COVID-19’s Economic Impacts on the LNG Market

Link to article: https://stillwaterassociates.com/covid-19s-economic-impacts-on-the-lng-market/

March 11, 2020

By John Wolff

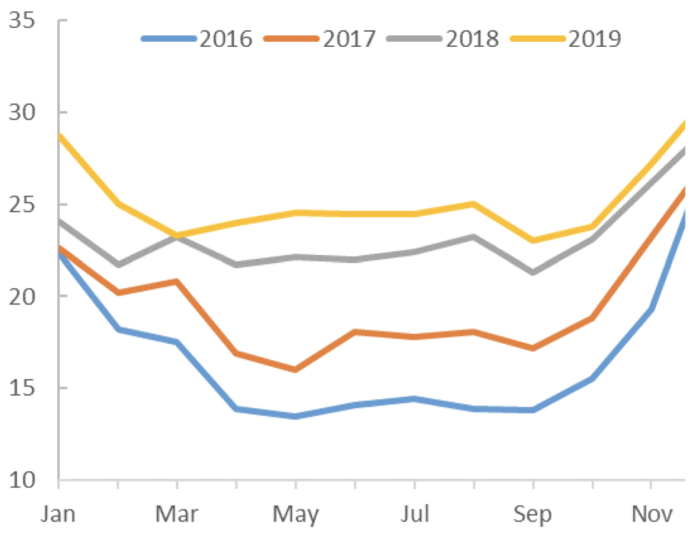

Worldwide natural gas markets are unsettled by the current and plausible impacts of the COVID-19 virus. There has been a widely reported reduction in Chinese crude oil and products demand as auto travel, commercial deliveries, and airline flights have been reduced. The likely duration of the economic impacts is not clearly understood at present. Chinese natural gas consumption has grown substantially in the recent past and was expected to continue. But reported natural gas and LNG imports to China grew by just 2.8% for January and February 2020 compared to the same period in 2019. That growth is much lower than the total natural gas 18.5% growth seen in 2019 over 2018 volumes, as shown in the figure below.

Figure 1. Chinese Gas Demand (billion cubic meters)

Source: Customs, NBS, OIES. https://www.oxfordenergy.org/wpcms/wp-content/uploads/2020/02/When-China-sneezes….pdf

According to the Oxford Institute for Energy Studies, the Wuhan region (the area in China most directly affected by the COVID-19 outbreak) is estimated to contribute 5% of Chinese GDP – mostly through manufacturing. The Chinese government has undertaken many steps to spur the economy as it encourages many manufacturing plants to reopen after the extended Lunar (New Year) Holiday stoppage. Included in these steps are government efforts to provide greater financial liquidity to China’s market. In late February, China’s National Development and Reform Commission (NDRC) put lower summer natural gas rates in place that had been expected to take effect in April. The government also eliminated the 10% tariff on U.S. LNG imports that it had put in place in 2018. While seeking more normal economic activity, the Chinese government is attempting to protect the Beijing area from the COVID-19 outbreak with rigorous inspections, so there are offsetting measures that will shape Chinese economic activity and recovery.

Sublime China Information (SCI99), a Chinese consulting firm, reported that LNG imports were halved in February 2020, and it projected that natural gas demand is expected to be 10 billion cubic meters (bcm) lower in 2020 than expected in the absence of the coronavirus outbreak. That impact is modest, a 3% reduction in annual demand, given the Chinese natural gas market demand was 304 bcm (or 31.3 billion cubic feet per day, bcfd) in 2019.[1] Most of the reduction (around 9 bcm) is expected in the first quarter with another 1-bcm reduction in the second quarter. According to Petroleum Economist, Michael Mao, senior energy analyst at SCI99, expects that the economic impact of the coronavirus will be short-term in nature: “We expect that the market will return to normal from March if things do not escalate.” The expectation remains that Chinese natural gas demand would grow in 2020, albeit at a slower rate than anticipated prior to the coronavirus arriving on the scene. Long-term LNG contracts that are in place cover 50 million tons (mt) of LNG. The government has supported additional LNG regas terminals in China, so future LNG demand growth is still expected.

