Downstream Oil & Gas M&A Part 1: Pssst… Want to Buy a Refinery?

Link to article: https://stillwaterassociates.com/downstream-oil-gas-ma-part-1-pssst-want-to-buy-a-refinery/

November 15, 2020

By Vaughn Hulleman & Jim Mladenik

The petroleum industry is known for its cyclic nature, and, traditionally, value-buyers find opportunity to acquire assets during periods of stress. The current reduction in oil products’ demand brought on by the pandemic, along with other factors, have severely distressed downstream oil and gas assets. Several refineries have already shut down with rumors of several more to follow – all conditions that imply a buyer’s market. Some market observers believe that we are at or near peak-oil demand, which begs the question: Is this really a good time to buy, or is this market-cycle different?

This article is the first of a three-part series on downstream oil and gas mergers and acquisitions. In this first article, we review macro and regional factors that may help answer the question at hand.

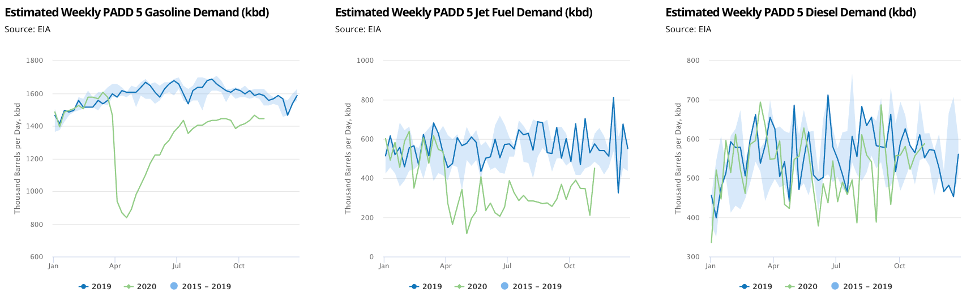

The drivers that precipitated previous economic downturns have varied, but the impact on petroleum products has been relatively similar. In contrast, the impacts of the COVID-19 pandemic have been much more variable by product type. The border closures and travel restrictions have had a significant and potentially lasting impact on jet fuel demand. This impact has been felt regionally, as those areas heavily dependent on flight-tourism have been disproportionally affected by reduced demand. With quarantine and telecommuting becoming the norm, driving habits were also severely impacted, affecting light-duty transportation fuels, although gasoline has recovered better than jet demand, as shown in the figures below. Goods movement has been relatively less impacted, and diesel demand has shown less demand destruction and quicker recovery as the pandemic progresses.

Figures shown are published in Stillwater’s West Coast Watch which is updated in an ongoing fashion.

Clearly, there has been a big shift in transportation patterns, but will it last? An International Energy Agency (IEA) study looked at previous events that impacted transportation to draw conclusions about the current pandemic’s long-term impacts. For example, the 2005 London subway bombing resulted in a significant shift away from public transport with lingering effects. Covid has resulted in a similar shift away from public transport, but the IEA study indicates that the long-term affect is uncertain because some switching has been to non-fuel transport (cycling, electric drive, etc.) while other switching has occurred to more fuel-intensive private automobiles. While the long-term impact of product demand is uncertain, we can draw some insight on how this unprecedented change in demand affects refineries or refining regions differently.

Ordinarily, petroleum refineries are most profitable when running at full capacity and at specific constraints to their upgrading capabilities. Refineries can modestly shift the balance of products they produce, but this flexibility is limited and depends on their configuration and complexity. At reduced crude runs, the ability to shift production from jet fuel to diesel or gasoline increases significantly. For example, the relatively complex California refineries’ typical product distribution has been about 60% gasoline, 20% diesel, and 20% jet fuel to roughly match local demand. According to the California Energy Commission’s (CEC) analysis of Petroleum Industry Information Reporting Act (PIRA) data, in response to the extreme changes in demand caused by the pandemic, California refineries (with reductions in total crude runs) were able to change that distribution in July of this year to about 74% gas, 15% diesel, and 11% jet fuel. With supply exceeding demand, product prices drop, reducing refinery margins. When refineries operate at reduced rates, there is also less product to sell at the lower margins to cover fixed operating costs, further negatively impacting profitability. With these types of impacts, some regional trends can be identified. For example, U.S. Gulf Coast (USGC) refineries generally have high complexity, greater flexibility, and lower costs than U.S. West Coast (USWC) refineries. This makes USGC refineries better suited to operating in the low-margin environment brought about by the pandemic.

There are other factors that make this cycle different for some but not necessarily all refineries. The West Coast, for example, has more extensive environmental regulations making it more difficult and expensive to operate and invest in petroleum refineries. These regulations, which include California’s Low Carbon Fuel Standard (LCFS) and Carbon Cap and Trade (C&T) program alongside Oregon’s Clean Fuel Program, also reduce demand for petroleum products by creating large financial incentives to displace them with lower-carbon renewable fuels. As the effects of the pandemic recede over the next few years, the impacts of these regulations will grow to further decrease demand for petroleum products and increase financial pressures on petroleum refineries. The shift to lower carbon transportation fuels and associated government programs to encourage the shift vary from state to state, and certainly from country to country. The resulting risk for a refinery is a factor that is different in this market cycle than cycles in previous decades. Ironically, these carbon regulations may also present an opportunity for refinery acquisitions which will be discussed in the second article in this series.

Clearly, there are some unique aspects that make this market cycle different from others, particularly for downstream assets. Covid-driven changes in product demand are unprecedented, and the timing for the recovery and what markets look like post-recovery are uncertain. By the time the impacts of the pandemic are resolved, there will likely be increased risk of new environmental legislation impacting the refining sector. Simply put, if we are near “peak oil,” purchasing a refinery now would be madness… or is it? In our second article, we will look at the factors indicating that although this market cycle is different from previous cycles, there are many reasons why buying a refining asset still makes sense. Stay tuned.

Stillwater’s Mergers & Acquisitions Expertise

Stillwater Associates brings together a unique blend of real-world downstream experience, building competitive advantage and delivering results. Our associates have extensive expertise in energy transactions with particular expertise in refining operations, storage, pipelines, and retail marketing. The Stillwater team is experienced, accountable, and committed to results.

Contact us to learn more about our mergers and acquisitions services.

Tags: acquisitions, coronavirus, COVID, COVID-19, M&A, mergers, Oil & Gas, Pandemic, Refinery, Refining assetsCategories: Economics, Mergers and Acquisitions, News