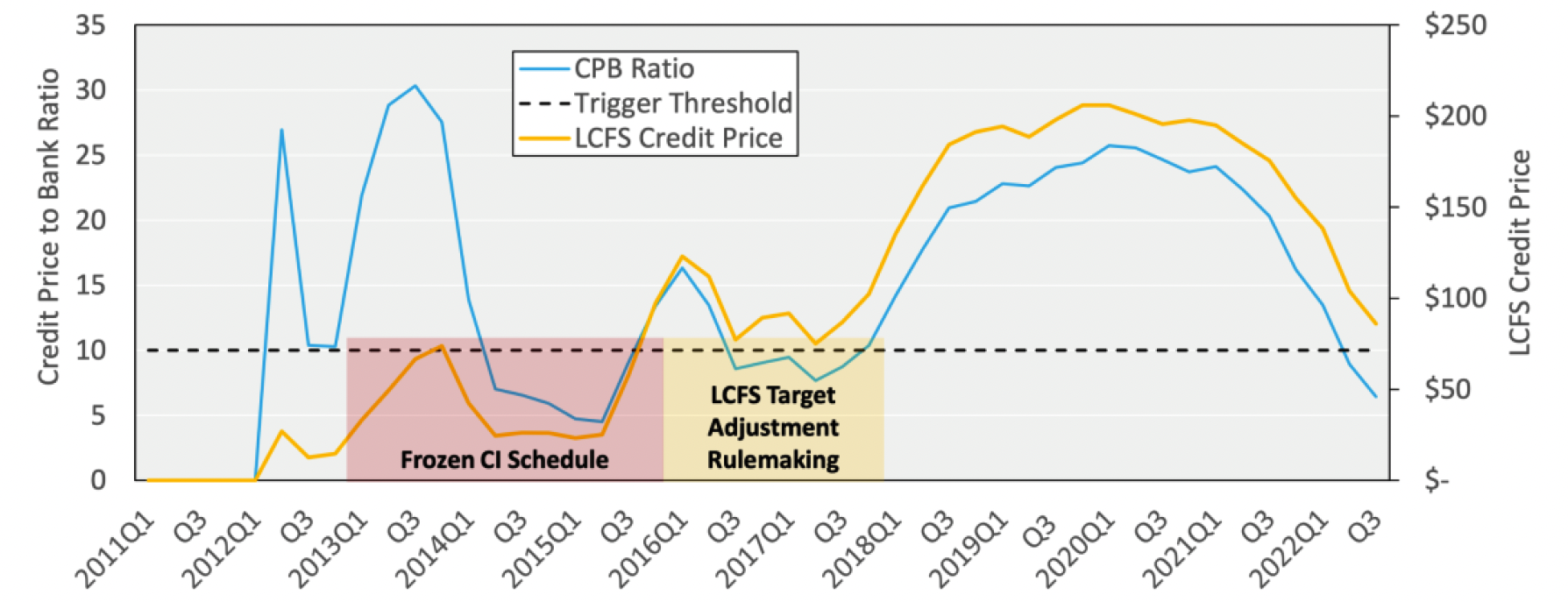

- Credit Price-to-Bank (CPB) Trigger – This trigger would be based on publicly available data and would be calculated based on an average credit price divided by the total banked credits. The adjustment would be triggered when the Credit Price-to-Bank (CPB) ratio drops below a threshold value. CARB floated a ratio of 10 as a potential threshold and requested stakeholder feedback on that threshold value. See the figure below from CARB’s deck for visualization of this concept.