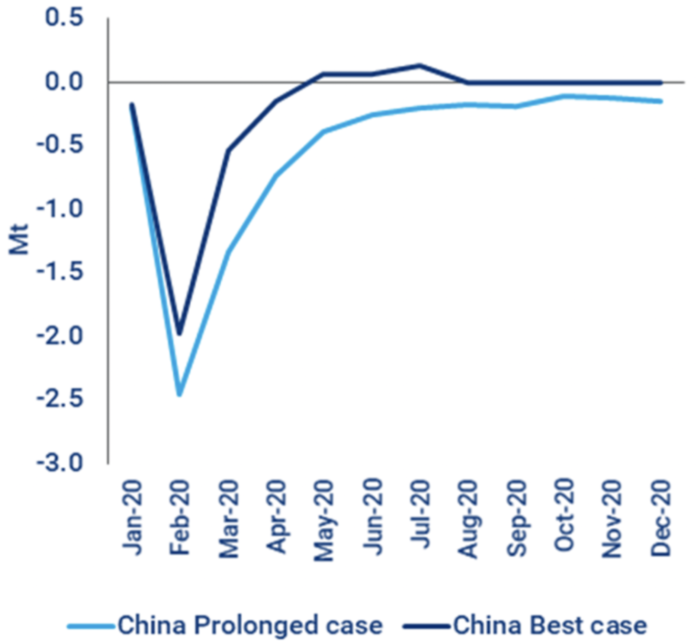

Much like SCI99, Wood Mackenzie has projected higher Chinese LNG demand in 2020 but noted that their February 2020 assessment was reduced by 3 to 6 mt from its earlier outlook. It assumes a short-term economic impact as shown below.

Figure 2. Coronavirus threatens 6 MT of 2020 growth in China

Source: WoodMackenzie. https://www.woodmac.com/news/the-edge/global-lng-and-coronavirus/

While the market observers mentioned above expect a relatively quick gas demand recovery, recent claims of Force Majeure by the China National Offshore Oil Corporation (CNOOC) and China National Petroleum Corporation (CNPC) imply a more prolonged period of decreased Chinese natural gas demand. CNOOC has 21.45 mt of LNG contracts in place and was reported to have claimed Force Majeure for up to half of its February LNG commitments. Several of CNOOC’s LNG sellers, such as Shell, were reported to have rejected that claim. PetroChina, a subsidiary of CNPC, has 15.3 mt of LNG contracts in place, and World Oil reported that CNPC declared Force Majeure in March 2020. CNPC also included pipeline contracts with Turkmenistan, Myanmar, and Russia in its Force Majeure claim. The CNPC action is more surprising to learn about since CNPC has historically worked out accommodations with its suppliers in the past to balance Chinese natural gas supply and demand as needed. These announced claims do imply a weaker Chinese natural gas demand is more likely than expected before the Force Majeure announcements.

U.S. Impacts on the LNG Market

For its part, the U.S. LNG market had little direct impact in China in 2019 due to trade issues and a 10% tariff that China had put on LNG imports from the U.S. Only two cargoes, representing 0.13 mt, were delivered to China from the U.S. in 2019. That Chinese share was just 0.4% of total U.S. LNG exports which were approximately 37.8 mt (1,817 billion cubic feet).

Other countries experiencing significant COVID-19 impacts, however, were larger buyers of U.S. LNG in 2019. Japan (59 U.S. cargoes, 4.2 mt), South Korea (76 cargoes, 5.5 mt) and Italy (21 cargoes, 1.4 mt) are among those buyers. Economic weakness may not immediately affect LNG deliveries. As winter seasonal demand tails off, LNG buyers can start building inventories for the upcoming peak summer and winter periods. The timing and volume of these storage injections and withdrawals can buffer the impact of demand changes on scheduled LNG deliveries over a short term. The U.S. and other natural gas market prices have trended down independently of that health crisis, but this story is still developing.

U.S. natural gas supply has continued to rise even as the benchmark Henry Hub price weakened. U.S. dry marketed production grew by 3.1 trillion cubic feet (tcf) in 2019, a 10% increase from 2018 figures. This volume is equivalent to a growth of 8 bcf per day (bcfd). Annual LNG exports from the U.S. increased by 2 bcfd in 2019, averaging 4.98 bcfd.

In spite of all of the short-term uncertainty driven by the coronavirus outbreak, gas demand from U.S. LNG projects should continue to ramp up. By year-end 2020, the installed U.S. LNG plant capacity should have a nameplate capacity of 10.4 bcfd. Kinder Morgan anticipates U.S. natural gas production at LNG plants will reach 13 bcfd by 2025, a nominal output of 99 mt per year.

