Airlines want Renewable Jet Fuel, but Renewable Diesel is Stealing their Thunder

Link to article: https://stillwaterassociates.com/airlines-want-renewable-jet-fuel-but-renewable-diesel-is-stealing-their-thunder/

February 6, 2020

By Jim Mladenik

Alternate jet fuel (AJF, also known as bio-jet or renewable jet fuel) has made the news lately as it is now included as an opt-in fuel under California’s Low Carbon Fuel Standard (LCFS), and many airlines are clamoring to reduce their carbon footprints and paint themselves as more climate-friendly. But the production of and market for AJF is in direct competition with renewable diesel (RD), which complicates matters. In this commentary, we will discuss how AJF is valued relative to RD in California and what this means for airlines that are looking to lower their carbon profile by increasing their use of AJF.

AJF can be produced from a variety of feedstocks using several different technologies, most of which are similar to how RD is produced. The most common method to produce both is hydro-processing fats or vegetable oils to produce a mixture of hydrocarbons in both the jet and diesel fuel boiling ranges. In fact, on-spec diesel fuel may contain a large fraction of fuel which might otherwise be used as jet fuel (that is to say, jet-fuel-boiling-range material). In many RD processes, however, the resulting “jet fuel” is not separated from the diesel product because this additional fractionation step would add cost, and the RD market is not yet saturated. (Interestingly, fractionating the AJF from RD also requires energy. If the energy used in this fractionation process is not renewably sourced, the separation of AJF from RD actually slightly increases global GHG emissions from the refining process.)

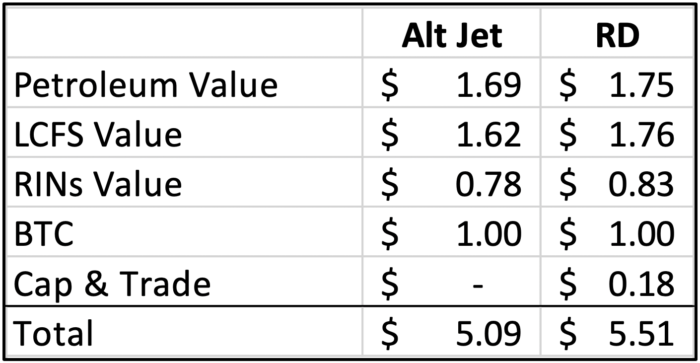

The value of AJF is greatest in California because the LCFS program allows AJF to “opt-in” and generate valuable credits in addition to qualifying for the federal Biodiesel Tax Credit (BTC) and bio-mass based diesel credits known as “D4 RINs” (where RINs stands for Renewable Identification Numbers) under the Renewable Fuel Standard (RFS). However, RD is worth more than AJF because RD is assigned a higher energy density which is used to calculate RINs and LCFS credits per gallon of fuel. (RD generates 1.7 RINs per gallon and AJF earns 1.6 RINs per gallon. For calculating LCFS credit value, CARB assigns RD an energy density of 129.65 MJ/gal and AJF an energy density of 126.37 MJ/gal.) The cost to purchase allowances for California’s Carbon Cap and Trade (C&T) Program is also much lower for RD than its petroleum-based diesel counterpart (ULSD), so RD has additional value relative to diesel in the market. Table 1 below shows the components and calculation of value for AJF and RD in California using recent market prices.

Table 1. Recent Product Values for Alternate Jet Fuel and Renewable Diesel

Source: OPIS February 6 Los Angeles Closing Prices

As can be seen, RD is currently worth roughly $0.42 per gallon more than AJF, and because of the additional production step, AJF is more expensive to produce than RD. Interestingly, any AJF blended into RD does not alter the assigned energy density or RINs value of the RD, so the AJF’s value is essentially “upgraded” when blended into diesel fuel as opposed to being used to fuel an airplane. That plus the treatment of RD under C&T (mentioned above) means that airlines would need to pay at least $0.42 more per gallon of AJF than the price of jet fuel in order to pull the AJF from the diesel pool into the jet fuel pool. As such, for airlines that are trying to reduce their carbon footprint, doing so with AJF today would add about 25% to the cost of their fuel, and fuel is estimated to make up 22% of commercial airlines’ expenditures in 2020. Any airline trying to reduce its carbon footprint by using AJF would, therefore, be at a considerable competitive cost disadvantage to another airline that does not use AJF.

One thing that could reduce this premium to airlines in California is if RD production capacity becomes greater than demand in California, this premium could be expected to diminish or even be eliminated. Since RD only made up about 16% of the California diesel pool in 2019, and the LCFS continues to get more stringent every year, this is not something Stillwater foresees happening for years.

Do you have questions about AJF? Contact us to find out how Stillwater can help. If you have questions about the LCFS, subscribe to our LCFS Newsletter for regular updates and analysis to inform your market decisions!

Tags: Alt Jet, Alternative Jet Fuel, BioJet, GHG, LCFS, RD, Renewable Diesel, Renewable Jet, Renewable Jet Fuel, RFS, RJ, SAF