Bubble Map Update: Crude Oil Oversupply Leads to Creative Storage Solutions

Link to article: https://stillwaterassociates.com/bubble-map-update-crude-oil-oversupply-leads-to-creative-storage-solutions/

January 20, 2015

2015 kicks off with crude oil prices continuing to fall, having dropped over 50 percent since last June. It’s great news for drivers as retail prices have dropped to a nationwide average of $2.05. And it doesn’t seem like anything can stop this party. Even the dreaded California Cap-and-Trade price hike has yet to materialize.

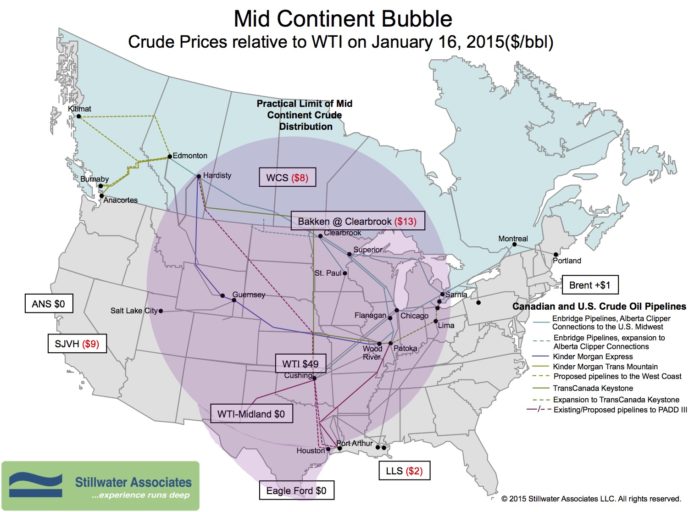

Crude oil spot price differentials have not changed much since last month. The Western Canadian Select discount to WTI has narrowed to $8 under. The Bakken discount has narrowed slightly to $13 under WTI. Eagle Ford and WTI-Midland remain at parity with WTI, as does Alaska North Slope. Louisiana Light Sweet remains at $2 under WTI. The biggest change is the San Joaquin Valley Heavy discount, which has widened from $4 in December to $9.

Oversupply and falling global demand is driving down crude oil prices, creating a contango in the market. Contango happens when the future price of a commodity is greater than the current price. To take advantage of the phenomenon traders are buying cheap crude and storing it for sale later at a higher price. Storage stocks in Cushing, Oklahoma have risen by 9 million barrels (mb) since December. Stocks are also piling up off-shore. According to the Wall Street Journal, traders including Vitol SA are chartering tankers to remain anchored just off-shore and store crude oil until it can be sold for a higher price. Look for storage options to become tighter as the weak market continues.

Tags: WisdomCategories: Wisdom from the Downstream Wizard