Update on the Mid Continent Bubble

Link to article: https://stillwaterassociates.com/update-on-the-mid-continent-bubble/

May 17, 2012

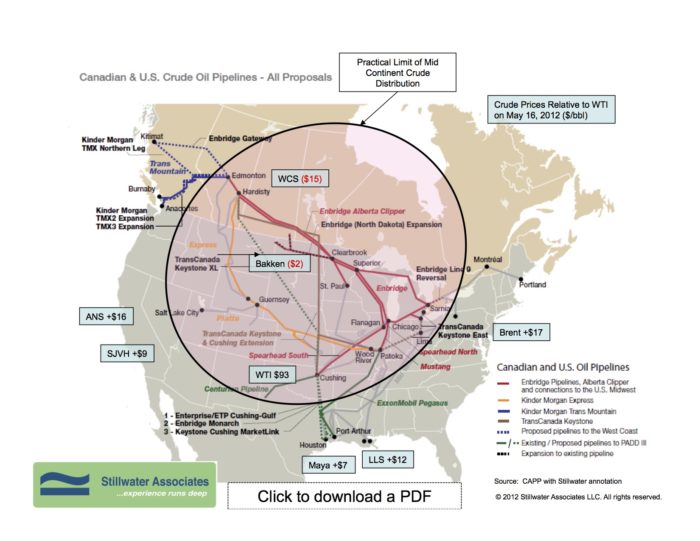

We continue to keep a close eye on the crude oil supply situation in the mid continent. Since the last blog post, the price differentials of marker crudes have shrunk. As you can see from the map, on May 16, WTI was selling at $99 a barrel, down from $103 a barrel this time last month. Brent is $17 over the price of WTI. This time last month Brent was priced at $20 over the price of WTI. Most significantly, the price differential between WTI and Western Canadian Select and Bakken Crudes went from discounts of $23 and $11 respectively to $15 and $2.

We continue to keep a close eye on the crude oil supply situation in the mid continent. Since the last blog post, the price differentials of marker crudes have shrunk. As you can see from the map, on May 16, WTI was selling at $99 a barrel, down from $103 a barrel this time last month. Brent is $17 over the price of WTI. This time last month Brent was priced at $20 over the price of WTI. Most significantly, the price differential between WTI and Western Canadian Select and Bakken Crudes went from discounts of $23 and $11 respectively to $15 and $2.

Clearly Mid Continent crude oil is finding it’s way out of the bubble. So far it’s still leaving on rail cars destined for the East and West Coasts in dribs and drabs. But larger rail facilities and pipeline solutions are coming on line. Enbridge announced early in the year that they plan to reverse the Seaway Pipeline to send crude oil from Cushing to the Gulf Coast. Seaway is scheduled to come on line on May 17th with an initial capacity of 150,000 barrels per day. Capacity is expected to expand to 400,000 barrels per day by the end of 2013.

Global Partners L.P. is currently doubling the rail car capacity at it’s Albany, NY terminal to import mid continent crude to the East Coast. The current facility can receive 80-car unit trains and will expand to 120-cars when construction is completed this summer. Global plans to ship Bakken by barge to East Coast refineries desperate for discounted crude. With these new investments in infrastructure, Delta’s purchase of the Trainer facility may be perfect timing.

We’re interested to hear your thoughts. Will Mid Continent Crudes save the troubled East Coast refineries? Let us know what you think.

Tags: WisdomCategories: Wisdom from the Downstream Wizard