source: CARB Presentation slide 29

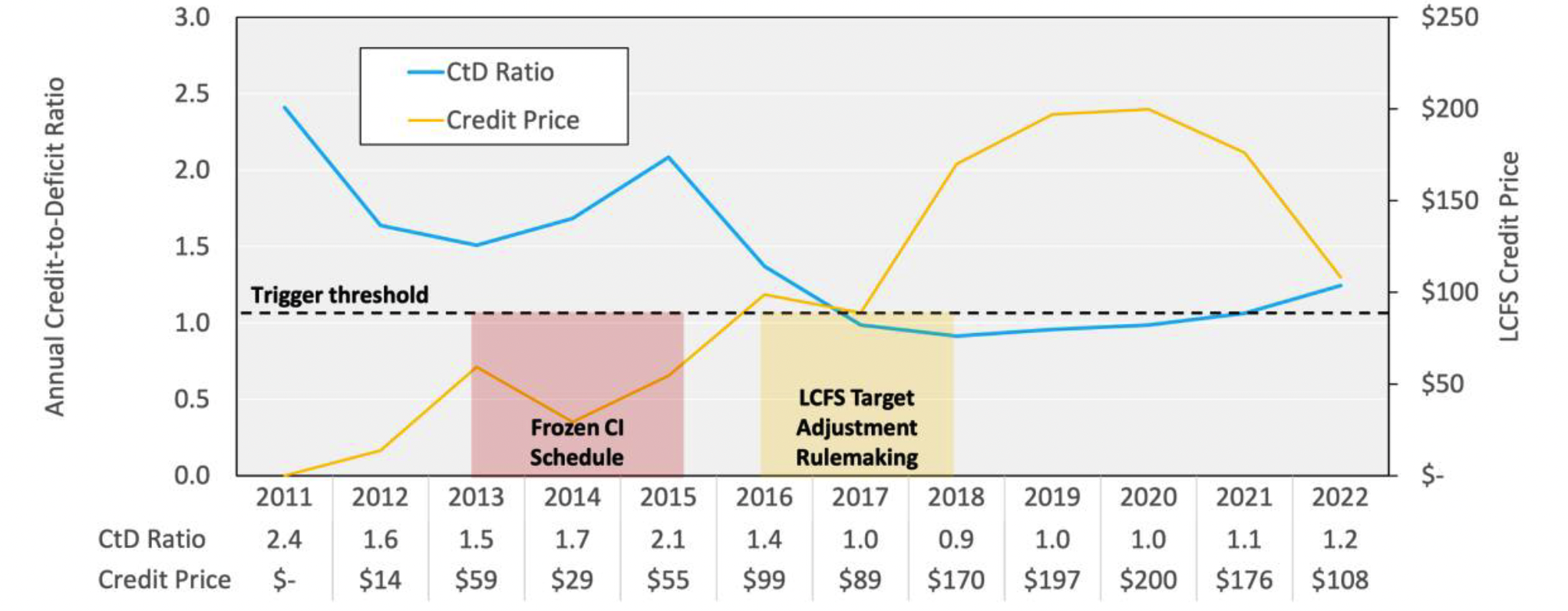

- Credit-to-Deficit (CtD) Trigger – This trigger would be based on the total credits generated divided by the total deficits generated. If the total credits generated relative to total deficits generated exceeds a threshold level for the calendar year, the AAM would be triggered. CARB floated a ratio of 1.1 as a potential threshold and requested stakeholder feedback on that possible metric. See the figure below from CARB’s deck for visualization of this concept.

