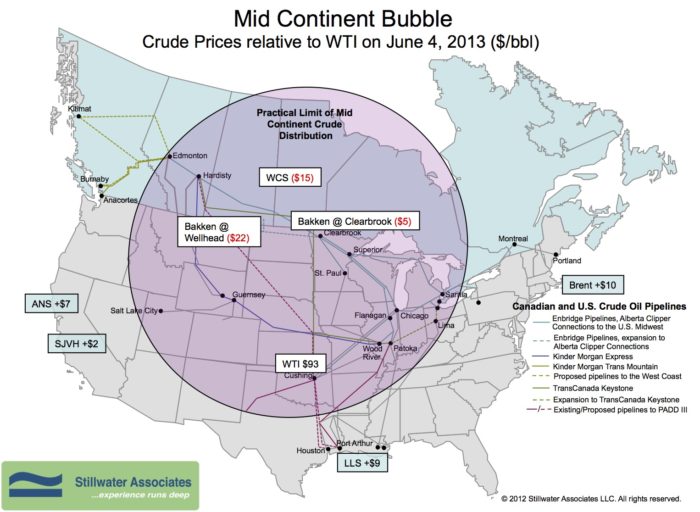

June Bubble Map: Rail is the Big Winner

Link to article: https://stillwaterassociates.com/june-bubble-map-rail-is-the-big-winner/

June 5, 2013

In the June Bubble Map we see some interesting differentials west of the Bubble. The WTI-San Joaquin Valley Heavy differential is the tightest we’ve seen…ever. SJVH is just a $2 premium over WTI, down from $6 in our last post. The WTI-ANS differential has also tightened to $7 over, down from $10 last month. It looks as if moving Mid Continent crudes out of the Bubble by rail is having a real effect on prices on the West Coast. The rail option has become so flexible, and fast that Kinder Morgan scrapped plans for it’s proposed Freedom pipeline from West Texas to California due to lack of interest.

The WTI-Bakken differential both at the Wellhead and at Clearbrook are holding steady. The WCS discount has tightened to $16 under WTI, from $19 last month. There has been some reporting that the WCS price has strengthened on the expectation that PADD 2 refineries will increase utilization since a string of outages last month. However, we hear the strengthening is due to increased rail loadings in the region. The Globe and Mail is reporting that trains are helping to clear export clogs and export capacity has exceeded the rate of supply.

Tags: WisdomCategories: Wisdom from the Downstream Wizard