California’s Scoping Plan: What’s the Scoop?

Link to article: https://stillwaterassociates.com/californias-scoping-plan-whats-the-scoop/

March 2, 2022

By Adam Schubert

California LCFS credit prices have been on a downtrend since 2020 with the return of quarterly credit surpluses driven by increasing volumes of renewable diesel (RD), growth in the electric vehicle (EV) fleet, and dramatic reductions in the carbon intensity (CI) of renewable natural gas (RNG). Many see this as an opportunity for CARB to implement more stringent LCFS requirements as the state strives to meet its goal of being carbon neutral by 2045. Despite calls from some quarters, CARB has chosen to hold off on amendments to the LCFS program until the 2022 Climate Change Scoping Plan Update process is complete.

Recall that the LCFS is just one of many California’s multi-year programs to reduce greenhouse gas (GHG) emissions in California. These programs were established by AB 32, the California Global Warming Solutions Act of 2006. AB 32 initially required the state to reduce GHG emissions to 1990 levels by 2020 (about a 15% reduction from levels which were then projected). Subsequent executive orders by California governors expanded the GHG reduction target to 40 percent below 1990 levels by 2030 (Executive Order B-30-15) and carbon neutrality by 2045 (Executive Order B-55-18). In addition to the LCFS, other programs falling under the AB 32 umbrella include Cap and Trade, the Renewable Portfolio Standard (regulating the power sector), Clean Car regulations, energy-efficient building codes, regulation of hydrofluorocarbon (HFC) refrigerants, regulation of methane emissions from landfills and livestock facilities, high-speed rail, public transit, and forest management.

The key tool used to monitor progress and lay out the strategy for reaching these goals is the Scoping Plan. This plan is required to be updated every five years; the most recent update was done in 2017, and Stillwater summarized what was new at that time here. Accordingly, CARB is tasked with leading the effort to draft the 2022 Scoping Plan with support from over 20 other agencies of the California Executive Branch with a role in regulating GHG emissions. The goals of the 2022 Scoping Plan will be to identify the most cost-effective and technologically feasible path to meet the 2030 and 2045 targets while not exacerbating harm to disproportionately impacted communities nor interfering with ambient air quality efforts. They also will aim to minimize emissions “leakage” (from incentivizing increased GHG emissions outside of CA) and facilitate sub-national and national collaboration on GHG reduction policies.

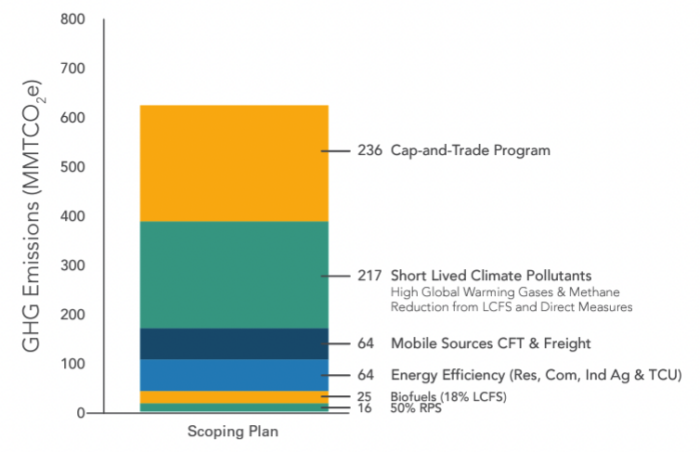

Fig. 1 Scoping Plan Scenario – Estimated Cumulative GHG Reductions by Measure (2021–2030)

Source: California Air Resources Board

The final 2022 Scoping Plan, expected for approval by the CARB Board by year-end, can be expected to provide a high-level set of action items for each AB 32 program, a standardized set of assumptions for state agencies to use in their work of updating their programs, and an assessment of quantity of GHG reductions which can be achieved with the mechanisms of the LCFS and each of the other GHG reduction programs. As a result, the Scoping Plan will be the basis for CARB to use in setting future CI reduction targets for the LCFS; this may reach out as far as 2045 and may include strengthening the existing LCFS CI reduction benchmarks prior to 2030 as well.

CARB has previously indicated that the next round of LCFS amendments is awaiting the completion of the Scoping plan. Proposals on future CI reduction benchmarks and other program provisions are expected to be released in the 2023-2024 timeframe. In addition to potentially strengthening pre-2030 and extending post-2030 targets (potentially at an accelerated reduction rate), CARB has listed several areas which may be addressed in the next set of amendments, including:

- Book-and-claim accounting for hydrogen shipped via pipelines,

- Promotion of electricity storage,

- The phase-out of credit-generation for petroleum projects,

- Making intrastate fossil jet fuel an included fuel,

- Support for hydrogen refueling infrastructure for medium-and-heavy-duty vehicles,

- Updating energy economy ratios (EERs) for emerging zero emission fuel-vehicle combinations,

- Updated models, and

- Opportunities for streamlining the program and enhancing exportability to other jurisdictions.

It remains to be seen which of these areas will be addressed in the forthcoming Scoping Plan update and how CARB will address each potential area of focus. Stay tuned for more insights from Stillwater as the Scoping Plan is developed.

More questions on the scope of the LCFS past, present, and future? Contact us to learn how Stillwater can help!

We also recommend signing up for our LCFS Newsletter. It’s chock-full of LCFS data and exclusive Stillwater analysis.

Stillwater’s LCFS team also offers LCFS Credit Balance and Credit Price Outlooks!

Stillwater’s LCFS credit price outlook includes historical LCFS credit balances and prices as a foundation for understanding forward-looking curves. We also present three credit balance and credit price curves through 2031 – our “most likely” curves for both credit balances and credit prices in addition to high and low curves which serve to bound the outlook. Our price projections are based on our analysis of the supply of low-CI fuels in California, the demand for fossil gasoline and diesel, our outlook on carbon intensities of each fuel pool, the evolution of the vehicle fleet, and the ongoing development of the LCFS regulation. Overlaying the numerical analysis is Stillwater’s deep understanding of regulatory actions and the evolution in California, the commercial fuels market, fuels logistics, market structure and players.

Stillwater’s Ten-Year LCFS Credit Balance and Credit Price Outlook includes:

- A table of our annual projected values for LCFS credits.

- Graphs of the supply, demand, and CI trends that inform our view of the LCFS credit price curve.

- Commentary around CARB’s historic and expected actions to regulate LCFS credit pricing.

- Qualitative descriptions of all key variables and how the data and factors mentioned above influence the forecast.

Stillwater can also run additional scenario investigations utilizing the above-described proprietary model. In this way, Stillwater can evaluate your assumptions and produce unique credit balance and price curves based on these assumptions.

Contact us to learn more about Stillwater’s LCFS Outlook!

Categories: Uncategorized