Flash Report: 1Q2021 LCFS Data Show 259,301 MT Draw in the Credit Bank

Link to article: https://stillwaterassociates.com/flash-report-1q2021-lcfs-data-show-259301-mt-draw-in-the-credit-bank/

August 2, 2021

On Friday afternoon, July 30th, CARB posted the first quarter 2021 data for the LCFS program. The 1Q2021 report gives us insight into the credit bank situation for a full year following COVID-19 stay-at-home orders. In today’s flash report, we offer a quick look at the first quarter data. Our comprehensive analysis will be published in Stillwater’s Quarterly LCFS Newsletter which will be available to subscribers on August 10th.

The first quarter data shows a draw in the credit bank of 259,301 metric tons (MT) of credits, nearly offsetting the 4Q2020 net credit of 373,724 MT. This first-quarter draw in credits is about half the size of the 1Q2020 net deficit of more than 470,000 MT. With the 1Q2021 net deficit, the credit bank now stands at 7.6 million MT.

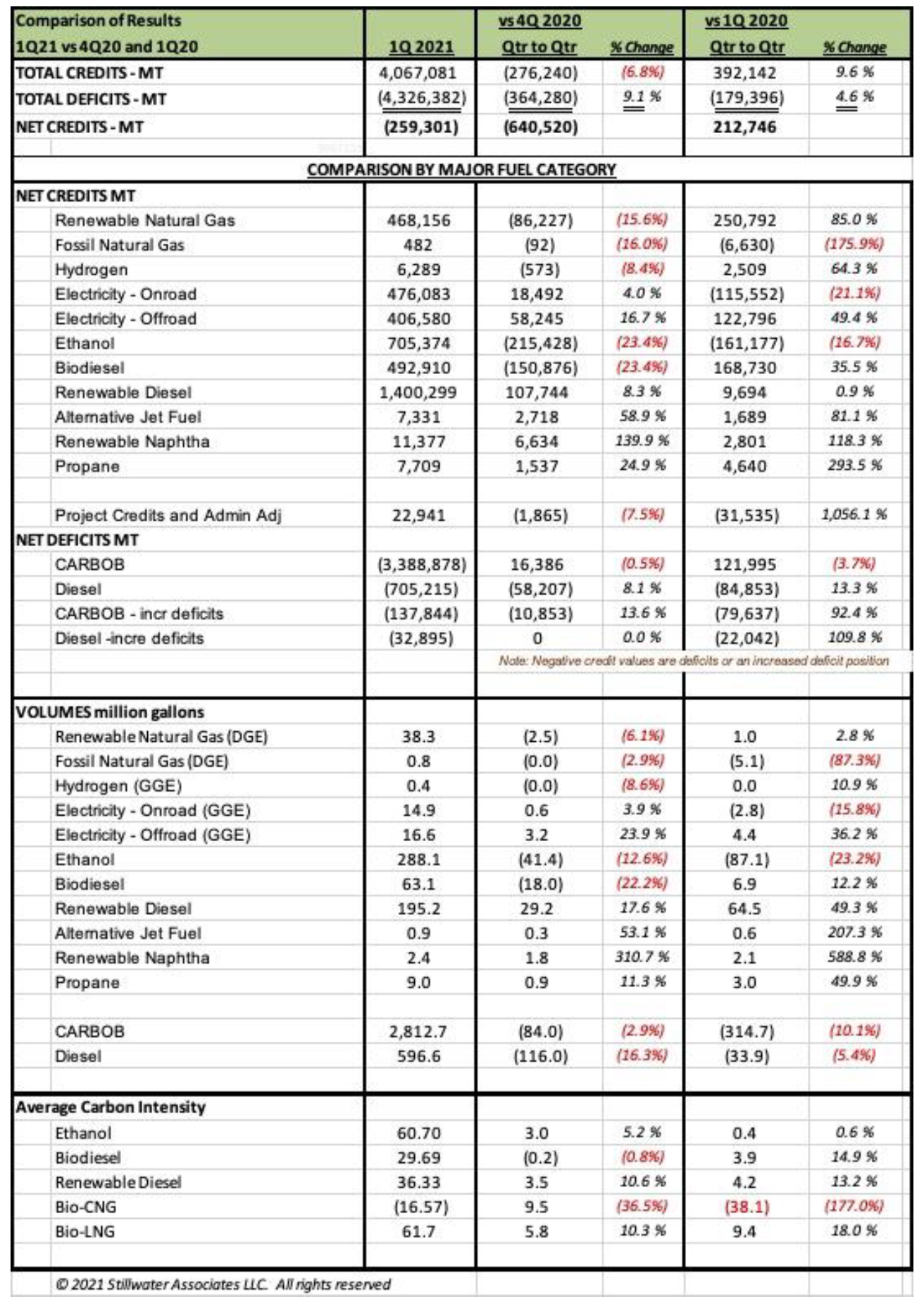

The table below summarizes the quarter and compares it to the prior quarter and same quarter last year.

A quick look at this data shows a few trends of interest. RD volumes rose by nearly 18% from the previous quarter and 49.3% from 1Q2020. Off-road electricity credits rose 16.7% and volumes rose nearly 24% from 4Q2020.

Ethanol credits dropped by a whopping 23.4% and ethanol volumes dropped by nearly 13% from 4Q2020. Meanwhile, CARBOB volumes declined by just 2.9% compared to 4Q2020 but were off 10% compared to 1Q2021. Typically, CARBOB and ethanol track each other to make the E10 requirement. As such, this disparate decline between ethanol and CARBOB likely marks a backlog of ethanol inventory being drawn down. Biodiesel also dropped, generating 23.4% fewer credits than the previous quarter and dropping in volume by 22%. ULSD volumes also dropped by 16% from 4Q2020.

We will provide an in-depth analysis of this data in our upcoming quarterly newsletter, published on August 10, 2021. Access to Stillwater’s LCFS Newsletter is only available to subscribers. For more detailed information on LCFS data trends and analysis, be sure to subscribe! Your first two weeks are free, so subscribe today to receive our Quarterly Analysis in your trial period.

Categories: News