Downstream Oil & Gas M&A Part 2: A Fistful of Dollars

Link to article: https://stillwaterassociates.com/downstream-oil-gas-ma-part-2-a-fistful-of-dollars/

December 15, 2020

By Vaughn Hulleman with Leigh Noda and Barry Schaps

On November 15th, we published the first article of a three-part series on downstream oil and gas mergers and acquisitions. That first article covered macro and regional factors that may help answer the question at hand. This is the second article in our Downstream Oil & Gas M&A series.

The petroleum industry is known for its cyclic nature, and value-buyers often find opportunity to acquire assets during periods of financial stress. In our first article of this three-part series on downstream oil & gas M&A, we concluded that this market cycle looks different than previous cycles, particularly for refining assets. The pandemic affected petroleum-product demand differently than previous recessions,[1] and by the time the pandemic risk is resolved, there is likely an increased chance of environmental legislation negatively impacting the sector. So, purchasing a downstream asset in this market would be madness, right? Not so fast. In this second article, we review the factors that support acquisitions as well as specific acquisition strategies that may argue that for the right acquiror, the current environment may indeed be the right time to buy!

Downstream assets include more than the “Refineries” and are far more than just processing units used to create finished petroleum products and chemical feedstocks. For the purposes of defining alternative acquisition strategies, a typical refinery can be thought of in terms of its three parts:

- The core refining units,

- The logistical assets required to receive crude oil and distribute petroleum products, and

- The land on which they are sited.

Here, we review “alternative-use” acquisition strategies for each of these components.

Core Refining Units

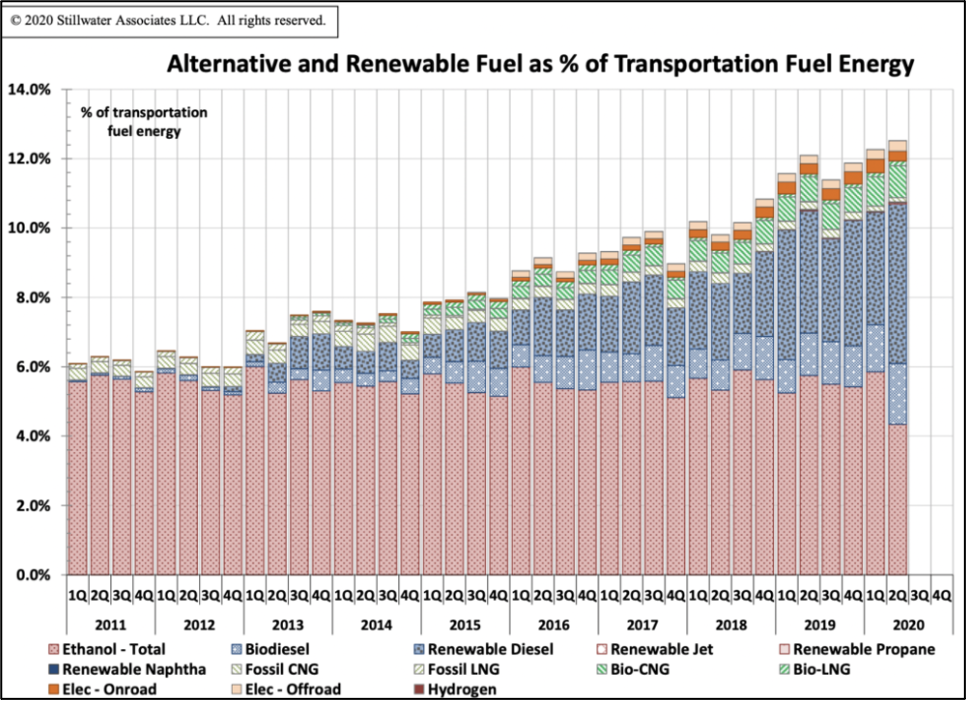

The refinery itself is an asset that could be used in other ways. As outlined in the first article in this series, environmental legislation can pose risks for downstream assets. On the other hand, however, the same environmentally focused legislation can present opportunity as some refineries have been repurposed to process biofuels which actually benefit from some of the incentives created by environmental legislation. For example, California’s Low Carbon Fuel Standard (LCFS) and Carbon Cap and Trade (C&T) programs and Oregon’s Clean Fuels Program provide credits that support the production of low-carbon biofuels. Biofuels have lower carbon intensity and are produced from biomass including used vegetable oils, animal fats or recycled cooking grease. Fuel volumes from these sources have been growing, as shown in the following graph which shows that alternative and renewable fuels volumes reached a record 12.68% of California’s total transportation fuel energy in the second quarter of 2020.

Alternative and Renewable Fuel as % of Transportation Fuel Energy

Logistical Assets

A second alternative-use strategy relates to refinery logistics assets. These assets are used to receive crude oil and distribute petroleum products and include crude pipelines/tanks, blending facilities, product tanks/pipelines, rack loading facilities and marine docks. The layout and capacity of the logistic assets affect how the refinery can be run and its overall efficiency. If the refinery were not financially competitive the assets could be used to import and distribute finished products or could be a valuable addition to other neighboring refineries to improve their operations. And even if the assets were not used for petroleum-related activities, berthing/port facilities, for example, could have value for import/export of other commodities or goods.

Land

Land also has alternative uses. When first conceived, refining assets were constructed far from population centers. Over time, however, cities have expanded and grown up around some refining facilities such that some refineries are now located within city limits and could be valuable for alternative use in commercial, industrial, or even domestic-housing purposes. This strategy may be more attractive given that, for asset purchases, environmental liabilities for downstream assets may remain with the seller or mitigated through insurance, although this would have to be confirmed through the due diligence process.

Other Options

Beyond alternative-use, several core strategies may still apply despite the current risks. North American downstream assets are aged and, for the most part, fully depreciated. Newly purchased assets become depreciable again for the buyer, thereby lowering annual tax liabilities. Growth, market access, or operational synergies may still motivate some buyers. While the risks cited earlier are important, the International Energy Agency’s oil demand forecast contains a scenario for rapid transition to alternative energy. This forecast projects about a third lower-than-current oil production by 2050. If this forecast manifests, a third of current refining capacity would need to shutdown, but equally, two-thirds would remain through 2050.

Conclusion

We began this article by asking: “In today’s market, buying a refinery would be madness, right?” Whether your acquisition strategy is for alternative or traditional use, perhaps the question should be: “How do you know whether you are buying the right refinery assets at the right price?” That will be the subject of our third and final article in this series.

Stillwater sees things others miss, and now you can, too. Contact us to learn more.

[1] The drivers that precipitated previous economic downturns have varied, but the impact on petroleum products has been relatively similar. In contrast, the impacts of the COVID-19 pandemic have been much more varied by product type. The impact on jet fuel has been the most pronounced, and the demand destruction may persist for some time. Light-duty transportation fuels were affected, although gasoline has recovered better than jet demand. Goods movement has been relatively less impacted, and diesel demand has shown less demand destruction and quicker recovery as the pandemic progresses. For further details, see the first article in our 2020 Downstream Oil & Gas M&A series.

Tags: acquisitions, coronavirus, COVID-19, M&A, mergers, Oil & Gas, Pandemic, Refinery, Refining assetsCategories: Economics, Mergers and Acquisitions, News, Wisdom from the Downstream Wizard