source: CARB Presentation slide 31

Potential AAM Ratchet

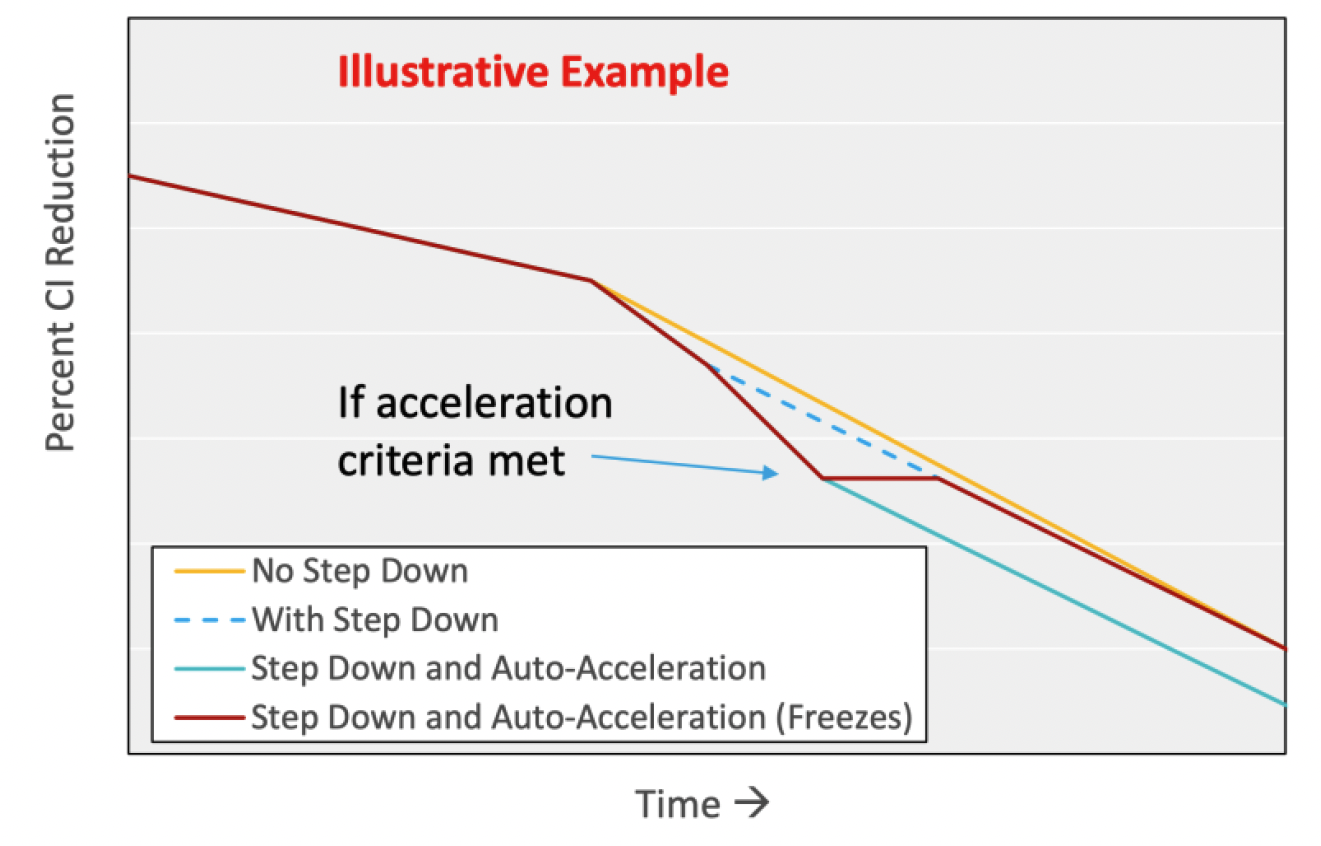

If an AAM trigger condition is set and met, the program would be set to auto-adjust (ratchet) the CI reduction schedule to make the program more stringent, at least in the short term. Staff presented details around the potential mechanism or approach for adjusting the CI schedule, including a) altering the entire schedule by a calculated amount for all following years, b) adjusting only one year of the schedule, and c) shifting the entire schedule up by one calendar year.

The two illustrative examples offered for AAM implementation are:

- A one-year benchmark adjustment which is then “frozen” (red line in the figure below)

- An acceleration of the whole curve, including all future benchmarks (teal line in the figure below)

source: CARB Presentation slide 15

source: CARB Presentation slide 15

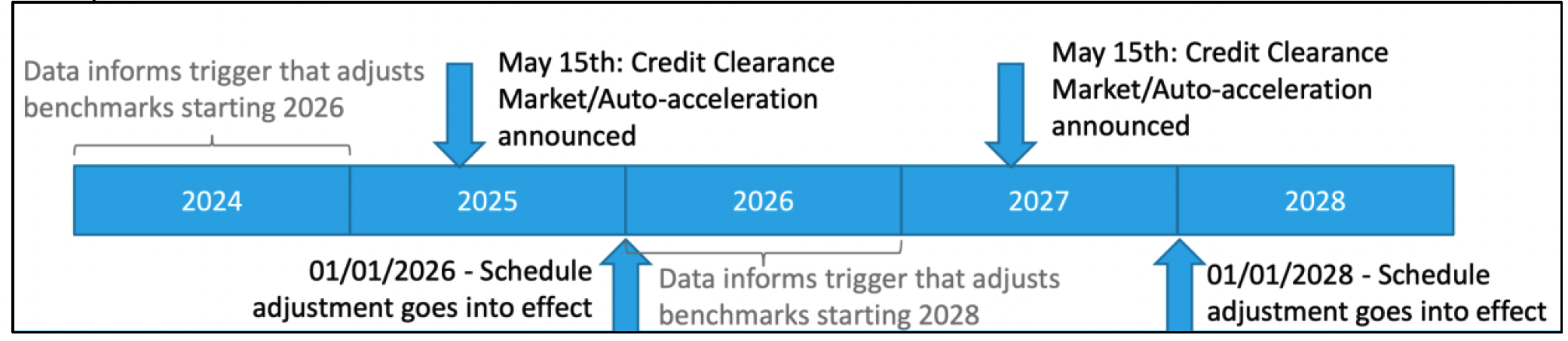

Staff seemed to be leaning toward advancing the LCFS benchmark schedule by one-year (beginning the following year) if an AAM trigger is set and met. Below is the illustrative timeline CARB used as an example:

