Pipeline Disruption Creates Deep WCS Discount

Link to article: https://stillwaterassociates.com/pipeline-disruption-creates-deep-wcs-discount/

August 1, 2012

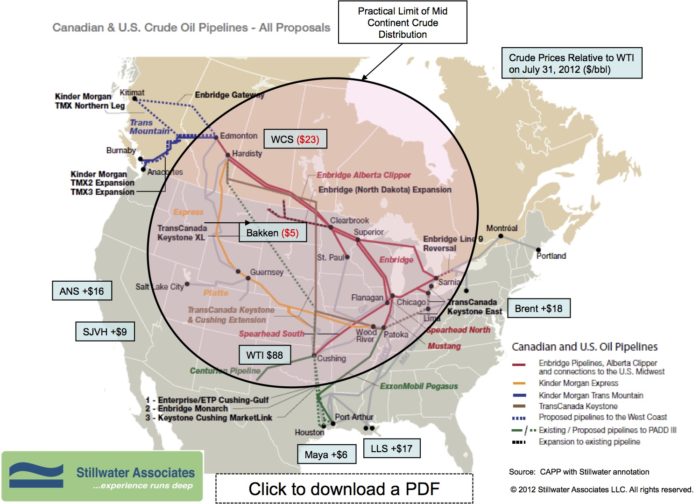

WTI closed at $88 on July 31st, unchanged from our last blog post. The spreads between WTI and Brent, Alaska North Slope and San Joachin Valley Heavy are up. The Brent spread is up $2 from July 16, to $18. Discounts in the Mid Continent have widened again. Bakken’s discount is back to $5 under WTI. The spread between WCS and WTI has opened up to a high of $23 under WTI, a big jump from $17 under on July 16. The greatest discount we’ve seen in some months can be blamed on the spill from Enbridge’s Line 14 in Wisconsin. Line 14 was shut down last Friday after the 1,000-barrel spill was discovered. The company expected to complete line repairs today. However, the Federal Pipeline and Hazardous Materials Safety Administration (PHMSA) delivered a corrective order blocking the restart of Line 14 until Enbridge can show regulators it has met safety standards. Corrective orders can delay resumption of pipeline operations, sometimes for weeks or months. When an Enbridge pipeline spilled crude into Michigan’s Kalamazoo River in 2010, the line was not approved for restart until six weeks later.

WTI closed at $88 on July 31st, unchanged from our last blog post. The spreads between WTI and Brent, Alaska North Slope and San Joachin Valley Heavy are up. The Brent spread is up $2 from July 16, to $18. Discounts in the Mid Continent have widened again. Bakken’s discount is back to $5 under WTI. The spread between WCS and WTI has opened up to a high of $23 under WTI, a big jump from $17 under on July 16. The greatest discount we’ve seen in some months can be blamed on the spill from Enbridge’s Line 14 in Wisconsin. Line 14 was shut down last Friday after the 1,000-barrel spill was discovered. The company expected to complete line repairs today. However, the Federal Pipeline and Hazardous Materials Safety Administration (PHMSA) delivered a corrective order blocking the restart of Line 14 until Enbridge can show regulators it has met safety standards. Corrective orders can delay resumption of pipeline operations, sometimes for weeks or months. When an Enbridge pipeline spilled crude into Michigan’s Kalamazoo River in 2010, the line was not approved for restart until six weeks later.

Categories: Wisdom from the Downstream Wizard