The RFS Point of Obligation Part 3: Will moving the point of obligation significantly increase the use of renewable fuels?

Link to article: https://stillwaterassociates.com/rfs-point-obligation-part-3-will-moving-point-obligation-significantly-increase-use-renewable-fuels/

July 12, 2017

by Michael Leister

As we continue our RFS Point of Obligation series, we look at the RIN obligations calculated in the simple example last month using 100,000 gallons of gasoline and 50,000 gallons of diesel, we need to remember typical refineries produce much larger volumes of these products. A typical refinery processes around 150,000 barrels per day (bpd) of crude oil producing roughly about 100,000 bpd of gasoline and 50,000 bpd of diesel fuel. There are 42 gallons in a barrel and 365 days in the year which results in a total gasoline and diesel production of about 2.3 billion gallons per year. At a 10.7% total renewable fuel percentage this results in an RVO of about 246 million RINs of various sorts. Recent RIN values for the required basket of various RINs is an average of about $0.82 per RIN with D6 RINs priced at $0.71; D4 RINs priced at $1.11, D5 RINs priced at $1.10, and D3 RINs priced at $2.72. RFS compliance costs for this typical refinery will be about $200 million for 2017. Refiners with multiple and larger refineries can easily have 2017 RFS compliance costs over $1 billion. The total RFS compliance costs for all refiners and importers will be around $160 billion for 2017 using the RIN prices above.

If refiners pay $160 billion who gets that money? The EPA? No. The Federal Government? No. The renewable fuel producers who generate the RINs get most of the RIN value, assuming that they are able to capture thefull RIN value. In fact, while refiners pay the $160 billion, since refiners usually sell their gasoline and diesel at a profit, refiners are able to pass their RIN costs on to buyers in the wholesale product market under most circumstances. Every entity in the gasoline and diesel supply chain attempts to pass the costs of RINs to the next party until at last the final gasoline and diesel consumer ends up paying for most of the $160 billion in RIN costs in 2017.

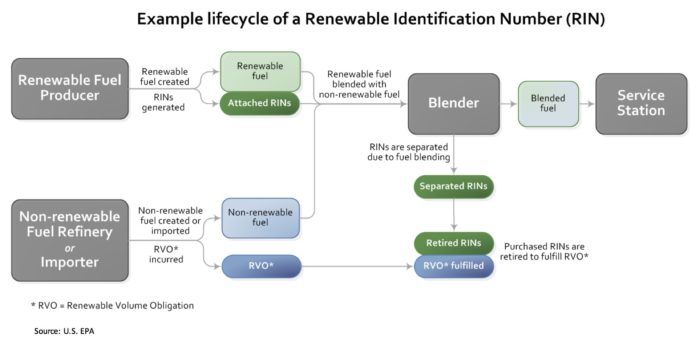

While all refiners have RVOs, refiners who have downstream marketing operations have the ability to generate some or all of the RINs needed for their RVO. Merchant refiners, those who do not have significant downstream marketing assets, do not have this ability and must purchase their RINs from other parties. All refiners must either purchase all their RINs or must hold on to (rather than sell) RINs they have generated and they have to turn over these costly RINs to EPA at compliance time.

The proposal to move the RFS point of obligation from the refiner to the point of blending does have the potential to simplify marketing forces driving the blending of renewable fuels. The parties that end up with this “moved” obligation are closer, if not directly linked, to the parties that must sell the renewable fuels blended into either gasoline or diesel. However, other RFS provisions discourage this from taking place. Since the renewable fuel portion of the RFS mandate can no longer be met simply by blending 10% ethanol into gasoline, the increasing renewable fuel portion of the mandate should encourage more sales of E15 and/or E85. But before the D6 RIN prices reach a sufficient level to encourage more E15 and E85 sales, the RFS nesting provision allows D4 RINs to be used to meet the renewable fuel portion of the RVO. Thus, currently D4 (and some D5) RINs represent the incremental compliance cost in the renewable portion of the RVO. This means that marginal compliance is being met with increased biodiesel (rather than ethanol) production and blending.

Without some changes to make the generation of additional E15 and/or E85 D6 RINs less expensive than the generation of D4 RINs or changes that make the generation of D4 RINs more expensive (such as the elimination of the $1.00 tax credit for biomass based diesel), the current situation will continue. Changing the parties that have the RVO obligation may simplify the RIN market forces and may arguably eliminate some perceived unfairness in the RFS but it will not reduce the expense required to place additional E15 or E85 in the market. Therefore, moving the RFS point of obligation will not appreciatively result in increases in the use of renewable fuels.

Tags: Renewable Fuels Standard, RFSCategories: Policy, White Papers