source: CARB Presentation slide 35

source: CARB Presentation slide 35

Potential Step-Down

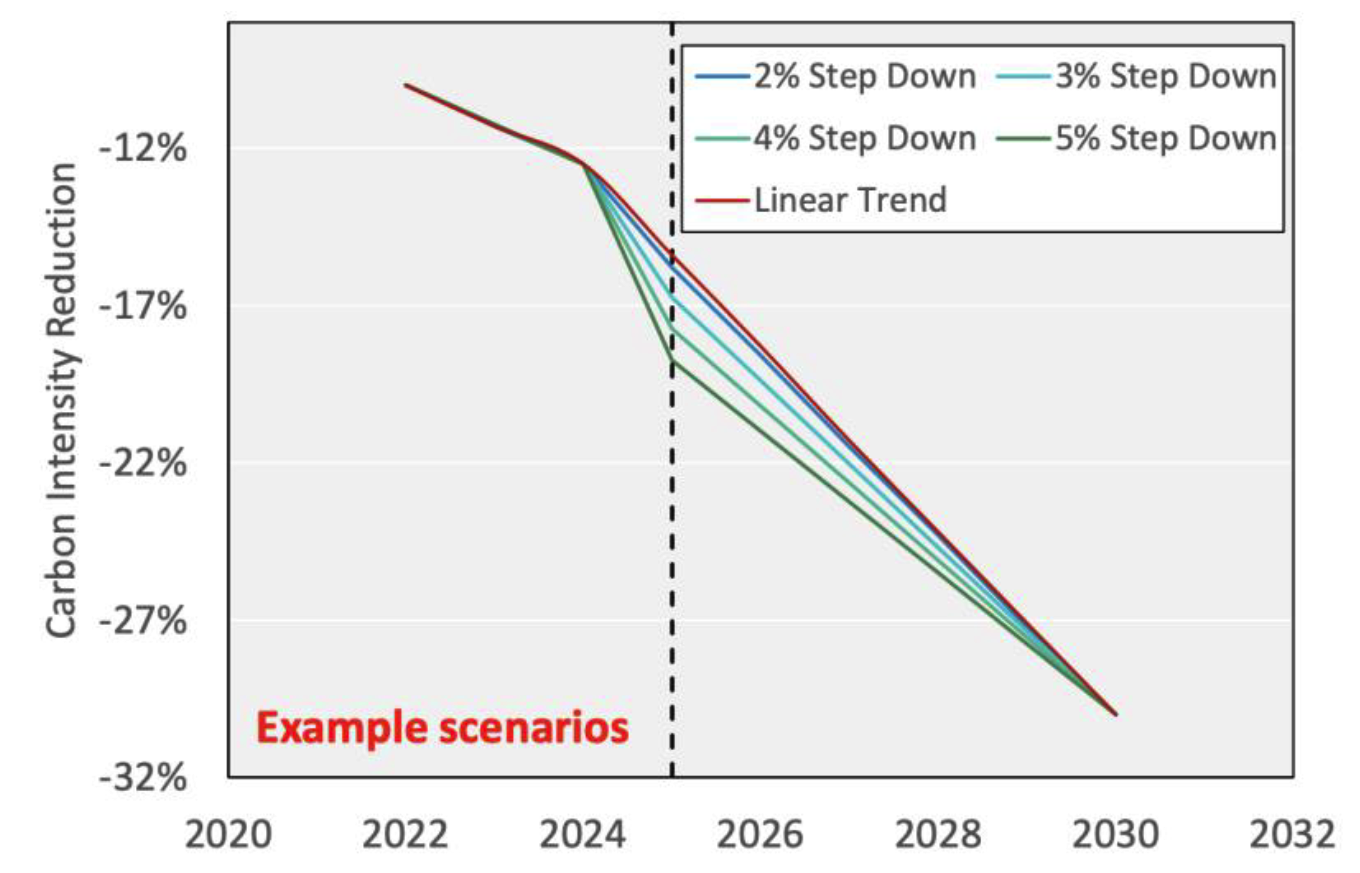

Concerning the step-down concept, which would give a larger annual reduction than a linear schedule to the next year (or maybe two) to mitigate the large net credits experienced in 2022, Staff offered a look at several example scenarios between 2% to 5% in 2025, as depicted in the figure below from CARB’s presentation.

source: CARB Presentation slide 13

source: CARB Presentation slide 13

During the public comment and question period, CARB noted that the 2025 implementation in these example scenarios is not set in stone. Staff are still targeting January 1, 2024 implementation, but these examples take into account the possibility that rulemaking may take longer than desired. Stakeholders who commented during the workshop strongly urged CARB to implement the step-change in CI reduction schedule on January 1, 2024 even if other provisions in this rulemaking package require more development.