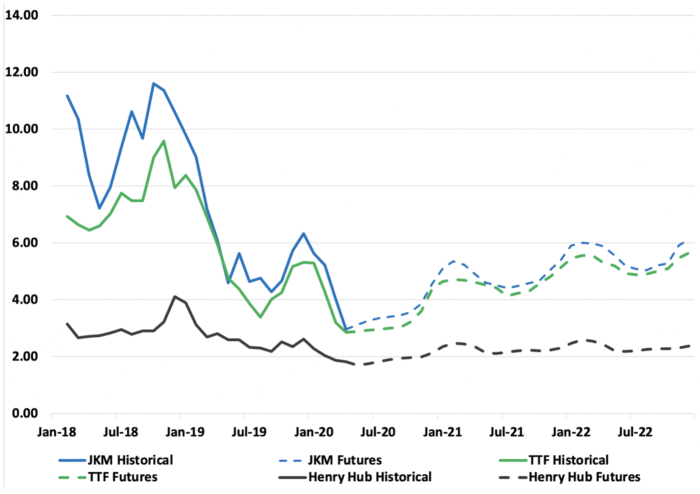

The growth in domestic U.S. natural gas supplies and in LNG supplies have led to lower prices, as shown in the figure below. The June 2020 Henry Hub Futures traded at $1.804/MMBtu, a 31% drop from the June 2019 contract which settled at $2.633/MMBtu. The impact of lower oil prices following the OPEC discord may lead to less U.S. drilling and eventually higher natural gas prices as upstream natural gas supplies tail off.

Figure 3. International Natural Gas Prices ($MMBtu)

As the U.S. natural gas market integrated more closely with the European (TTF) and Asian (JKM) markets through the expanding LNG trade, prices weakened. Politics are at play here because Gazprom, for example, sought high prices from European buyers but needs to restrain price signals from encouraging additional U.S. LNG projects from reaching positive financial Final Investment Decisions (FIDs).

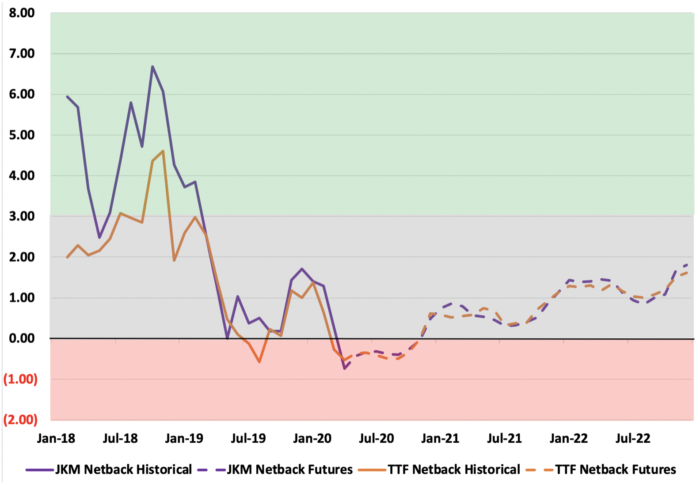

The figure below displays the arbitrage for U.S. LNG above cost for a historical period with a large spread. As can be seen, for several months into the future of this year, buying gas at Henry Hub and paying a liquefaction fuel charge of 15% and nominal shipping and regasification costs (in the case of European deliveries) results in selling prices not recovering these marginal costs. After a modest recovery by October 2020, marginal costs are recovered and there can be a contribution toward recouping a nominal liquefaction charge, which could be in the range of $3.00/MMBtu. Still, the spot price netback calculation shows that the capacity holders are not recovering the nominal liquefaction charge of $3.00/MMBtu for sales at the spot prices through 2022.

Figure 4. Arbitrage for U.S. LNG Above Cost ($/MMBtu)

If the Chinese natural gas market is slow to recover, the U.S. liquefaction plant offtakers will pursue sales in other regions. Floating LNG storage in the Fall may emerge as well. Hopefully, the relatively low LNG reflected by the futures prices will attract more buyers.

[1] One cubic meter of natural gas is defined as 35.315 cubic feet of natural gas. 10 billion cubic meters (bcm) per year is about 1 billion cubic feet per day (bcfd) in casual discussions (0.9675 more precisely).

Do you need help sorting out how the shifting market forces will affect your downstream transport fuels business?

Stillwater Associates can help. Contact us to learn more.