🤓 What did the panelists have to say?

Following CARB’s presentation, four panelists provided outside perspectives on the auto-acceleration and step-down concepts.

First, Colin Murphy Ph.D. of UC Davis’ Policy Institute for Energy, Environment, and the Economy presented modeling around the AAM concept. Murphy’s team’s modeling considered several potential triggers including annual credit balance, cumulative credit bank, credit price, and energy-weighted average CI of delivered fuels. As for the ratchet mechanism, Murphy presented several possibilities, all of which fell within two categories:

- A “target adder” – adds a specified amount to the CI reduction target if triggered

- The “pull-forward” – advances an additional year in the compliance schedule if triggered

These ratcheting moves can be temporary or permanent, although Murphy’s team cautioned that a permanent pull-forward might be dangerous given the need for rapid acceleration of targets once their assumed ZEV transition justifies it, while a one-year temporary pull-forward may be insufficient to provide the desired market certainty.

The UC Davis presentation shared CARB Staff’s concerns that the credit bank (rather than prices) should be the key to triggering the AAM and that the design of the AAM needs to be transparent while minimizing the potential for LCFS credit market manipulation. In addition to the need for an AAM, Murphy expressed concern about program under-performance that could diminish the bank and create an infeasible program. To this end, the UC Davis team introduced a “Trigger and Release” concept for the AAM. The trigger would be consistent with the other suggestions for AAM but would add that a year of reduction targets be skipped if the program delivers an annual net deficit.

Next, Mary Solecki offered AJW’s perspective on potential AAM concepts. Solecki’s presentation sought to answer four questions:

- What is the basis for triggering the mechanism?

- What is the duration of time that triggers?

- What is the magnitude of increased stringency?

- What is the lead time given to market participants?

In answer to these four questions, AJW concluded that:

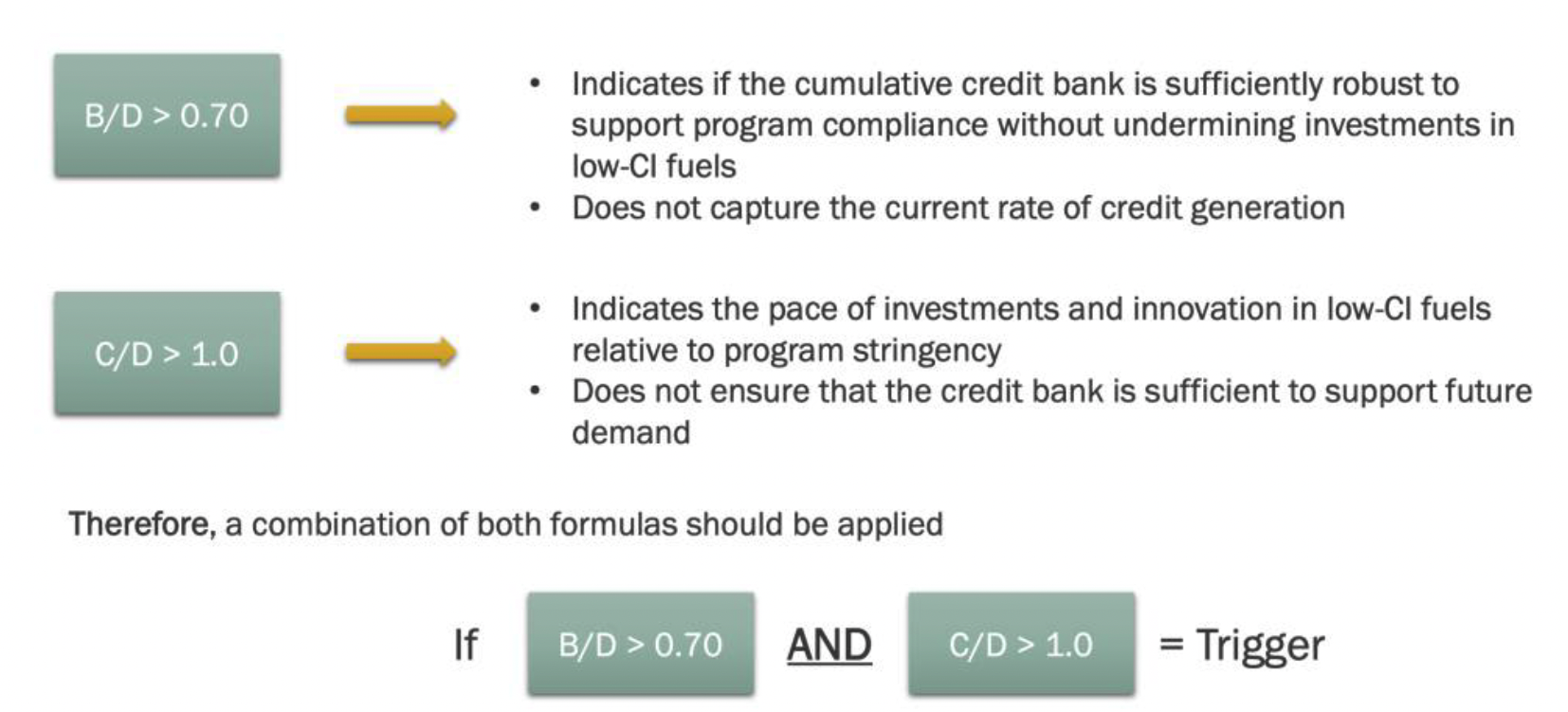

- A credit-based trigger – i.e., a formula that incorporates the bank (B), credits generated (C), and deficits generated (D) – with a two-test verification was most logical. The two-test basis for the trigger is intended to protect against a one- year event such as the 2020 COVID pandemic. An example of AJW’s two-test verification is offered below:

source: AJW slide deck slide 7

Note that AJW’s ratio of credit bank to annual deficits (B/D) falls in line with the “quarters of coverage” metric we have reported in Stillwater’s LCFS Newsletter since its inception in 2016. Dividing the “quarters of coverage” by four produces the B/D ratio.

- A timeframe of one calendar year is the simplest, clearest, and most logical duration for the data reporting required to trigger the AAM.

- The CI reduction stringency should increase continuously but with guardrails. Under this scheme, all future years would automatically ratchet down, sending a year-over-year signal that becomes quite large over time, but Board approval would be required for a third consecutive trigger.

- An annual assessment with a decision by May 15th and effective January 1 (following the existing Credit Clearance Market schedule) is advisable.

Graham Noyes presented the Low Carbon Fuels Coalition’s support of AJW’s proposals.

Finally, Russel Dyk, head of environmental products at Bridge to Renewables (BTR) Energy, presented his perspective concerning the CI step-down concept. Dyk advocated for a significant step-down towards 20% in 2024 and at least 30% in 2030. According to BTR, this adjustment to the program would result in an immediate inflection in the trajectory of the credit bank, would lead to an immediate and robust price response, and would encourage a front-loading of investment. Dyk referred to the CI step-down as “the most consequential action” CARB can take in this rulemaking process. Notably, BTR’s example case used a ~7% step-down in 2024.

🗣️ What did public commenters convey?

CARB also solicited feedback from stakeholders to move forward on designs. Several commenters during the workshop indicated the urgency for an increase in the stringency of the CI reduction schedule. In addition to the comments heard live in the workshop, CARB will also be accepting public feedback in written form.

🔮 So, what does Stillwater think CARB will do?

There were several takeaways for us. This workshop also gave us a clearer picture of the parameters and considerations CARB is considering. After this workshop, we believe that we can frame up what we think the reduction schedule will be and the auto-acceleration mechanism & step-down will take shape.

This expert analysis and perspective are exclusively available to Stillwater’s LCFS Newsletter subscribers!

If you’re an LCFS Newsletter subscriber: You received this exclusive analysis in your e-mail inbox on May 24, 2023 with the subject line “FLASH REPORT: Finally some detail around potential auto-acceleration & step-down mechanisms.” If you can’t find that e-mail in your inbox, contact us and we’ll send you the full analysis.

If you’re not yet a Stillwater LCFS Newsletter subscriber: Sign up here to gain access to this sort of exclusive analysis going forward. Your first week is free, and you can cancel at any time!